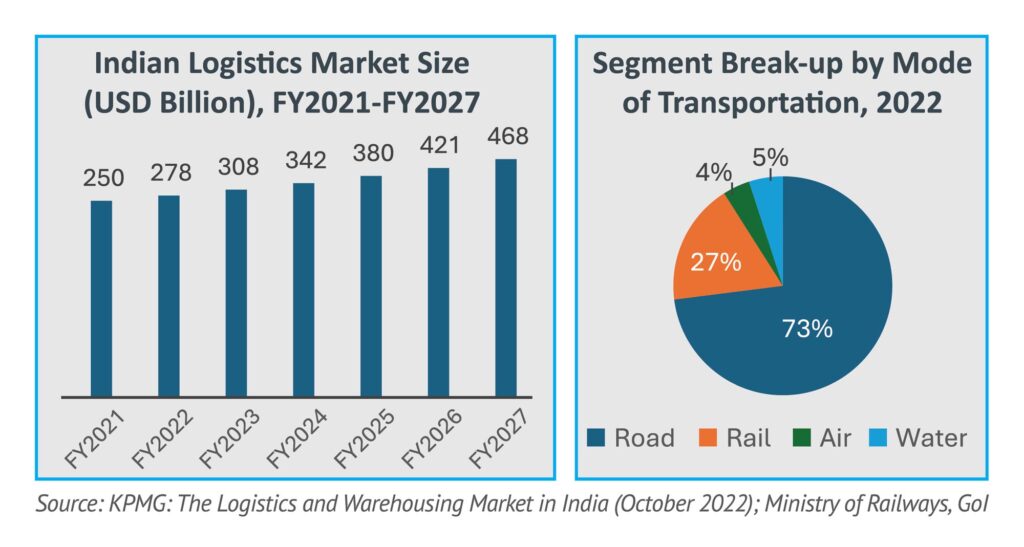

India’s logistics sector is evolving rapidly, propelled by government policies, infrastructure development, and the rise of e-commerce. Central to this transformation is road transport, which remains the dominant mode of goods transportation in the country. As logistics becomes increasingly complex, road infrastructure plays a pivotal role in supporting the economy’s growth, ensuring connectivity across regions, and facilitating trade, states a Rubix Industry Insights report on Logistics and Transporation.

The Expanding Role of Road Transport in Logistics

According to the report, road transport accounts for more than 60% of the logistics sector in India. The country’s road network, the second largest globally, is vital for ensuring the timely movement of goods across vast distances. National highways, though covering only 2% of the total road network, bear the brunt of this logistics load, handling approximately 40% of the traffic. The importance of road transport is underscored by the government’s substantial investments aimed at improving infrastructure and reducing logistics costs.

Infrastructure Developments

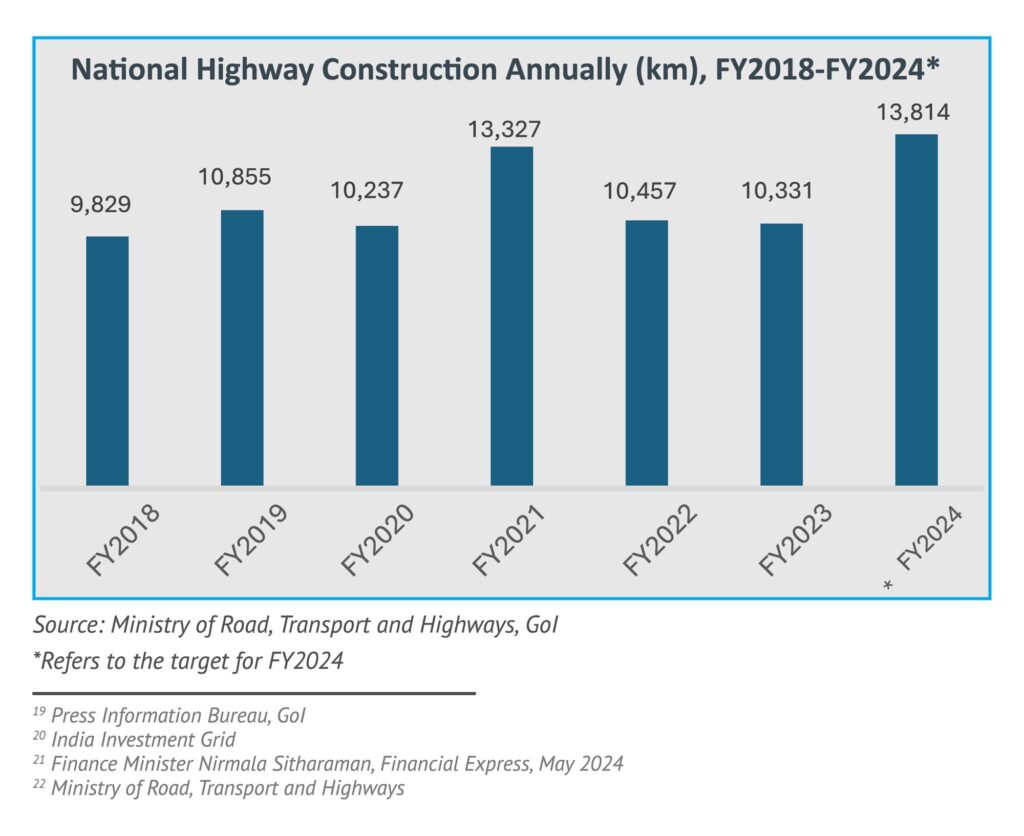

The report points at significant investments that have been made to improve road infrastructure, driven by government initiatives such as the Bharatmala Pariyojana and PM Gati Shakti National Master Plan. Since 2014, there has been a 500% increase in budget allocation for road transport and highways, leading to faster construction of national highways and better road quality. As a result, highway construction speeds have increased from 26.9 km/day in FY2018 to 37.8 km/day in FY2024.

This improvement is crucial, as better roads reduce transit times, enhance connectivity, and lower logistics costs, which are currently higher in India compared to global standards. The government aims to bring logistics costs down from 13%-14% of GDP to 8%, which aligns with international benchmarks. The increased focus on infrastructure development is expected to save between INR 2.4 trillion and INR 4.8 trillion annually in logistics costs.

Key Drivers of Growth in Road Logistics

The report highlights several factors that are contributing to the expansion and modernization of the road logistics sector in India. These include government policies, technological advancements, and the increasing demand for efficient transportation solutions due to the growth of e-commerce and other industries.

1. Government Policies and Investments

Government initiatives like the National Logistics Policy (NLP) and PM GatiShakti are aimed at building a robust logistics ecosystem in India. These policies focus on improving infrastructure, streamlining processes, and fostering a more efficient and competitive logistics industry. The NLP, for instance, emphasizes reducing logistics costs and improving supply chain efficiency through better infrastructure, technology integration, and enhanced connectivity.

2. Technological Advancements

Technology is playing a pivotal role in transforming road logistics. The adoption of technologies such as GPS, RFID, and AI is helping companies optimize routes, reduce delays, and enhance overall operational efficiency. Digitalization in logistics, including the implementation of the E-Way Bill system and satellite-based toll collection, has streamlined processes and reduced paperwork, leading to faster and more efficient movement of goods across the country.

3. E-commerce Boom

The surge in e-commerce is driving the need for more efficient road transport solutions. Consumers are increasingly expecting quick deliveries, and logistics companies are investing in technology and infrastructure to meet these demands. The rapid expansion of online retail, particularly in Tier 2 and Tier 3 cities, requires a robust last-mile delivery network, further emphasizing the importance of road transport in the logistics chain.

Challenges Facing Road Logistics

Despite the positive developments, the road logistics sector in India faces several challenges that hinder its growth and efficiency.

1. High Logistics Costs

One of the most significant challenges is the high cost of logistics, which accounts for around 13%-14% of India’s GDP, compared to the global average of approximately 8%. These elevated costs are a result of several factors, including inefficient road transport, poor truck utilization, and the reliance on road transport for the majority of freight movement.

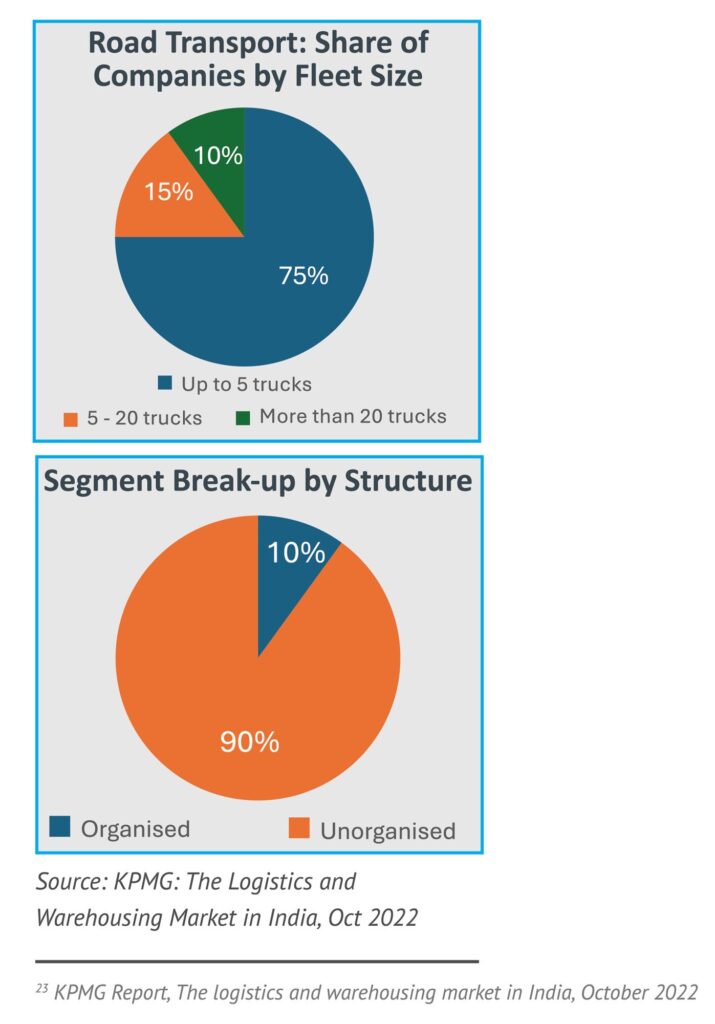

2. Fragmented Industry

The road logistics industry in India is highly fragmented, with small-sized players (owning less than five trucks) dominating the market. This fragmentation leads to inefficiencies in supply chain management, with many smaller players lacking the resources to invest in technology and optimize their operations.

3. Poor Truck Utilization

Truck utilization in India is suboptimal, with trucks covering an average of only 300 km per day, which is significantly lower than the global standard of 500-800 km per day. Additionally, about 40% of trucks run empty, leading to increased costs and emissions. This inefficiency is compounded by the fact that road transport is heavily reliant on unorganized segments of the market, making it difficult to implement standard practices.

4. Last-Mile Connectivity Issues

Last-mile delivery remains a significant challenge, especially in remote and rural areas. Poor road infrastructure, congestion, and inaccurate address mapping contribute to delays in delivery and higher costs. Enhancing last-mile connectivity is crucial for improving overall logistics performance.

Future Outlook: Opportunities for Growth

The future of road logistics in India looks promising, with several opportunities for growth driven by government initiatives, technological advancements, and increasing demand from industries like e-commerce.

1. Organized Players to Gain Market Share

Currently, organized players hold only about 5%-6% of the logistics market. However, this share is expected to double by FY2027 as these players leverage their scale, technology, and integrated services to capture a larger portion of the market. The shift towards more organized logistics players is likely to bring greater efficiency and innovation to the sector.

2. Electric Vehicles (EVs) in Logistics

The adoption of electric vehicles (EVs) for freight transportation is another area of growth. Although EV penetration in road logistics is currently less than 1%, there is increasing awareness of sustainable practices, and companies are exploring green logistics solutions to reduce their carbon footprint. Startups focusing on electric logistics solutions are expected to drive the transition to more eco-friendly transport.

3. Technological Innovation

New-age startups are also playing a critical role in driving innovation in the logistics space. These startups are using technology to address challenges such as route optimization, fleet management, and real-time tracking. The use of AI, IoT, and other advanced technologies is expected to continue transforming road logistics, making it more efficient and customer-centric.

Conclusion

India’s logistics and road transport sector is at a crucial juncture, with significant opportunities for growth and modernization. Government policies, infrastructure investments, and technological advancements are driving the sector’s evolution, making it more efficient and competitive. However, challenges like high logistics costs, fragmented supply chains, and poor truck utilization remain. Addressing these issues will be essential for India to realize its goal of becoming a global logistics hub and reducing logistics costs to global standards. The road ahead for road logistics in India is paved with both challenges and opportunities, but with the right strategies and investments, the sector is poised for substantial growth in the coming years.