The increasing pace of global industrialization is driving a surge in demand for heavy trucks. The Asia-Pacific (APAC) region, serving as a prominent global industrial hub, is experiencing a substantial demand for heavy trucks. Notably, China is anticipated to lead the growth in the heavy truck market within the region, with India and Japan following suit. In light of these trends, the heavy truck market in APAC is forecast to achieve a compound annual growth rate (CAGR) of 4.9% during 2023 – 2028, according to GlobalData, a leading data and analytics firm.

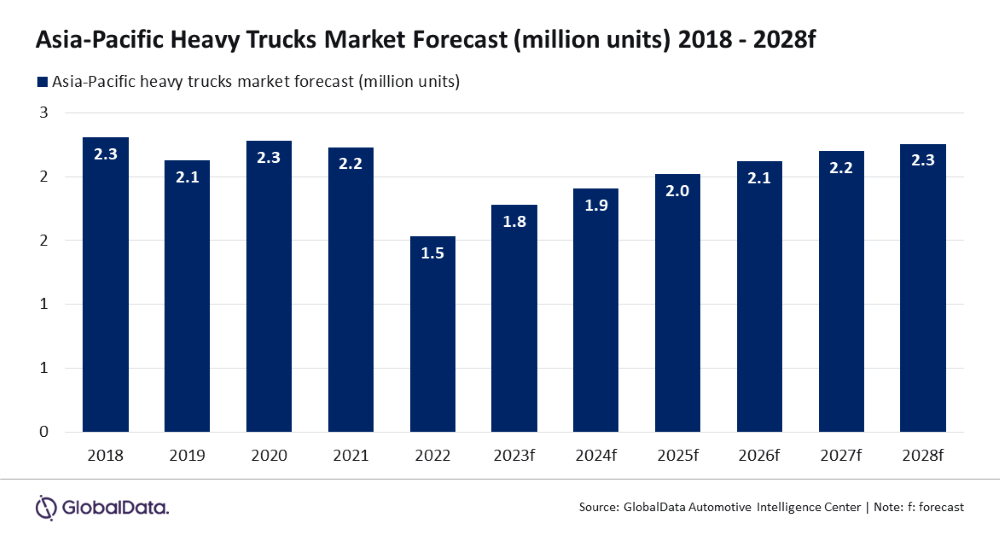

GlobalData’s latest report, “Global Sector Overview & Forecast: Heavy trucks” reveals that the heavy trucks market in APAC is estimated to reach 1.8 million units in 2023 and 2.3 million units in 2028. The region commands a significant 56.4% share of the global market for heavy trucks in 2023, and this share is projected to rise to 60.9% by 2028.

Madhuchhanda Palit, Automotive Analyst at GlobalData, comments: “The surge in online shopping is further intensifying the demand for heavy trucks in APAC. In the realm of e-commerce, medium to heavy trucks play a vital role in the cost-effective bulk transportation of goods between warehouses, factories, wholesalers, and retailers. Moreover, there is a growing need for specialized heavy trucks, including refrigerated trucks, due to the expanding cold chain logistics sector. This is particularly evident in transporting perishable goods such as food and pharmaceuticals, where temperature-controlled transportation is essential.”

Escalating fuel prices in the APAC region in recent years has significantly elevated transportation costs for businesses. This surge has prompted businesses to explore the electrification of heavy trucks as a viable alternative. Many APAC nations heavily depend on fuel imports, with a substantial portion of these imports utilized by freight trucks. This reliance contributes significantly to harmful emissions, creating an incentive for governments to promote the electrification of heavy trucks to reduce fuel consumption and mitigate environmental impact.

In India, for example, electric trucks could help in potentially reducing greenhouse gas emissions compared to diesel trucks. To expedite the transition, the Indian government has set a target of achieving 70% electrification of commercial vehicles, including heavy trucks, by 2030.

Palit adds: “As the number of heavy trucks on the road increases, so does the number of truck accidents. To improve safety and reduce accidents, fleet operators and logistics companies are demanding advanced driver assistance system (ADAS) technologies, which include a driver monitoring system, tire pressure monitoring system, forward collision warning, active brake assist, adaptive cruise control, night vision system, and parking assist systems. Although ADAS features are progressively gaining popularity in heavy trucks across APAC, their current implementation is predominantly confined to premium high-end trucks.”

Governments in APAC are mandating the use of ADAS technologies in heavy trucks. For example, China has mandated that all new heavy trucks sold in the country must be equipped with ADAS features by 2030.

Palit concludes: “While the APAC region is anticipated to maintain its dominant position in the heavy truck market in the coming years, the complete electrification of all heavy trucks in the region is a process that will require substantial time due to the necessary development of charging infrastructure. Additionally, advancements in electric vehicle battery range are essential to accommodate long-distance travel with heavy loads. The initial cost of electric heavy trucks is notably higher than that of diesel trucks, posing a challenge for small fleet operators seeking integration.”