By Anuj Sethi, Senior Director, CRISIL Ratings

Despite a moderation in exports, India’s automotive components sector is expected to maintain healthy double-digit growth in fiscal 2024, thanks to robust demand from domestic original equipment manufacturers (OEMs) and the aftermarket. Moreover, the segment supplying components for electric vehicles (EVs) is poised for even higher growth due to the increasing demand for EVs. Additionally, investments in the sector are set to rise in the coming years.

The sector’s revenue surged approximately 23% to around Rs 4.8 lakh crore in fiscal 2023, and it is projected to grow a further 10-12% this fiscal.

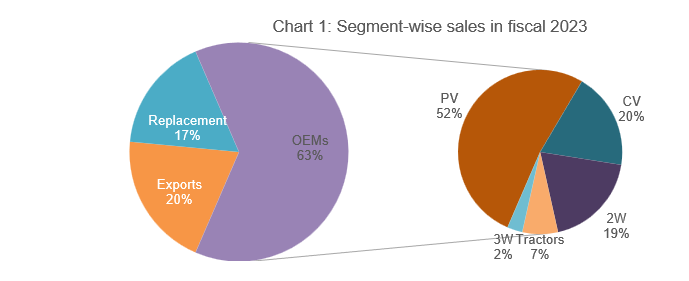

Revenue from domestic OEMs, which contributed 63% of the revenue last fiscal, is estimated to grow by 12-14% this fiscal, fueled by consistent demand from all segments except tractors.

Within the OEM segment, passenger vehicles (PVs) – accounting for over half of the OEM sales (see chart 1 – Segment-wise sales in fiscal 2023) – are expected to grow by 6-8%, while commercial vehicles (CVs) and two-wheelers (2Ws), contributing approximately 20% each, will rise by 8-10% and 9-11% respectively. Tractors, representing around 10% of the balance, will see muted growth.

Source: CRISIL Ratings, CRISIL Research

Exports, the second-largest revenue contributor at 20%, are expected to grow at a modest pace of 6-8% this fiscal (compared to 8-10% last fiscal) due to global headwinds and uncertainties in key markets like Asia, Africa, and Latin America. However, the long-term prospects for automotive component exports from India remain positive, mainly due to the increasing share of critical and high-value components such as engines and gearboxes in total exports, accounting for around 64% in fiscal 2023, up from 50% in fiscal 2020. This growth in critical and high-value component exports bodes well for the sector’s future export growth.

The aftermarket, contributing 17% of revenue, is expected to grow by 6-8%, similar to fiscal 2023, supported by healthy automotive sales in past fiscals.

The steady demand momentum, driven by OEM demand, recent price hikes, and cost-efficiency measures by automotive component manufacturers, will lead to increased operating leverage. Consequently, the operating margin is expected to inch back to the pre-pandemic level of 12.0-12.5% this fiscal after making a mild recovery in fiscal 2023.

Automotive component manufacturers diversified into supplying components for EVs will be in a better position compared to those focusing solely on internal combustion engine (ICE) vehicles. EVs – including two-wheelers, three-wheelers, and PVs – are projected to grow faster than ICE vehicles, albeit on a low base. Suppliers of two- and three-wheeler EVs are expected to fare even better as EV adoption is fastest in these segments.

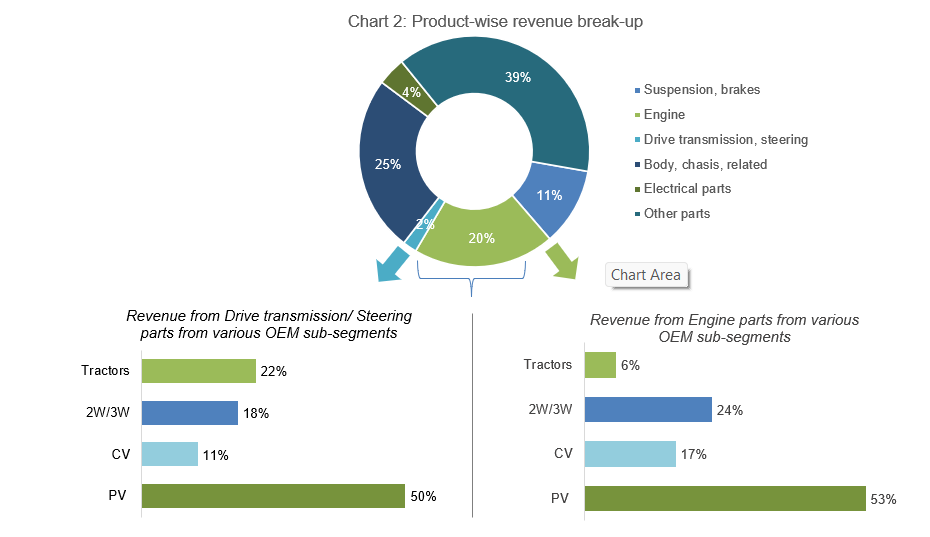

A CRISIL Ratings analysis of 230 rated automotive component manufacturers, accounting for approximately 50% of the sectoral revenue, reveals that around 22% of the revenue comes from ICE engines and drive transmission components (see chart 2 – Product wise revenue break-up). Players heavily exposed to ICE engines and transmission components need to diversify their product offerings and include fast-growing EV-related components to remain relevant.

Source: CRISIL Ratings

Currently, a significant portion of the automotive components required for EVs are imported from China and a few other countries. To reduce India’s import dependence and promote indigenous manufacturing of advanced automotive technology components essential in EVs, the PLI scheme was introduced in September 2021. About 75 automotive component manufacturers, representing almost 50% of the sector, participated in the PLI scheme and proposed a total investment of approximately Rs 30,000 crore over five years.

Although there has been limited progress in achieving the scheme’s objectives, especially concerning critical parts like electronics, investments are expected to increase following the announcement of standard operating procedures by the Ministry of Heavy Industries in April 2023, providing clarity on availing incentives under the PLI scheme. This, along with improved access to global technology for component production, such as sensors and other critical parts, is likely to boost investments.

The push for EV components, product diversification, and capacity enhancement driven by higher capex from OEMs will result in automotive component manufacturers undertaking a capex of around Rs 17,500 crore this fiscal, representing a 20% increase from the previous year.

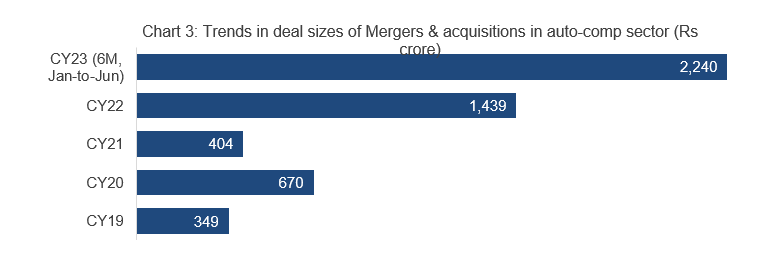

Furthermore, inorganic expansion is gaining momentum, with the deal size surpassing the previous year’s figures in the first six months of calendar year 2023 (see chart 3 – Trend in deal sizes of Mergers & Acquisitions in auto component sector). Despite rising capital expenditure for organic and inorganic expansion, credit profiles of automotive component makers are expected to remain stable due to steady cash generation and sufficient balance sheets.

Key debt protection metrics of component makers rated by CRISIL Ratings should also remain healthy. For instance, interest coverage is anticipated to be around 7 times this fiscal, only slightly lower than the ~7.5 times seen last fiscal, while the debt-to-earnings before interest, taxes, depreciation, and amortization (EBITDA) ratio is expected to remain stable at 1.5 times (~1.6 times last fiscal).

In conclusion, while the sustainability of demand from domestic OEMs, increased indigenisation of EV components, movement in commodity prices, and the global macroeconomic scenario are essential factors to monitor in the future, the automotive components sector is well-positioned for growth in fiscal 2024.