Regional performance varies sharply, north appears most impacted

Dealers of two-wheelers, passenger vehicles and commercial vehicles expect sales to increase 10-15% this fiscal on a low base of last fiscal, driven by new model launches, pent-up demand, and festive season sales, a CRISIL survey has revealed.

On the flipside, a possible third wave, spurt in fuel prices and supply constraints of original equipment manufacturers (OEMs) are seen among factors that could slow the sector down.

The survey was aimed at gauging dealer sentiment and expectations and drawing a comparison with previous year’s poll1. It covered 123 dealers of two-wheelers, and passenger and commercial vehicles with a fair mix across regions and OEMs.

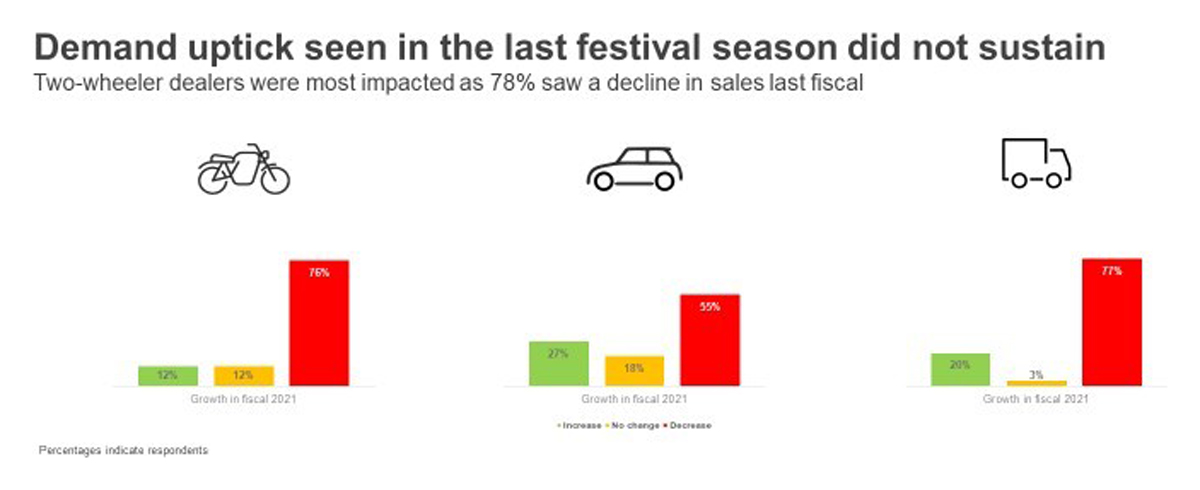

Bhushan Parekh, Director, CRISIL, says: “Last fiscal did see a demand uptick during the festival season, but it did not sustain. Two-wheeler dealers were the most impacted. This fiscal, too, sales across segments are yet to reach pre-pandemic levels. Also, the deal conversion cycle has doubled, with customers deferring purchase decisions. While sentiment is positive among dealers, the risk of a third wave during the upcoming festive season is a key concern.”

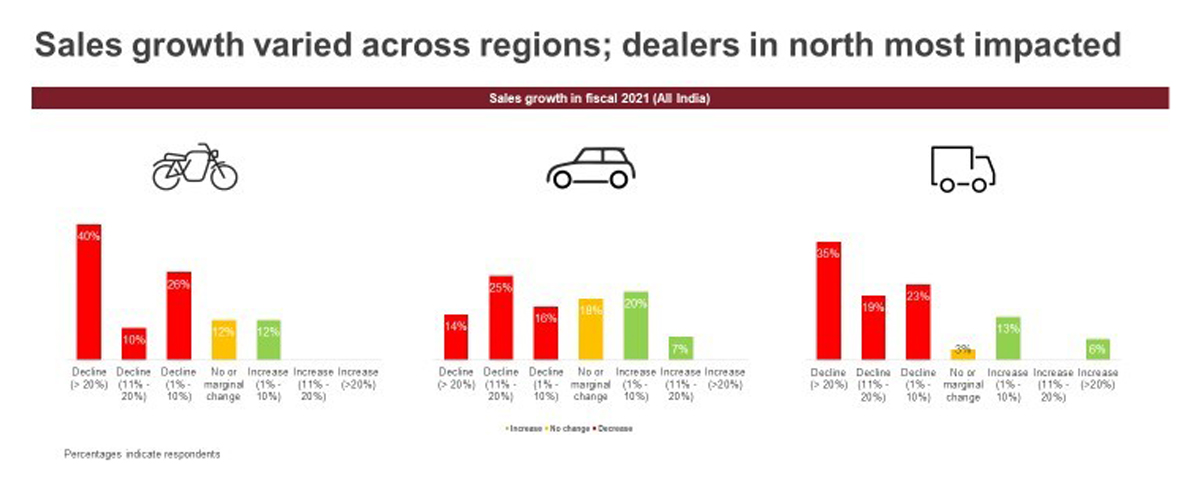

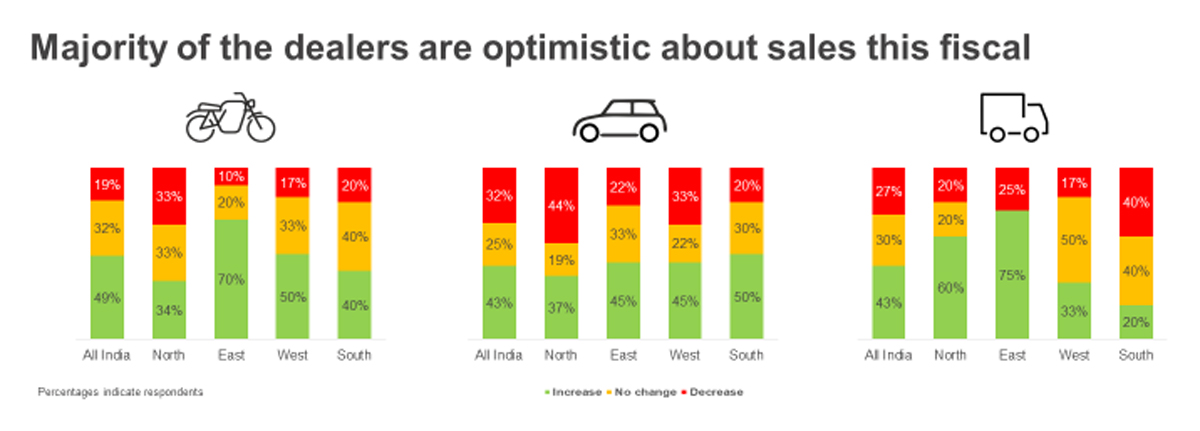

Similar to last fiscal, regional performance is expected to show sharp variation. While most passenger and commercial vehicle dealers expect sales to improve across regions, 44% of passenger vehicle dealers in the north and 40% of commercial vehicle dealers in the south expect a decline. Last fiscal, 45% of the commercial vehicle dealers surveyed in the north and 67% in the west witnessed over 20% on-year decline in sales.

Overall, two-wheeler dealers are optimistic about sales this fiscal. Dealers in the east and west expect higher sales, while 33% in the north and 20% in the south are not as hopeful. Last fiscal, ~60% of the two-wheeler dealers surveyed in the north and south reported over 20% on-year decline in sales.

Mubasshir Bakir, Associate Director, CRISIL, shares: “Low inventory levels will help in quicker recovery and also reduce holding costs. About 75% of the surveyed dealers reported vehicle inventory of less than 45 days due to better management. Indeed, while lockdowns started in April this fiscal, they had liquidated inventory in March. Added to this, staff rationalization and cost control measures initiated last fiscal have softened the impact on dealers’ financials. Majority of the survey respondents do not expect any material retrenchment or attrition of staff, or dealership exits this fiscal.”

Though the government did not introduce specific measures for the auto industry’s revival in Union Budget 2021-22, it recognized auto dealerships as micro, small and medium enterprises (MSMEs). Since then, a large number of commercial and passenger vehicle dealers surveyed have registered themselves as MSMEs, though two-wheeler dealers are yet to do so. This could be because many dealers are not fully aware of the credit schemes available for MSMEs and have only availed of moratorium extension until now.

1 https://www.crisil.com/en/home/our-analysis/reports/2020/06/the-epicentre-of-an-existential-crisis.html