Lockdown will dent auto aftermarket spend by 11% in the top 75 districts this fiscal

The economic crisis brought on by the extended lockdown to contain the Covid-19 pandemic is expected to whip up the woes of the auto-component industry (including tyres, engine oil and lubricants) this fiscal. The industry, which has been battling a steep slowdown in demand from both original equipment manufacturers (OEMs) and export markets, will also see challenges mount in the aftermarket.

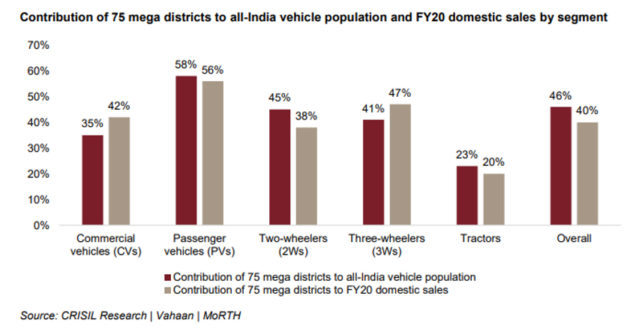

In this report, we analyse the likely decline in aftermarket revenues of auto-component industry from the top 75 districts in fiscal 2021. These districts together account for a significant chunk of automobile sales by OEMs and 46% of the vehicle parc – or total number of automobiles – in the country. A good 43% of the industry’s aftermarket revenue is also concentrated in these 75 districts.

Our analysis takes into account engine oil, lubricants, tyres, and all auto-component parts and labour spends to arrive at the overall impact of Covid-19 on revenue this fiscal. It also considers the likely impact at a granular level, taking into account annual running of a vehicle, and replacement cycle of lubricants, engine oil, tyres and spare parts, etc., besides customer behaviour and attitudes towards replacement of parts, and commuting trends.

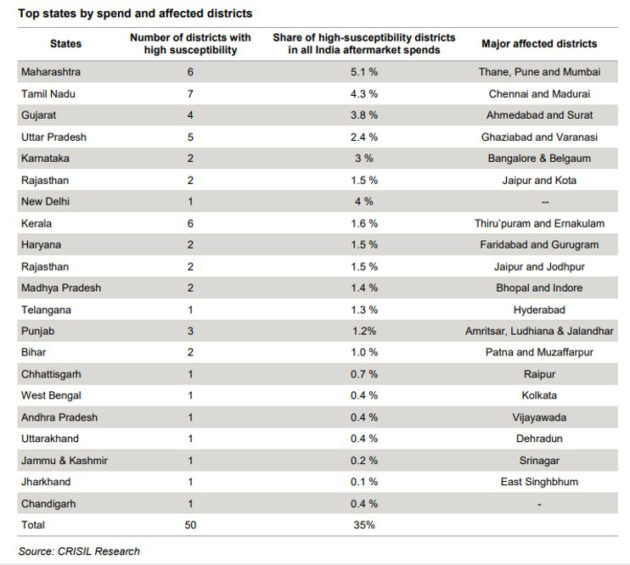

We have bucketed the districts on susceptibility, factoring the spread, risk and intensity of Covid-19 as on June 25. Of the 75 districts considered, 50 are ‘high susceptibility’ areas, 23 ‘medium susceptibility’ areas, and the remaining two ‘low susceptibility areas’. The 50 high-susceptibility districts account for 75% of the total spend of the 75 districts.

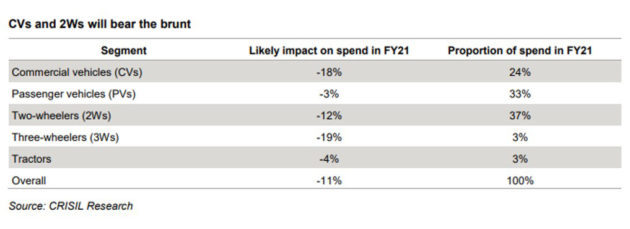

Based on CRISIL Research’s analysis, we see aftermarket revenue in the 75 districts falling ~11% this fiscal.

In CVs, utilisation had reached 25-30% by May end, and is likely to touch pre-Covid levels only by September.

Reduced running, along with the highly price sensitive nature of customers in this segment; will drive down aftermarket spends. In 2Ws, a high proportion of aftermarket spend goes towards tyre and engine oil replacement, which will be sharply lower as both are directly linked with annual running. Besides, 2W owners are likely to heavily down trade – or opt for cheaper options in the aftermarket – given the impact of the economic slowdown.

Usage of 2Ws should improve gradually as commuters increasingly prefer personal vehicles. We expect normal running levels only by September, once factories and businesses restart (work from home gets replaced by going to office for work) and reach their normal tempo.

In PVs, aftermarket revenue may fall only 4% because of maintenance expenses after lockdown. PVs, too, would see more usage as commuters shift to personal vehicles to commute for work. The tractor segment, which is relatively unaffected by demand shocks, would see low decrease in aftermarket spends.

About 15% more office-goers plan to commute by own vehicle

The lockdown that started on March 25 has affected about 1/6th of annual running in varying degrees, depending on city level vehicular population and their zone classification (except tractors). Starting June, various State Governments are opening up areas with fewer restrictions, which would gradually increase the usage of vehicles.

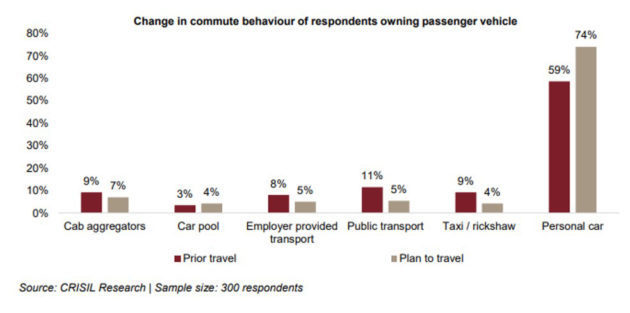

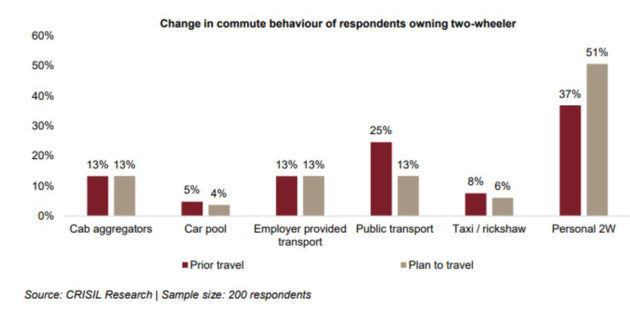

Travel plans will change, too, a survey by CRISIL Research in Tier 1 districts showed. Notably, compared with PV owners, 2W owners are more dependent on public transport, though this will likely decline post pandemic.

The respondents here already had at least one personal passenger vehicle in their households, and most of them were salaried professionals. Before the pandemic, 41% of them used to take other modes of transport rather than their own personal vehicles. But once the lockdown is lifted, 75% of them intend to use their personal vehicles for travel. Accordingly, cab aggregator’s share of commute is expected to see a decline. Two-wheeler owners are on the same page, as the chart below shows.

Here, too, the respondents already owned at least one two-wheeler in their households. And while only 37% of them used to commute to work by their own vehicles before the pandemic, a whopping 51% plan to do so now.

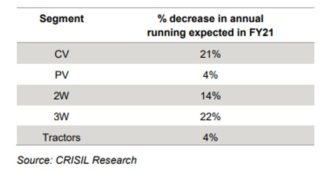

Annual running of vehicles expected to decline

Annual running of a vehicle (in km) is estimated by analyzing the impact of economic slowdown, vehicle end use, duration of lockdown restrictions, and also the risk, spread and intensity of Covid-19 infections.

It is highly unlikely that both commute and business operations would return to normal immediately post lifting of the lockdown. Indeed, CRISIL Research expects all vehicle segments to achieve normalcy in operations only by September.

Consumers likely to opt for cheaper options

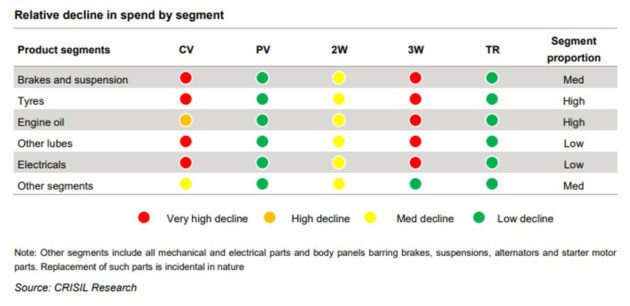

Aftermarket automotive spends are typically driven by annual running and replacement frequency. Thus, a parts level decline mirrors the contraction at vehicle segment level based on running and wear and tear of parts.

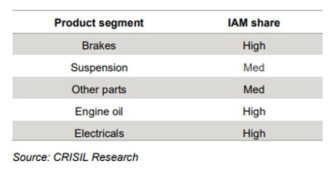

For calculating the spend matrix across sub-segments, we undertook extensive interactions with mechanics and service stations, In the current pandemic scenario, where there is negative demand sentiment, it is likely that consumers will prefer Indian aftermarket brands (IAM) over original equipment supply (OES), especially in areas of medium criticality such as other lubes (apart from engine oil) and other parts. This will bring down revenue for these two product segments more sharply than for the industry on average, since price differential between IAM and OES brands is 20-25%.

Maharashtra most affected on aftermarket spend, followed by Tamil Nadu

Of the 50 high-susceptibility districts, Tamil Nadu has seven, followed by Maharashtra with six. For both these States, the list includes key cities. These 50 high-susceptibility districts together constitute 35% of automotive aftermarket spends. That said, cities with higher proportion of passenger vehicles will be impacted much less compared with those with higher dependence on commercial vehicles or two-wheelers.

Among metro districts, Kolkata is better than others. This is because it has the aftermarket spend concentrated in the PV segment, which accounts for 50% of the city’s vehicle population. This is in stark contrast to Mumbai, where two-wheelers constitute 65% of the city’s vehicle population.

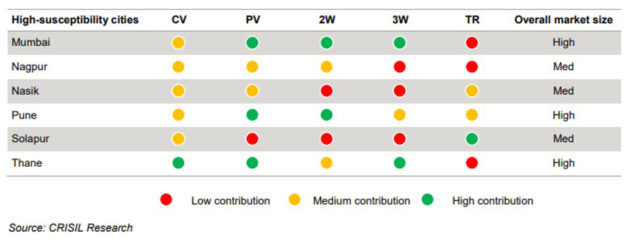

Maharashtra’s high-susceptibility districts

In this section, we have plotted only the high-susceptibility districts of Maharashtra, and have underlined high dependence segments based on annual aftermarket automotive spends.

Districts with high contribution of PV segment will see lower decline. For instance, Pune has high dependence on PVs, which will see relatively lower decline compared with other vehicle segments.

Auto-component vendors in the aftermarket space would be well advised to analyse the nature and mix of automobile parc in the markets they operate in, the relative price sensitivity of customers, and the pace of opening up of the markets as they fine-tune their post-pandemic strategies.