India Ratings and Research (Ind-Ra) expects investments in the auto ancillary sector in the form of acquisitions and joint ventures to continue in the medium term. Companies are investing both in the domestic and emerging markets to take advantage of technological developments and increase their product availability. Furthermore, a strong balance sheet, coupled with buoyant domestic demand and high capacity utilisation, entices them to tap inorganic growth opportunities.

Ind-Ra also does not expect the acquisitions to materially affect the credit metrics of auto ancillary companies due to their underlying low leverage.

With the advent of more technologically enhanced vehicles and in view of the ongoing regulatory changes and premiumisation, there has been a tactical shift in demand of auto parts, primarily from original equipment manufacturers (OEMs). The onset of electric vehicles may further necessitate the development of new parts and components.

Although powertrains will be important, OEMs are increasingly emphasising in-vehicle user experience or human machine interface. Lane tracker, navigation systems, mobile connectivity and cruise control are some of the technological features in the latest models. The recent acquisitions by domestic auto parts companies indicate their intent to diversify traditional product portfolios into more technologically advanced and software-enabled products.

For example, Motherson Sumi Systems Ltd., through its step-down subsidiary, has acquired Reydel Automotive Holdings BV, a prominent player in manufacturing automotive interior products. Similarly, Minda Industries Ltd.’s acquisition of iSYS RTS GmbH, a developer of embedded systems and software for major OEMs, displays its intent to foray into digital content-driven products.

Minda Corporation raised funds through a qualified institutional placement to expand inorganically. While technological arrangements with global payers have always remained in the auto ancillary space, the same is on an upward trend recently with companies such as Sandhar Technologies Ltd. and Precision Camshafts Ltd. actively forming joint ventures to leverage the advancements.

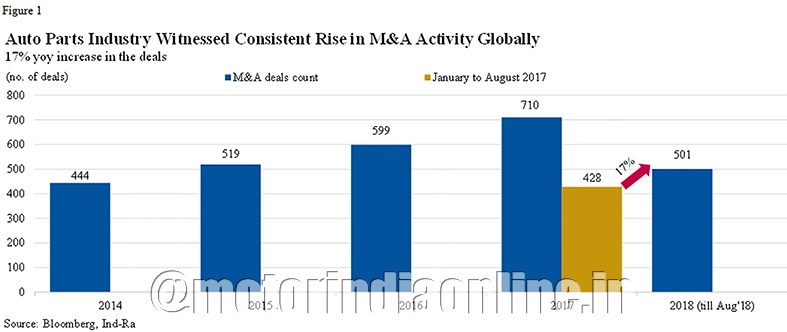

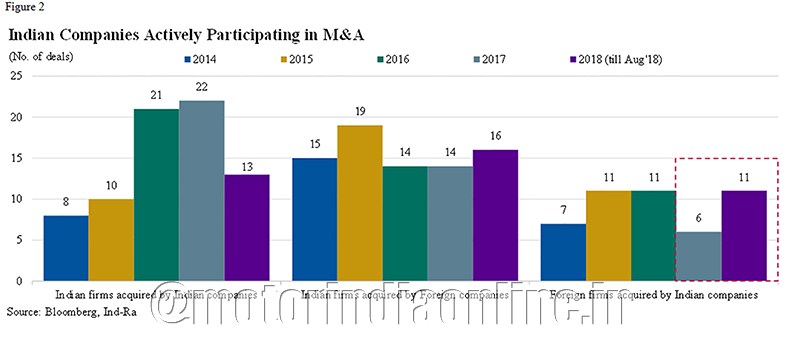

The M&A activity has been on the rise globally. There have been 11 deals during January-August 2018 where domestic companies have acquired foreign firms, as against six deals in 2017. Also, the number of domestic acquisitions was slightly higher in 2017 than in 2016.

Merger motives are mainly to integrate and expand scale in a similar business industry; hence, around 90% of the acquisitions globally have been strategic since 2015. Also, target companies for potential acquisitions range from matured to early-stage companies, having solid tech innovations and distinguished product offerings.

Ind-Ra believes the sector will continue to witness acquisitions at least for the next two years, as large corporates will look to start expanding horizontally across geographies and building a resilient product portfolio. The integration bodes well for domestic companies in the long run, as OEMs increasingly roll out models with latest features on road in India.

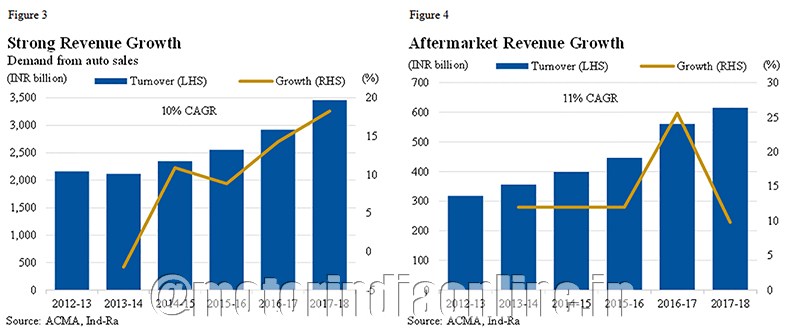

Revenue in the auto parts industry grew consistently over FY17-FY18, mainly due to an uptick in demand for automobiles & aftermarket sales volume. Simultaneously, exports of auto components increased at an 11% CAGR over FY13-FY18. Ind-Ra expects revenue growth to be 10-12% yoy for FY19 with a stable demand outlook. Ind-Ra opines this will enable domestic companies to grow inorganically and expand product offerings.

Balance sheet to support growth

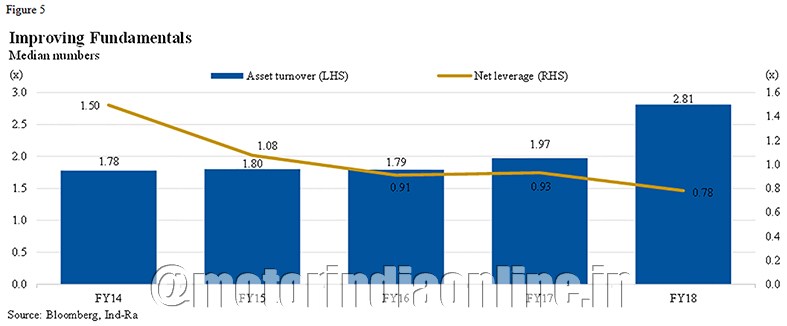

Healthy demand across all automobile types since 2015 has led to volume growth and thus improvement in capacity utilisation for auto ancillaries companies. The asset asset-turnover ratio (sales/gross block) as a measure of efficiency peaked in FY18, after remaining flat during FY14-FY17.

Similarly, the median net leverage of the sector bottomed in FY18, after improving gradually from the FY14 levels. This is mostly due to higher cash balances and impressive EBITDA growth during the same period. Companies in the sector are better placed to fund any inorganic growth opportunities without materially impacting their leverage positions.

Cyclicality of auto OEMs

A cyclical downturn in the auto OEM industry could impact auto component manufacturers, especially in cases where companies have expanded their capacity through lateral mergers. Furthermore, parts manufacturers with a greater exposure to commercial vehicle OEMs than passenger vehicle OEMs could face more challenges than before, due to commercial vehicles’ higher elasticity in a cyclical downturn. Thus margins as well as credit metrics could come under pressure.

Furthermore, the auto industry continues to face regulatory changes (vehicle scrappage policy, revised axle load limits, technological changes related to electronic vehicles, etc.), which could change the focus areas of the companies in the sector. As such, the dynamics of a merger may not materialise as expected in the first place.