Operating margin to remain stable, capex to increase by 30% this fiscal

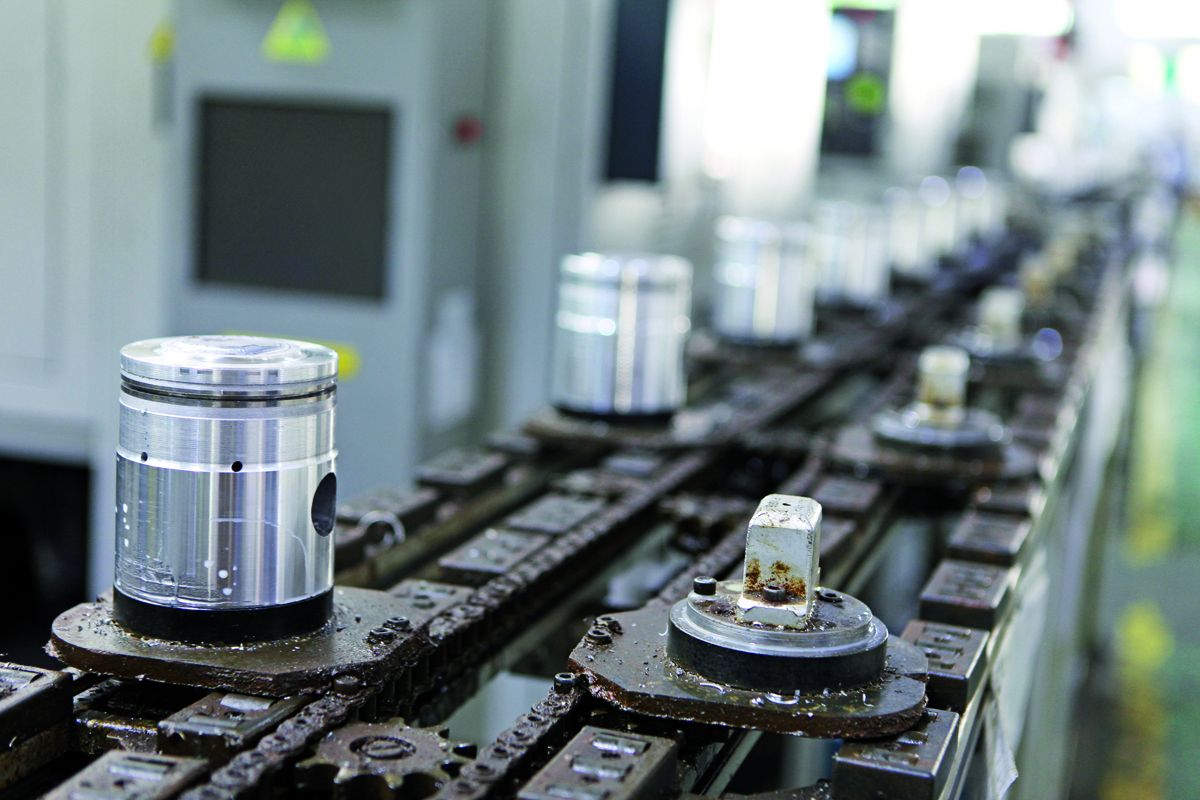

India’s automotive components sector will see revenue cranking up 14-16% to a new high this fiscal, marking the second straight annual double-digit growth milestone after the ~24% clocked last fiscal. Operating margin will be stable at 12-13% due to better utilisation and as companies pass on higher input costs to customers – with a lag. Improved demand outlook across segments will drive a 30% rise in capital expenditure (capex), which will be funded partly through debt, and the balance through higher accruals generated.

An analysis of 220 automotive component entities rated by CRISIL Ratings, which account for about one-third of the sector revenue of Rs. 4.2 lakh crore, indicates as much. The segment derives about 61% of its income from automobile original equipment manufacturers (OEMs), 18% from the aftermarket, and the remaining 21% from exports.

Says Pushan Sharma, Director, CRISIL Research: “We expect all three segments to fuel healthy revenue growth. Demand from OEMs should increase a robust 18-20% this fiscal, driven by higher production of commercial and passenger vehicles (PVs). Aftermarket demand is expected to grow 7-9% on a high base of last fiscal, which benefited from an elongation in vehicle replacement cycle amid the pandemic. And component exports will rise 8-10% on top of ~40% growth last fiscal due to steady demand from the US and European markets.”

There has been a sharp increase in input prices – primarily of steel and aluminium – over the past 18 months. The impact on operating profitability has, however, been somewhat muted as the bulk of the input cost increase has been passed on to OEMs.

Higher operating leverage and moderation in steel prices from June 2022 due to the recent imposition of export duty on many steel products (including automotive grade steel) will help buttress the impact of rising freight costs. This will ensure operating margin remains stable at 12-13% this fiscal, though still below ~14% achieved in fiscal 2019, which was among the better years for the sector.

Says Naveen Vaidyanathan, Director, CRISIL Ratings: “Capex by CRISIL-rated automotive component makers is expected to see a significant step-up of ~30% this fiscal, driven by strong demand outlook, including for electric vehicles, and investments related to the Production-Linked Incentive scheme. Working capital should also increase due to higher cost of inventory caused by elevated commodity prices. But higher operating profits would nevertheless support healthy debt metrics leading to ‘Stable’ credit outlook for players. The debt to Ebitda ratio of automotive component makers is estimated at ~2 times and interest coverage ratio 6-7 times in fiscal 2023, almost similar to last fiscal.

A prolonged semiconductor shortage which can derail growth in PVs in particular, further intense waves of the pandemic and inflationary headwinds in key export markets will bear watching.