People from all walks of life in the country were glued to the TV on February 29 as the Finance Minister, Mr. Arun Jaitley, presented the Union Budget for 2016-17. Most of the stakeholders were watching with bated breadth his announcements related to the automotive industry and road infrastructure.

Industry experts have claimed that the Budget is a mixed bag for the automotive and affiliated sectors. While the significant Budget focus is on bettering the road infrastructure across the country which might benefit the auto industry, the additional taxation on vehicles might adversely impact its growth.

For development of roads, including the national highways and rural roads, an investment outlay of Rs. 97,000 crores for the road sector, including PMGSY allocation, has been made for 2016-17. An allotment of Rs. 55,000 crores for roads and highways alone has been proposed, which will be further topped up by an additional Rs. 15,000 crores to be raised by NHAI through bonds.

The Finance Minister further said that almost 85 per cent of the projects stalled have been reinitiated through the efforts of the Ministry of Roads, Transport and Highways. The amendment to be made in the Motor Vehicles Act to open up the road transport sector in the passenger segment has also been lauded by the industry. However, introduction of service tax on passenger transport will have a dampening effect.

The grant of Rs. 200 crores to the FAME scheme and NATRiP was well anticipated. Further, the validity period of exemption granted to specified goods for use in the manufacture of electrically operated vehicles and hybrid vehicles is also being extended without a time-limit.

The basic customs duty (BCD) on raw material used for manufacture of catalytic converters has been reduced from 7.5 per cent to five per cent. The technological innovation for the industry also got a massive fillip with the reduction in the tax rate on royalty and fees from 25 per cent to 10 per cent for technical services paid to a non-resident. However, the duty on import of aluminium & aluminium products and zinc alloys has been raised. This will impact the industry.

One of the biggest worries for the industry is that Mr. Jaitley has announced an increase of 30 per cent, from 10 per cent to 40 per cent, in the customs duty on commercial vehicles entering the country.

Before the Budget was announced, the auto industry had made a few recommendations for the NDA Government to consider, including enforcement of the Goods and Service Tax (GST) and lowering of interest rates and excise duty on vehicles.

The auto industry, comprising both passenger vehicle and commercial vehicle players, hoped that its primary demands would be met so as to facilitate its sustained development. Barring the GST Bill, none of the other demands, particularly for boosting R&D activities in the automobile industry have been considered. However, with positives like the increase in the share of funds for infrastructure growth and reduction in corporate tax rate, from 30 per cent to 25 per cent till 2019, have been well received by India Inc.

A mixed bag, says Vinod Dasari, SIAM President

Mr. Vinod Dasari, President, Society of Indian Autombile Manufacturers (SIAM), has said that the Union Budget for 2016-17 is a mixed bag for the Indian automobile industry. It aims to boost the rural economy of the country, with adequate impetus given to the rural, agricultural and infrastructure segment. This will help boost the consumer sentiments of rural India, which had been subdued for more than a year.

Further, the Budget has focused on the development of roads, including national highways and rural roads. An investment outlay of Rs. 97,000 crores for the road sector has been made for 2016-17. Almost 85 per cent of the projects that were stalled have been re-initiated by the Ministry of Road, Transport and Highways.

While the amendment to be made in the Motor Vehicles Act to open up the road transport sector in the passenger segment is a welcome move, the introduction of service tax on passenger transport will have a dampening effect.

Mr. Dasari said the industry is happy to note that a grant of Rs. 200 crores has been made to the FAME scheme and NATRiP. Moreover, the validity period of exemption granted to specified items used in the manufacture of electrically operated as well as hybrid vehicles is being extended without time-limit. This will help improve the consumer sentiment and promote faster adoption of these vehicles.

While the basic customs duty on raw materials used for manufacture of catalytic converters has been reduced from 7.5 per cent to 5 per cent, that on import of aluminium & aluminium products and zinc alloys has been increased. This will have its adverse impact on the industry. Again, the weighted tax deduction on R&D expense has been reduced from 200 per cent to 150 per cent from April 1, 2017, and will be further reduced to 100 per cent from April 1, 2020. The move will go against indigenous R&D efforts in India.

According to him, SIAM, in fact, was expecting an announcement on fleet modernization, but in vain. Further, an additional one per cent tax to be collected at source on purchase of cars exceeding a value of Rs. 10 lakhs will be a further deterrent.

The infrastructure cess of one per cent on small petrol, LPG and CNG cars, 2.5 per cent on small diesel cars of less than 1500 cc and four per cent on other higher engine capacity vehicles would result in the rise of prices across categories of passenger vehicles and would hurt the industry. With the Government focus being rationalization and simplification of taxes, introduction of new taxes on vehicles will only dampen the spirit of the auto sector.

ACMA hails focus on infrastructure development – Arvind Balaji, ACMA President

The Automotive Component Manufacturers Association of India (ACMA) has welcomed the measures announced in the Union Budget providing the needed thrust to the economy, specially the focus on infrastructure development, including roads and power, education, skilling, ease of doing business and attracting investments.

In a statement, Mr. Arvind Balaji, ACMA President, said the focus on rural wealth creation will lead to increased demand for vehicles. The move for setting up of 1,500 multi-skill training institutes in partnership with the industry and academia, amendment to the Motor Vehicle Act and the CENVAT Credit Rules, 2004, would enable manufacturers with multiple units to maintain a common warehouse for inputs and distribute them with credits to individual manufacturing units.

Further, the proposal made in the Railway Budget to establish India’s first rail auto hub is a welcome move since it will significantly bring down the logistics cost and facilitate the last-mile connectivity for shipments.

Mr. Balaji said that the area of concern for the industry is the reduction in the 200 per cent weighted deduction on R&D spend. This will now be limited to 150 per cent from April 1, 2017, and 100 per cent from April 1, 2020. This will immensely impact the growth in domestic innovation at a time when there is a need for higher spend on R&D. That apart, the Government move to levy an extra one per cent tax on purchase of luxury cars, in addition to the one per cent infrastructure cess on small, petrol, LPG and CNG cars, and 2.5-4 per cent on diesel and SUV’s having higher engine capacity will have an adverse impact on the automotive industry that has been witnessing a flat growth over the last nine months.

Chandrajit Banerjee, Director-General, CII

Mr. Chandrajit Banerjee, Director-General, CII, quipped: “I think if this entire Budget can be defined in one sentence it is an agriculture / infrastructure Budget. So obviously there is a lot on the infrastructure side that one sees in the Budget. The (development of) infrastructure is important, and the way the Finance Minister addressed infrastructure and agriculture sectors as well as the rural sector, it is extremely important that with its greater outlays he has talked about. This is because we see infrastructure sector and public spending which he has talked about, it is going to propel and crowd in private investments very adequately. Therefore, the growth in the Budget it really comes from, it’s focus on infrastructure.”

Commenting on the Budget, Mr. Sumit Majumdar, CII President, said: “It is a very positive Budget. It is a very well rounded one and is growth oriented covering all sections of the society. The aim (of the Budget) is to aid growth of the country. There is a huge emphasis on rural India, infrastructure, etc.”

KVS Prakash Rao, FADA President

Mr. KVS Prakash Rao, President of the Federation Of Automobile Dealers Associations (FADA), has, in a press release, said a total investment Rs. 97,000 crores has been proposed for the road sector, including the PMGSY allocation, during 2016-17. The expansion and betterment of roads will not only generate additional jobs, but will also boost commercial vehicle demand, addressing to some extent the problems of environment pollution and road safety at the same time.

FADA has welcomed the proposed amendments in the Motor Vehicles Act to open up the road transport sector in the passenger segment, which will impart pace to the development of the transport sector while giving fillip to the commercial vehicle segment growth, in particular.

Vinod Aggarwal, VE Commercial Vehicles

Mr. Vinod Aggarwal, CEO, VE Commercial Vehicles, has stated that the Finance Minister has done well in delivering a growth-oriented Budget with clear agenda for inclusive growth and socio-economic reforms. Specifically the effort to contain the fiscal deficit and maintains of good focus on planned expenditure without cutting the same to meet fiscal deficit deserves all praise.

Focus on infrastructure with a total allocation of Rs. 97,000 crores for roads development and the proposal of 10,000 km of national highways in 2016-17 and 50,000 km State highways to be converted to NH roads augurs very well for the commercial vehicle industry. Reduction of excise duty on refrigerated containers will boost sales of reefer trucks.

Again, the proposal for relooking at the Motor Vehicles Act and supporting entrepreneurship in opening bus operations in new segments will help decongest cities.

“Overall, this appears to be a balanced, positive and bold Budget which is heavily rural and infrastructure-focused,” Mr. Aggarwal has added.

Roland Folger, Mercedes-Benz India

Mr. Roland Folger, Managing Director & CEO, Mercedes-Benz India, has commented thus: “Development of the agrarian sector emerged as the key priority in this year’s Budget, which is positive for the Indian economy. The Budget portrays a steady fiscal picture with considerable spending on infrastructure and rural development, which is laudable. The rationalization of the duty structure would have also created a level playing field for all brands. Overall, we applaud the infrastructural spending and the focus on building more roads and highways, which will have a long-term positive effect on the auto industry. But in the short to mid-term, we missed an opportunity to drive growth in the sector, which could have further benefited the long-term prospects of the auto industry.”

Mr. Roland Folger, Managing Director & CEO, Mercedes-Benz India, has commented thus: “Development of the agrarian sector emerged as the key priority in this year’s Budget, which is positive for the Indian economy. The Budget portrays a steady fiscal picture with considerable spending on infrastructure and rural development, which is laudable. The rationalization of the duty structure would have also created a level playing field for all brands. Overall, we applaud the infrastructural spending and the focus on building more roads and highways, which will have a long-term positive effect on the auto industry. But in the short to mid-term, we missed an opportunity to drive growth in the sector, which could have further benefited the long-term prospects of the auto industry.”

R.C. Bhargava, Maruti Suzuki

Reacting to the proposals, Mr. R.C. Bhargava, Chairperson, Maruti Suzuki, told PTI Economic Service: “Obviously it will lead to a rise in car prices. It came as a surprise for us as we were not expecting such kind of a cess.”

Lamenting the Finance Minister’s announcements, Mr. Bhargava said: “For pollution, we have already been asked to get to the Euro 6 emission norms by 2020. It involves a substantial amount of investment and would also add to the cost of vehicles. Besides, this additional cess when cars contribute only around 2 per cent of the air pollution comes as a surprise for us.”

S. Sandilya, Eicher Motors

Giving his special views on the Budget, Mr. S. Sandilya, Non-Exec Chairman, Eicher Motors, said: “If I look at it from the perspective of rural infrastructure spending, the Budget seems positive. Talking about the automotive sector, increasing the duty at a stage when the industry is not doing well doesn’t make sense. I was looking forward to something known as Fleet Modernisation Programme, but I have not seen that in any big way. But if you look at the entire Budget from any opportunity (perspective), this is one time the Government could have taken some real progressive steps rather than doing something ordinary.”

Chairman, Eicher Motors, said: “If I look at it from the perspective of rural infrastructure spending, the Budget seems positive. Talking about the automotive sector, increasing the duty at a stage when the industry is not doing well doesn’t make sense. I was looking forward to something known as Fleet Modernisation Programme, but I have not seen that in any big way. But if you look at the entire Budget from any opportunity (perspective), this is one time the Government could have taken some real progressive steps rather than doing something ordinary.”

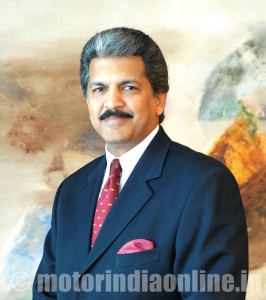

Anand Mahindra, Mahindra Group

Expressing disappointment, Mr. Anand Mahindra, Mahindra Group Chairman, tweeted: “In summary, despite our disappointment on the tax on cars, I see no reason for the mayhem in the market.”

Expressing disappointment, Mr. Anand Mahindra, Mahindra Group Chairman, tweeted: “In summary, despite our disappointment on the tax on cars, I see no reason for the mayhem in the market.”

Ashok P. Hinduja, Hinduja Group

The Hinduja Group of Companies (India) Chairman, Mr. Ashok P. Hinduja said the auto sector will stand to benefit by the proposed amendment to the Motor Vehicles Act to allow private sector participation in the passenger vehicle segment.

Dr. Wilfried Aulbur, Roland Berger

Dr. Wilfried Aulbur, Managing Partner & CEO, India, Chairman Middle East, Head Automotive Asia at Roland Berger, struck on optimistic note when he said: “Investments in roadways are positive for the commercial vehicle sector. Increased expenditure on infrastructure will lead to increased demand and will be beneficial for job creation. In particular, a greater investment in, and leverage of India’s coastline holds potential both for shipments within India as well as for export. Cost competiveness of this option vs. alternative transport options (e.g., road transport via trucks) needs to be ensured.”

Dr. Wilfried Aulbur, Managing Partner & CEO, India, Chairman Middle East, Head Automotive Asia at Roland Berger, struck on optimistic note when he said: “Investments in roadways are positive for the commercial vehicle sector. Increased expenditure on infrastructure will lead to increased demand and will be beneficial for job creation. In particular, a greater investment in, and leverage of India’s coastline holds potential both for shipments within India as well as for export. Cost competiveness of this option vs. alternative transport options (e.g., road transport via trucks) needs to be ensured.”

Vipin Sondhi, JCB

Mr. Vipin Sondhi, Managing Director and CEO, JCB India Ltd., said the Union Budget 2016 has been well aligned to the Prime Minister’s ‘Make in India’ campaign by enlisting nine key pillars to help transform India. The infrastructure sector is a key contributor, and the focus to address core growth issues such as agriculture, social programs, rural development, education with skill development and job creation, financial reforms, policy reforms in terms of ease of doing business, fiscal discipline and tax reforms would definitely give impetus to economic growth.

2016 has been well aligned to the Prime Minister’s ‘Make in India’ campaign by enlisting nine key pillars to help transform India. The infrastructure sector is a key contributor, and the focus to address core growth issues such as agriculture, social programs, rural development, education with skill development and job creation, financial reforms, policy reforms in terms of ease of doing business, fiscal discipline and tax reforms would definitely give impetus to economic growth.

The main objective of the Budget is to revive the economy through stimulation of demand. Almost 85 per cent of the stalled road projects are back on track, and the Government is upbeat by announcing an investment of total Rs. 97,000 crores in the Budget for the road sector. This includes the all-important Prime Minister Gramin Sadak Yojna (PMGSY).

The Budget has its emphasis also on physical infrastructure with the allocation for roads, national highways and irrigation put together at Rs. 2.13 lakh crores.

Anand Sundaresan, Schwing Stetter India

According to Mr. Anand Sundaresan, Vice Chairman & Managing Director, Schwing Stetter India, the huge investment proposed on infrastructure development like road, airport, railway and power projects will definitely give a fillip to construction equipment manufacturers. The road equipment manufacturers are likely to be benefited the most because of the huge investments planned in the national highway sector as well as on the upgradation of State highway roads to the national highway level.

According to Mr. Anand Sundaresan, Vice Chairman & Managing Director, Schwing Stetter India, the huge investment proposed on infrastructure development like road, airport, railway and power projects will definitely give a fillip to construction equipment manufacturers. The road equipment manufacturers are likely to be benefited the most because of the huge investments planned in the national highway sector as well as on the upgradation of State highway roads to the national highway level.

He has stated that, after a dull phase of almost three years, construction equipment manufacturers can look at growth in the coming years. Significant emphasis on irrigation projects and rural road projects under the PMGSY scheme will also help the construction equipment industry, creating enormous opportunities for smaller capacity construction equipment.

Guillaume Sicard, Nissan India Operations

Mr. Guillaume Sicard, President, Nissan India Operations, has observed: “The Union Budget 2016 has continued with the Government’s focus on maintaining fiscal deficit, agriculture, infrastructure development and recapitalizing of the PSU banks. The Budget has its special focus on the economy at the grassroot level, which will have an overall positive impact in the long run. Additionally, we also welcome the Government decision to amend the Motor Vehicle Act in the passenger vehicle segment to allow innovation. This, coupled with a focus on infrastructure, will help improve the overall public transport in the country.

Mallika Srinivasan, TAFE

Ms. Mallika Srinivasan, Chairman and CEO, Tractors and Farm Equipment Ltd. (TAFE), has stated: “Overall we welcome the agri and rural focus in the Budget, and we believe that with the support of a good monsoon we can look forward to a more robust agri and rural growth in 2016-17.”

Ms. Mallika Srinivasan, Chairman and CEO, Tractors and Farm Equipment Ltd. (TAFE), has stated: “Overall we welcome the agri and rural focus in the Budget, and we believe that with the support of a good monsoon we can look forward to a more robust agri and rural growth in 2016-17.”

Dr. Pawan Goenka, M&M Ltd.

In a press release, Dr. Pawan Goenka, Executive Director, M&M Ltd., says: “The Budget places strong emphasis on agriculture, the rural economy, and the infrastructure and social sector. This is what I was hoping for. The resurgence and thrust on the PPP in infrastructure is most welcome. I also appreciate laying down some very clear goal posts on farm income and on village electrification. Perhaps more could have been done for the financial sector and taxation, though staying with the FRBM target was an unexpected bold move and perhaps does put some spending constraints on the Government.”

TT Srinivasaraghavan, Sundaram Finance

Mr. TT Srinivasaraghavan, Managing Director, Sundaram Finance, has commented that well thought through and well-articulated proposals, the infra and rural sector focus is very welcome. Also with the fiscal deficit targets being met, a rate reduction could be on the cards.

Mr. TT Srinivasaraghavan, Managing Director, Sundaram Finance, has commented that well thought through and well-articulated proposals, the infra and rural sector focus is very welcome. Also with the fiscal deficit targets being met, a rate reduction could be on the cards.

Sumit Sawhney, Renault India Operations

Mr. Sumit Sawhney, Country CEO & Managing Director, Renault India Operations, has made it very clear that the Government has succeeded in ensuring that the Indian economy has held its own despite the prevailing uncertain environment and global headwinds.

The Budget clearly focusses on a long-term vision aimed at high growth, together with emphasis on the fiscal deficit, and keeping big bang investments in check. But, policies for the automobile sector remained largely unchanged.

Shekar Viswanathan, Toyota Kirloskar Motor Pvt. Ltd.

Reacting to the Budget proposals, Mr. Shekar Viswanathan, Vice Chairman and Whole-Time Director, Toyota Kirloskar Motor Pvt. Ltd., said: “We would have expected some measures to promote alternate fuel technologies which would have helped the environment also. We would encourage the Government not to just think based on size of the vehicle which has no relation to the technology. Taking older vehicles off the road should be a priority for the Government.

Reacting to the Budget proposals, Mr. Shekar Viswanathan, Vice Chairman and Whole-Time Director, Toyota Kirloskar Motor Pvt. Ltd., said: “We would have expected some measures to promote alternate fuel technologies which would have helped the environment also. We would encourage the Government not to just think based on size of the vehicle which has no relation to the technology. Taking older vehicles off the road should be a priority for the Government.

We hail the measures and schemes which have been introduced to benefit the masses and also the thrust on infrastructure which would have a long-term impact on the growth of the nation.”

Abdul Majeed, Price Waterhouse

Price Waterhouse Partner, Mr. Abdul Majeed said: “The increase in tax on luxury vehicles, infrastructure cess from 1-4 per cent as well as withholding taxes on bigger vehicles will have a negative impact, especially on bigger passenger vehicles.”

Rajeev Singh, KPMG

KPMG in India, Head of Automotive Sector, Mr. Rajeev Singh said passenger vehicles will have a significant negative impact due to the infrastructure cess. Also, the announcement to deduct TDS on luxury vehicles with more than Rs. 10 lakhs will dampen their demand in the short term.