In this exclusive interaction with Oomkar Kulkarnie, Head Product and Technology, 1Pay, Rajesh Rajgor finds out about the company’s comprehensive enterprise solution that enables fleet owners and financial institutions to get a 360 degree view of toll, state-of-the-art payment mechanisms, dispute management and a complete payment framework of FASTag.

The road logistics market is a USD 330 billion opportunity in India. Given that, a host of road logistics start-ups are taking on the challenge of managing inefficiencies by trying to organise this largely unorganised sector. They are doing so by leveraging technology and data. In the process, they are carving new channels, meeting existing needs and uncovering new opportunities. One such brand is 1Pay, a unified platform with a strong alliance with banks, non-banking finance companies (NBFCs) and new-age financial technology (fintech) platforms. Here are excerpts from the interview to know more about the company and its strategies:

Let’s begin with a brief about the whole idea behind starting 1Pay. What is the rationale behind the formation of the company?

The idea of launching 1Pay was to bring together transportation, logistics and the banking industry under one roof by creating a transportation-led neo-banking platform. Established in 2019, we aim to digitally unify the logistics and fintech space by offering a comprehensive suite of enterprise solutions that assist transport companies to manage their business lifecycle by providing telematics, payment solutions, FASTag issuance, seamless fuel and parking payments via FASTag along with analytics solutions. We started this platform as a bootstrapped company driven by innovation, disruption and the opportunity to learn and never raised funds.

Could you explain to us the mechanism or the pitch that on-boards banks and how it unifies the transport community?

1Pay’s strength was always customer connect and satisfaction. The ability of 1Pay’s business and sales team is to provide seamless FASTag experience which is today mandated for all fleet vehicles. To address the transport community’s concerns in terms of digital payments, toll plaza level issue resolution and reissuance of FASTag, our team is just a call away. Providing round-the-clock support has always been our USP. To top it, a strong technology and support system complements our offerings. Managing end-to-end processes, including the operations, is handled by 1Pay.

Additionally, 1Pay is an ISO 27001-certified organisation and our payment system is PCI DSS-compliant. 1Pay undergoes quarterly and yearly process and system audits by banks. It takes all these aspects very seriously which in turn builds confidence in our customers and partner banks to come on board. Working closely with compliance of the bank and audits allows us to be ahead of the game in terms of data security and risk. Working closely with multiple banks, managing the technology part and the ability to understand and overcome the banking integration challenges through our experiences has given us a considerable edge.

Could you take us through mechanism that eases multi-payment and multi-channel transactions for the fleets, right from when a customer is on-boarded?

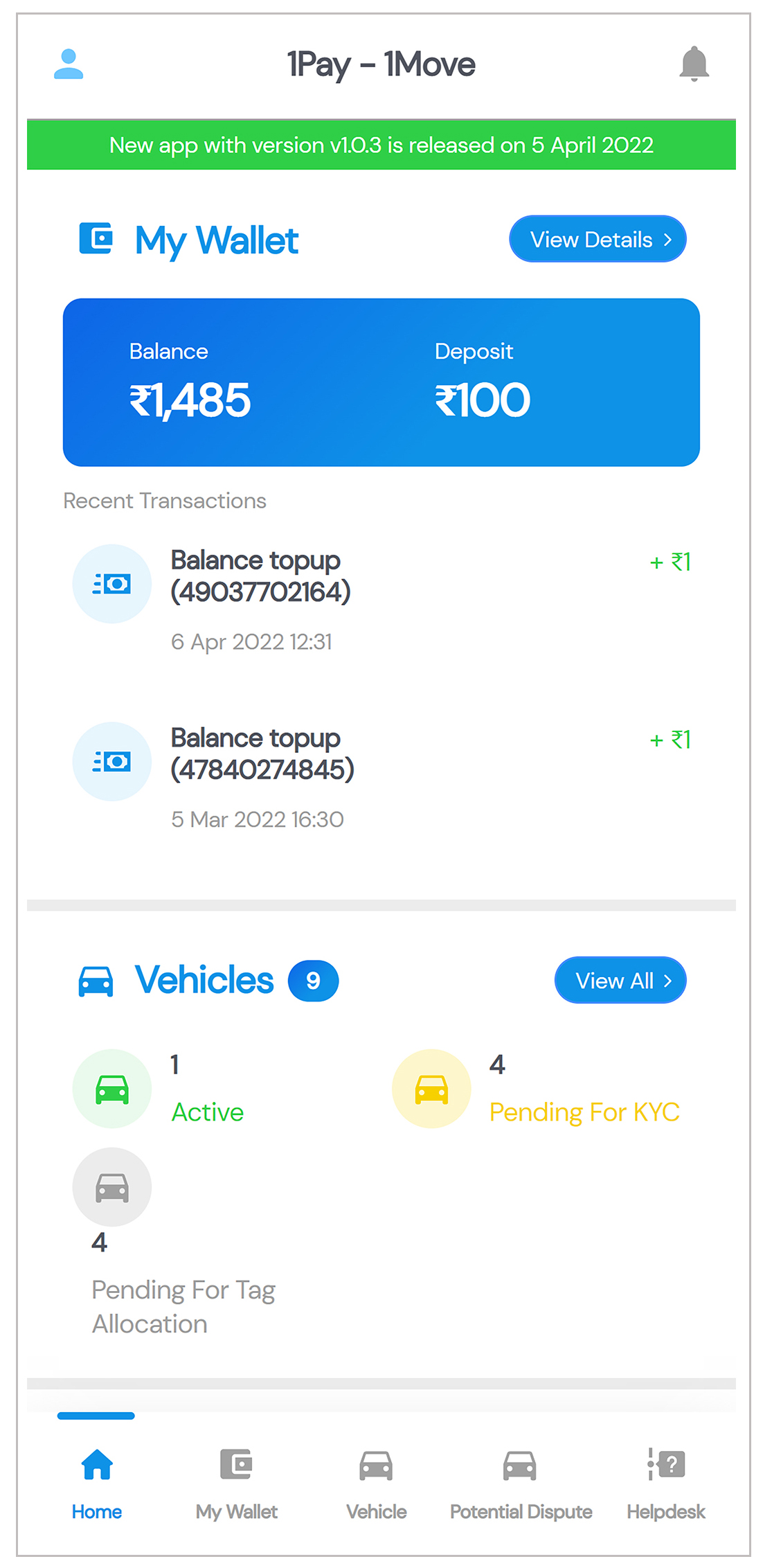

1Pay offers a mobile application (app) that is available both on Android and iOS and a web variant that can be used by fleet managers or owners for complete management of the FASTag ecosystem. Once a customer is on-boarded, the app allows fleet owners to request for tags, manage their current FASTag spends, define mechanisms for seamless payment top-ups and recharge of the FASTag, resolve transaction disputes seamlessly and undertake vehicle management including on-demand change of vehicle status such as active or inactive. 1Pay is working with transporters to ease various reporting concerns and trip management solutions which would include trip expense management and allocation such as trip-based expense reports. All these features will complement what has been built in the existing FASTag framework.

What have been your main achievements so far? How do you plan to grow over the medium to long-term?

With 1.7+ million tags using the 1Pay platform, the annualised GTV of the platform is worth Rs 36,000 million and we have already achieved Rs 240 million in revenue. We have an active customer base of over 1 million that includes the largest private sector banks, cooperative banks, travel booking platforms and transporters who are among the top 10 in India and aim to cross USD 500 million GTV per month by 2024. The platform will deepen its presence across the value chain by expanding to services such as analytics and business scoring. Also, we aim for a share in the USD 330 billion road logistics market spend in the coming year. 1Pay’s 1Move platform for end-users and envisaged offering of the neo-banking suite for our customers will be our way forward. Moreover, the platform also prepares customised B2B solutions by integrating modules like FASTag requisition, vehicle management, recharges etc. for collection and distribution via virtual accounts.

Could you elaborate about the different solutions you offer to stakeholders in the industry to ease their business operation?

With a commitment of providing round-the-clock service in terms of FASTag payment management and solutions to ensure that recharges are smooth and hassle-free are few of the out-of-the-box solutions for which customers trust us. At 1Pay we also ensure a connected ecosystem. Therefore, through the use of cloud and API gateways, we offer a robust and scalable platform. We are also compatible to extend APIs for ERP or end-user integration on demand. Currently, we are offering seamless FASTag on-boarding and tag request management, vehicle management, virtual ledger, seamless dispute management and bill payment services. 1Pay stresses the importance of financial management which includes a cost-saving mechanism, completely transparent ledger reporting and areas to address cost-saving measures of an unorganised segment. This is what makes it different from the existing players in the market.

Any examples or case-studies where a fleet operator or an owner-operator has benefitted from your comprehensive consolidated solution?

We provide a complete dispute management and resolution facility. A problem surfaces when a customer cannot raise a dispute easily for a transaction through other platforms. We help such customers with the ability to mark a dispute against the transaction and automatically identify the type of dispute to be able to resolve it immediately. And this is vastly appreciated by our customers. Our system’s ability to automatically look at transactions and mark transactions which are potential disputes is one of our value-added services. Customers otherwise spend a lot of time manually raising potential disputes. Our integrated feature helps customers to save expenses and avoid manual intervention in identifying the dispute. This builds trust. We are soon launching a virtual account framework where customers can transfer money in the 1Pay ecosystem and set dynamic logics to automatically sweep funds for recurring recharges.

Which are the areas you are strong in and what are the areas you would want to grow?

1Pay is a B2B2C fintech player that is creating solutions at the cusp of logistics technology and financial technology by leveraging FASTag’s ‘unique vehicle ID’ infrastructure for customer acquisition. We have developed multiple use-cases of FASTag, which simplifies payments and expense management for a vehicle or fleet owner. Apart from FASTag, we also have other use-cases of payment processing like prepaid and corporate cards and fleet management along with a neo-banking experience. Currently, 1Pay is looking to grow across India to connect with fleet operators and owners and provide pan-India support for all its product offerings. Primarily, our platform’s payment ecosystem is scalable and extensible to use-cases outside India such as the South Asia market which surely is where we would like to grow.