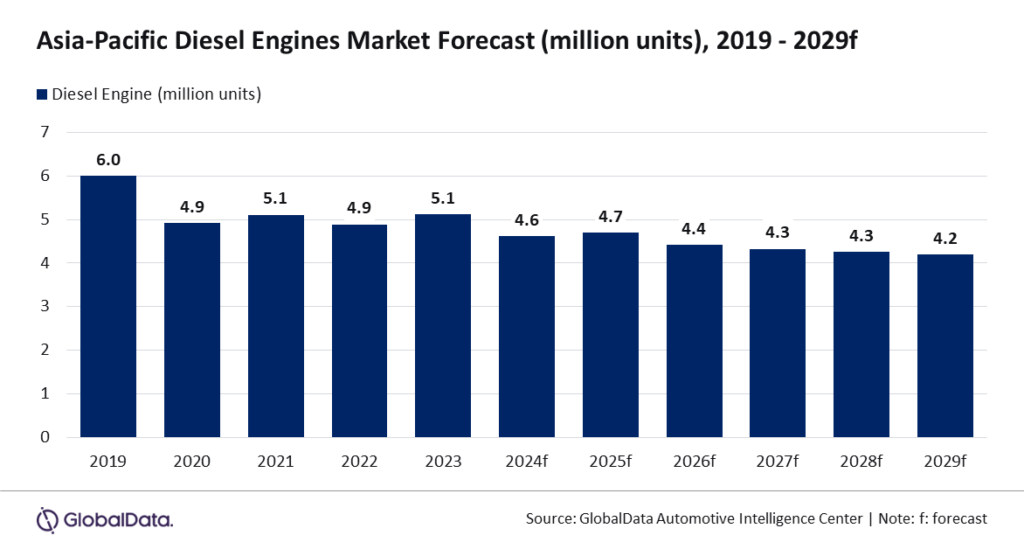

The automotive engines market in the Asia-Pacific (APAC) region is significantly influenced by increasingly stringent government regulations regarding exhaust emissions. Concurrently, in response to the growing trend of electrification, APAC governments are implementing policies and incentives designed to promote zero-emission vehicles. This shift is having a detrimental impact on the automotive diesel engines market. Against this backdrop, the APAC diesel engines market is expected to record a negative compound annual growth rate (CAGR) of 2.0% over 2024-29, according to GlobalData, a leading data and analytics company.

GlobalData’s latest report, “Global Sector Overview & Forecast: Engines Q3 2024” reveals that the diesel engines market is estimated at 4.6 million units in 2024 and is forecast to decrease to 4.2 million units by 2029 in the APAC region.

Madhuchhanda Palit, Automotive Analyst at GlobalData, comments: “Asian countries have demonstrated a proactive approach in implementing policies that foster the growth of the electric vehicle (EV) market, aiming for environmental sustainability and enhanced competitiveness in the global automotive manufacturing and export sectors. This strategy is contributing to a declining demand for traditional internal combustion engines (ICEs).”

While China has assertively positioned itself as the global leader in the EV market, other Asian nations are also making significant strides toward electrification. For example, Thailand has set an ambitious goal of transitioning 30% of its automotive production to EVs by 2030. To facilitate this transition, the Board of Investment (BOI) in Thailand introduced the Electric Vehicle and Hybrid Incentive Program in 2017. This program provides various incentives, including reductions in excise tax and exemptions from corporate income tax, to manufacturers that utilize locally produced batteries and components in their vehicles.

Both the passenger and commercial vehicle segments are currently experiencing a trend toward electrification. However, diesel engines are expected to demonstrate a slower rate of decline in comparison to petrol engines. This dynamic is particularly significant in the context of the commercial vehicle segment, where the electrification process presents considerable economic challenges for fleet owners. The high initial investment required for electric fleets, which typically exceeds that of ICE counterparts, poses a substantial barrier.

Palit adds: “When it comes to transporting heavy loads, ICE engines remain more advantageous. The battery systems needed to power heavy cargo trucks for long-distance hauls—such as Class 8 trucks, which typically require a battery capacity of 1-2 MWh—are considerably heavier than a full diesel tank. This additional weight diminishes the load-carrying capacity of the truck relative to that of an ICE vehicle, thereby impacting overall business efficiency. Inadequate charging infrastructure also works as a major restraint and reason for reluctance among fleet owners to shift towards electrification in countries such as India, Thailand, and Indonesia.”

Due to slower EV adoption rates, several key automotive manufacturers have announced a delay in their ‘going-all-electric’ plan. For instance, Volkswagen has reduced one-third of the planned investment for EVs and has allocated that towards ICE-powered cars. Mercedes-Benz has announced its decision to discontinue the development of the forthcoming MB.EA platform, which was intended for mid- and full-sized electric vehicles. In a similar vein, Ford is reducing its financial commitments to electrification and has significantly decreased its orders for batteries. These developments may be perceived as advantageous for the engine market and could potentially mitigate the rate of market decline.

Palit concludes: “In light of the numerous challenges associated with widespread electrification, which necessitates substantial investment and time, manufacturers are actively seeking solutions to comply with emission standards. The demand for turbocharged engines is increasing due to their ability to enhance fuel efficiency and reduce emissions.

“Furthermore, exhaust after-treatment solutions for ICEs, such as diesel particulate filters and selective catalytic reduction systems, are also witnessing rising demand as they effectively diminish harmful emissions. While it is anticipated that the market for ICE-powered vehicles may eventually face decline and transition towards full electrification in the APAC region, the timeline for this shift appears to be extending beyond initial expectations.”