While in the last decade the Indian CV industry transitioned and adapted many changes, this decade is likely to transform the CV industry technologically, structurally become more agile, collaborative and capable of riding the megatrends and disruptions, writes Jinal Shah, Director, Expandus, a company with 40+ years of cumulative experience in manufacturing, B2B research and consulting

As economies around the world battle the post-pandemic challenges and try to overcome continued damage caused by supply chain challenges along with the devastating effects of an extended war situation, a global economic slowdown was always on the charts. While the West races towards recession, the East seems to have lesser chances of slipping into a prolonged recession. As global economies contract, battling with inflation along with multiple headwinds, there is a remarkable difference between what is happening in the world versus India.

With most global agencies projecting Indian GDP growth forecasts in the range of 6-8% through this decade, India will steadily move towards its goal of a USD 5 trillion economy by 2026-2027, thus taking centre-stage. The Indian government’s focus on infrastructure development, self-reliance in tandem with various supporting policies and regulations like PLI, FAME, PMP, Scrappage Policy, National Hydrogen Mission, Battery Swapping Policy, COP 26 and ESG commitments, etc. defines the Indian commercial vehicle industry’s direction towards localisation of supply chain, reducing emissions, improving fuel efficiency, alternate fuel and sustainable solutions.

The CV industry was almost in a cruise control mode for most part of the last decade until the quicker regulatory-driven transformations from BS III to BS VI coupled with disruptions from demonetisation, GST, axle load norms, NBFC crisis followed by the pandemic. These disruptions in the shorter span accelerated the industry to adopt technological advancements and re-look at supply chain strategies. Over the years, rising domestic demand has resulted in incremental availability of freight for movement. This has subsequently resulted in a shift in preference towards higher payload capacity trucks by transporters.

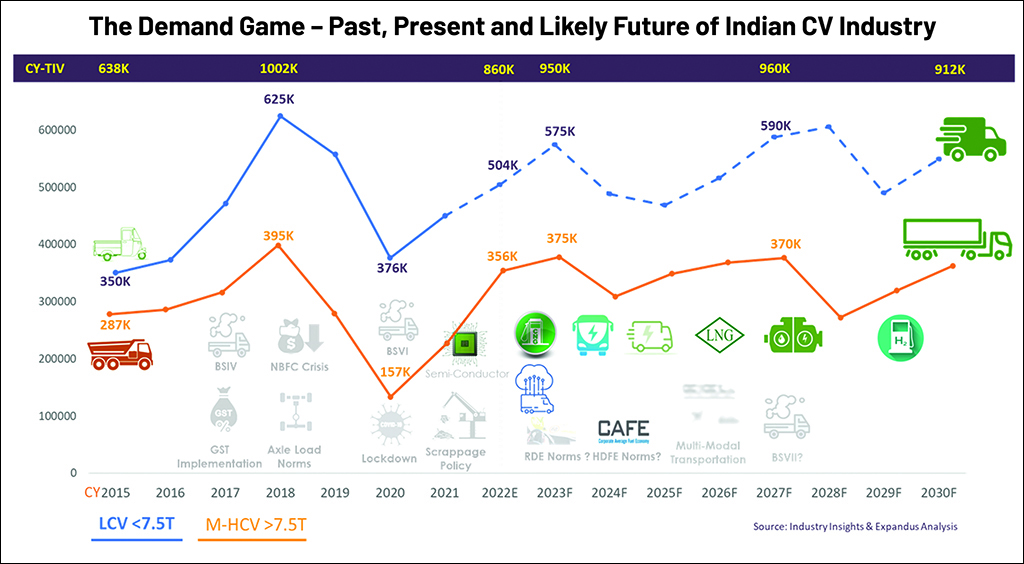

The Demand Game – Past, Present and Likely Future of Indian CV Industry

With sizeable CVs fleets greater than 15 years in service today, the industry will encash on the scrappage policy as enough organised recycling centres and fitness testing centres are set up in the coming years. While we will cross CY 2017 peak in CY 2022 and continue the growth trajectory in the following year, we are likely to be shy of achieving CY 2018 peaks! However, every five years we see a shift towards higher base of Total Industry Volumes (TIV) moving from 825K to 900K by end of 2030 and crossing 1Million commercial vehicles demand in the decade beginning 2031.

The competition from rail freight is likely to intensify as dedicated freight corridors (DFCs) near completion and we estimate volume impact on the Class 8 segment by about 7-10% through the forecast period. Supported by rising fuel prices, we have seen faster adaption of products with alternate fuel powertrains, especially in less than 19 ton CV categories. The SCV-CNG penetrations peaked at a high of 50-60% in 2022 and the ILCV-CNG adaptations at about 25%. Buses, SCVs and select applications within the less than 19 ton categories are seeing faster electrification driven by fleet, delivery trucks and electrification of public transport.

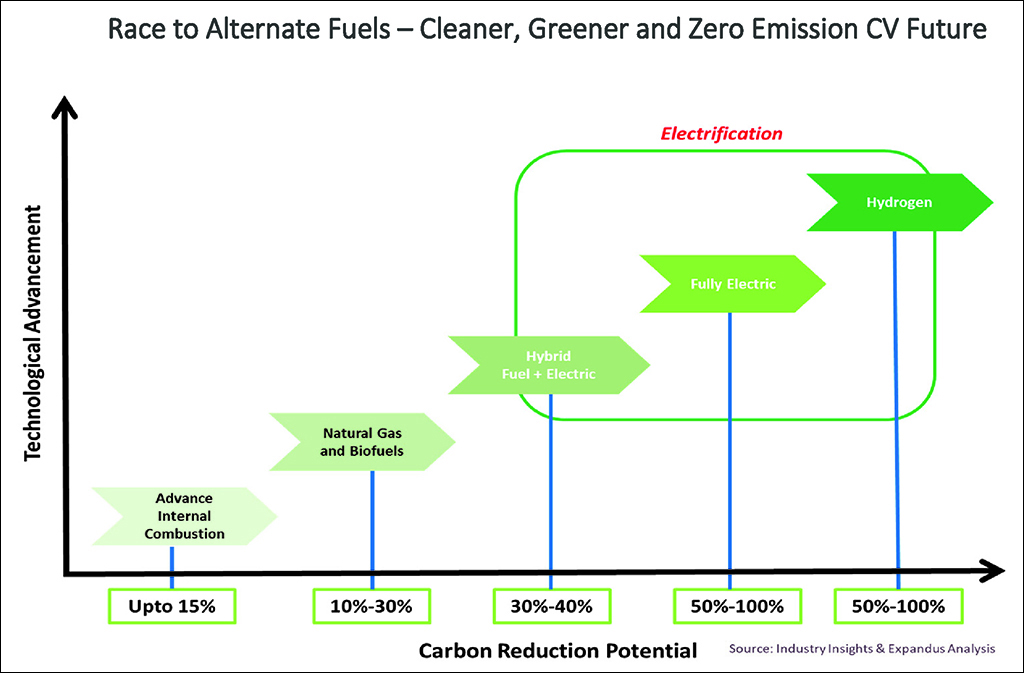

LNG appears to be a promising fuel for trucks especially in the golden quadrilateral freight corridors. The switch to hydrogen engine drivetrains in the short to mid-term will support many MHCVs to align emission norms, cleaner fuel adoption and become more efficient. When it comes to the rise of low to zero carbon fuels, renewable natural gas, biodiesel blends, electrification and hydrogen will lead the way while internal combustion engine technology will see improved efficiencies. We will see a mix of powertrain technologies co-exist based on TCO, charging infrastructure, supporting supply chain, regulations, policy-driven incentives and new business models.

Race to Alternate Fuels – Cleaner, Greener and Zero Emission CV Future

In our opinion, India will need a four-pronged approach to achieve its transport decarbonisation goals:

- Fuel Efficiency: India will need to continue evolving its fuel efficiency standards in line with global standards, beyond the current BS VI norms.

- Sustainable Fuels: Biofuels (ethanol, methanol, etc.) and gas-based fuels (CNG, LNG, etc.) are cleaner burning than petrol or diesel and are already commercially viable with today’s economics. Together, these fuels offer a cleaner interim alternative for India’s transition.

- Electric Vehicles: Electric vehicles are currently the most efficient technology compared to ICEs and other carbon-neutral options (e.g., synthetic fuels). The share of ECVs will reach 27-30% by 2030. However, India’s transport electrification journey will need a coordinated effort from automotive OEMs, charging infrastructure providers and government policy-makers over the coming decades. A mix of financial, behavioural and infrastructure-related incentives will be the key to mass scale electric vehicle adoption.

- Hydrogen Mobility: For hard-to-abate, heavy mobility modes such as trucks, hydrogen could emerge as a viable fuel alternative. While hydrogen mobility technologies are still evolving, India could potentially transition LCVs, MHCV trucks and buses from fossil fuels to hydrogen over the next few decades.

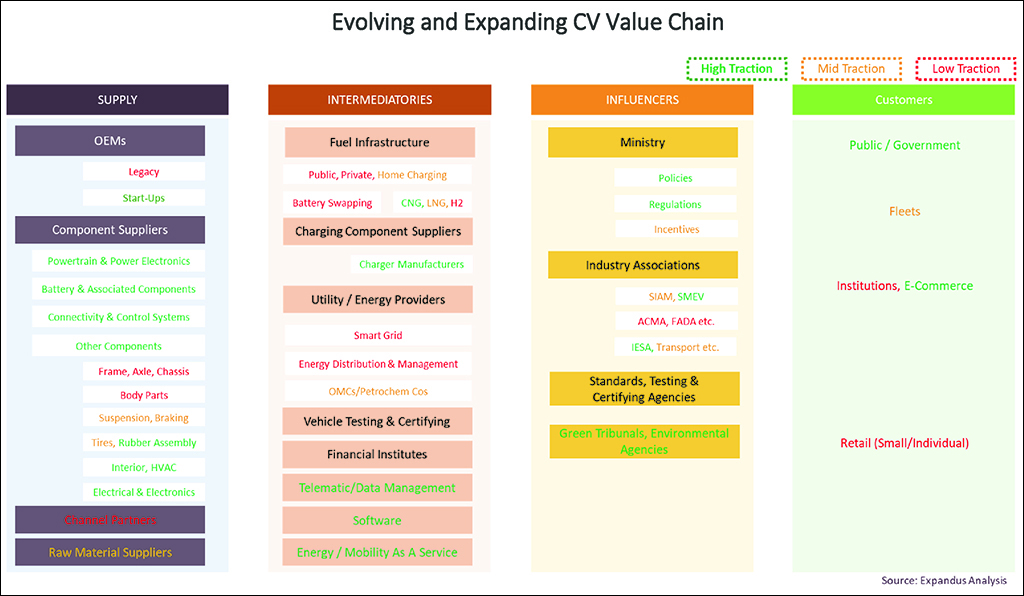

All of the above regulatory trends, supply and demand side challenges and evolving future market requirements have offered an opportunity for many new entrants to address the existing need gaps in the value chain, thus expanding the ecosystem.

Evolving and Expanding CV Value Chain

As electrification becomes a clear pathway for most OEMs to achieve a greener and sustainable future, the ecosystem has seen an influx of new ECV OEMs and component suppliers. It also lays emphasis on greater role of electronics, IT, shift in bill-of-material composition, connected vehicles, charging infrastructure, energy and mobility as a service, new business models, etc. These exciting areas of development within the value chain are addressing many of the existing challenges within the electric vehicle ecosystem. As the world is changing, the balance of power too is shifting, and India is poised to be gaining the most. While in the last decade the Indian CV industry transitioned and adapted many changes, this decade is likely to transform the CV industry technologically, structurally become more agile, collaborative and capable of riding the megatrends and disruptions!

About Expandus

With 40+ years of cumulative experience in Manufacturing, B2B Research and Consulting industry; Expandus is Your Hands-On Partner. Our Mission is to fast-track efforts to accomplish Your Vision.

We partner with decision makers in Automotive, Electronics and Plastics industries to offer a range of growth consulting services and custom-tailored studies helping individual clients develop unique solutions to the challenges of rapidly changing markets.

For Commercial Vehicle Industry, Expandus offers Model-Level Production-Sales-VIO Data intelligence and forecasting, component level opportunity identification and competitive intelligence.