By Mukund Pant, Director, Metal Power

The auto industry – Imperatives on cost and quality

While the wider market has witnessed a slowdown in the last few months, CV majors have faced it for a lot longer this decade; multiple firms have even invested heavily in focused consulting projects to drive cost savings and profitability. Such has been the focus on cost-saving that no facet has been left unexplored. Even items like the thickness of tyre walls have been the subject of discussion around whether a small reduction that didn’t impact quality could yield upsides.

Similarly, there has been tremendous investment in research to drive fuel efficiency, weight reduction, etc. In metals particularly, there has been a focus on micro-alloys and special alloys that reduce costs without compromising quality – e.g., reducing weight while retaining/increasing strength, driving better fuel efficiency or substituting expensive alloying elements with lower-cost ones while not compromising material characteristics.

These efforts have run parallel with the ceaseless focus on ensuring that all materials are of the highest quality in terms of toughness, weight, corrosion-resistance and strength while also being the most economical. The two pursuits seem not just at odds with each other, but also antithetical at times. Yet, the nature of the industry makes it impossible to take either one lightly or even weigh either as being more important. This is where smarter quality management helps firms across in driving value – meeting all quality objectives while simultaneously reducing costs.

Quality management – The toughest balancing act

More than anything, the automotive sector’s value chain is indelibly marked by deep inter-linkages and a very large multi-level ecosystem. Like any chain, this value chain too is only as good as its weakest link. As one moves upstream, it is possible for someone to cut corners – for example, for a small grey iron foundry to use mild steel scrap as input and not check for nitrogen, leading to higher brittleness. Likewise, for a bearings manufacturer to not check for oxygen – leading to failures ahead of schedule or specifications.

This just covers failure potential given inadequate quality management – and is clearly critical. That said, preventing such failures is one of the lesser value-adds when it comes to the benefits of good quality management. The far bigger benefits are that on costs, and bottomlines.

Vendor management – Managing cost and quality

Vendor management – Managing cost and quality

For OEMs, the three major ways of driving cost reduction, (in increasing order of difficulty and complexity) are:

- Inventory management

- Indirect cost reduction

- Direct cost reduction

Reducing inventory to industry norm or lower is the first and easiest way of managing costs and to a great extent, process and procurement efficiencies help in delivering benefits. Thereafter, the focus shifts to indirect costs which are easier to reduce as they don’t directly impact operations and/or quality. Direct cost reductions are far more complex – and this is where top-class quality and vendor management deliver real value – and this value also touches inventory!

Earlier, the focus of direct cost reduction was limited to procurement and negotiations. The more advanced firms moved to should-cost models, but that was about the limit of effort made. Today, things have changed. VA/VE and a focus on vendor management have proven to deliver phenomenal upsides across the board.

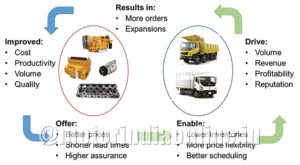

Vendor quality – The foundation of cost-efficiency

During negotiations, a vendor typically uses his cost structure as the baseline. Reducing this cost itself is therefore the key to optimizing value. A key driver for this is quality. If a vendor reduces his own material cost, and improves productivity and FTR (First Time Right), he reduces inventory, direct and indirect costs, benefits of which can be passed on to the buyer and ultimately to the OEM. The focus of comprehensive cost reduction must therefore begin with improving vendors’ quality.

Given the criticality and quantum of metals used in the industry, one of the simplest and most efficient focus areas is on the suppliers and processors of metals and metal parts. In metals particularly, cost savings and quality always go in tandem with a benefit on one side driving benefits on the other without exception.

Spectrometers – The key to metal quality

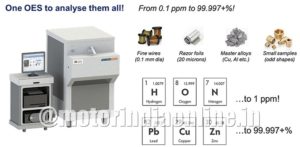

A spectrometer is an analytical instrument that – within just 10-20 seconds – analyses a metal sample and provides its elemental composition down to parts per million (ppm). While entry-level spectrometers provide the composition for 25-30 elements, higher-end ones provide such analysis for 60+ elements. Given that elemental composition determines material cost and quality, such testing is the fundamental step in ensuring vendor and material quality.

Spectrometers are used by all quality-conscious firms, from the smallest to the largest – and are not merely QC (Quality Checking) instruments. These are essential tools in QA (Quality Assurance). Given its short analysis time, spectrometers are optimal for in-process usage with readings used to make in-process changes. These changes include:

- Altering melts to meet grade requirements

- Altering the melt to improve cost by controlling expensive alloying elements closer to minimum limits and lower-cost ones closer to upper limits

Most importantly, such testing ensures that vendors produce the right quality each and every time as errors are identified and eliminated in-process. Proactive testing therefore yields benefits that stretch far beyond merely producing a “test certificate”.

Benefits across the value chain

The benefits stretch across the entire value chain.

- Cost reduction – The producer / castings maker is able to control direct costs and pass benefits on to his customers

- Vendor inventory reduction – When a vendor uses an in-house spectrometer, he has results and certificates immediately and doesn’t need to wait for laboratory results; this reduces inventory by 3-8 days.

- Higher productivity – Improvement in FTR directly improves productivity by eliminating rework and associated overheads (overtime, energy cost, etc.)

- Customer inventory reduction – Vendors with better quality infrastructure offer better OTD (On-time delivery) and FTR enabling customers to reduce the level of safety stock, driving inventory reduction

- Failure analysis – Parts sometimes fail. When a metallic part fails, it becomes essential to analyse specific points of failure to analyse whether elemental composition caused it – and if so, to build a solution

- Research and development – The focus on weight, efficiency and environmental regulations necessitate use of spectrometers to better understand materials and optimize them for the intended applications

- Quality improvement – Should every element of the value chain use the right testing infrastructure, the overall quality of the ecosystem rises – in turn driving cost and efficiency benefits, and also better market reputation and customer confidence.

This creates a sustainable and sustained “virtuous cycle” where improvements from each element help everyone else – and work their way back to the originator as well.

Quality – Investment and not a cost

Quality therefore is not a cost – it’s an investment that is a fundamental profit-driver. Decades of research have conclusively laid to rest the myth that Quality is best “managed” with the aim of clearing checks with minimal “cost”.

Such companies not only enjoy better reputations, but also accrue higher revenues and lower costs per unit. In the Automotive sector, this is amplified given the “cost of bad quality”, since failures can be not just expensive and messy affairs, but also catastrophic, with casualties, fatalities, lawsuits and of course, immense reputational damage – and the resultant loss in customer confidence, market image and marketshare as well. Thus, it is no surprise that without exception, market participants insist on the highest quality – and the only ones that survive and profit long-term are the ones with the most stringent standards.

Spectrometers – Accessible, economical and essential

Till the mid-2000s, while every metal firm knew and appreciated the value that Optical Emission Spectrometers (OES) add, usage was limited to large firms alone, as acquisition and running costs were extremely high and maintenance as well as operations required significant expertise. Further, OES also had severe restrictions – a lack of flexibility to make even the most minor changes to an instrument post-purchase, the inability to upgrade analytical performance and other such as:

- No analysis of oxygen, hydrogen – routinely termed as “poison” in all manner of steels – particularly those used in fasteners and bearings

- Exceptionally high price for nitrogen analysis – a key element for stainless steels, alloy steels, etc.

- Inability to analyse small samples such as wires, sheets, foils, etc.

As in most fields however, the last 10-15 years have brought about a revolution in virtually every area. The smallest OES then occupied half a room; today, the smallest measures less than one cubic foot (1 ft3). While the least expensive OES then was priced at ~Rs. 20 lakhs, today, a far more powerful one is available for <Rs. 7 lakhs! Nitrogen analysis, then limited to the high-end alone, is now featured even on entry-level models. In short, literally everything has changed.

The increased affordability, better service, and significant advancement in analytical capabilities means that today, not even the smallest supplier should be allowed to use affordability as an excuse for not having an OES in-house. Quite simply, if a vendor is even mildly committed to assuring quality, he must own a spectrometer – and have it in-house.

It is not merely at the entry-level or the “mass market” that the market has transformed. Advancement in technology for gratings and detectors as well as electronics and software has resulted in tremendous developments at the top end too. Today, top-end OES are like a “silver bullet” in terms of the analytical horsepower offered.

Quite simply, OES today offer benefits that cover virtually every need – and add more value than they have at any time in the past – while being far more economical and far more critical for the industry as a whole.