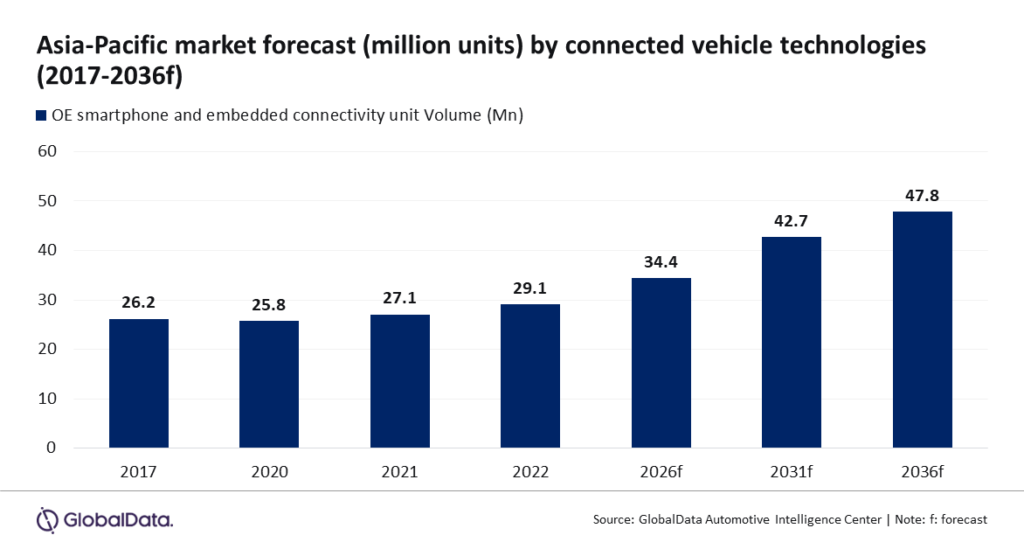

The Asia-Pacific (APAC) region is set to witness a revolution in the automotive industry as connected vehicles continue to gain momentum and reshape the way people travel. With technological advancements, policy support, and evolving consumer preferences, the outlook for connected vehicles in the region appears immensely promising. Against this backdrop, the connected vehicle technologies market in APAC is forecast to reach 34.4 million by 2026, registering a compound annual growth rate (CAGR) of 4.9% over 2021-26, according to GlobalData, a leading data and analytics company.

According to GlobalData, APAC’s connected vehicle market is anticipated to be stimulated by the growth in demand for digital features in automobiles, particularly in developing countries like China and India.

Lucy Tripathi, Senior Automotive Analyst at GlobalData, comments: “Connected vehicles, also known as smart cars or intelligent transportation systems, are equipped with advanced communication and connectivity technologies that enable them to interact with other vehicles, infrastructure, and external networks. These vehicles offer a wide array of benefits, including enhanced safety features, improved traffic management, reduced fuel consumption, and a more immersive driving experience.”

Due to the partnerships among top connected car companies and the widespread adoption of the 5G network for connected cars, the connected car market in the region is predicted to rise exponentially.In May 2023, Nvidia and MediaTek collaborated on connected car technology. Similarly, in Feb 2021 big players like Ford and Google launched Team Upshift, a six-year partnership intended to advance vehicle innovation and data-driven opportunities.

Tripathi continues: “Vehicle connectivity may be able to assist original equipment manufacturers (OEMs) in lowering warranty costs, speeding up response to product faults, and improving the signal-to-noise ratio of trouble codes. Improved data accessibility can also offer enhanced insights into the dependability of suppliers, assisting OEMs in choosing the ideal partners for their requirements. In turn, suppliers may be able to reduce lead times and profit from better-planned supply chains.”

For fleet owners, connectivity makes it possible to monitor fleet health down to the vehicle identification number (VIN) level to better anticipate impending breakdowns. Additionally, it can shorten the duration of breakdowns and enhance maintenance management.

Tripathi concludes: “Increased connectivity may also enable dealerships to automate repair scheduling, make more precise repair projections prior to a vehicle being brought in for service, and have better visibility into parts availability and quality issues, all of which can boost customer satisfaction. Connectivity delivers the data and engagement infrastructure for enabling a much more personalized and informative portal that delivers service, value, and, ultimately, a stronger bid for a customer’s loyalty. Unfortunately, connectivity also opens the door for potential security challenges in the form of cyberattacks.”

* GlobalData Automotive Intelligence Center – Global Sector Overview and Forecast, Connected Vehicle Technologies, accessed in May 2023