The Federation of Automobile Dealers Associations (FADA) has released the vehicle retail data for June’23, revealing positive trends in the auto retail industry.

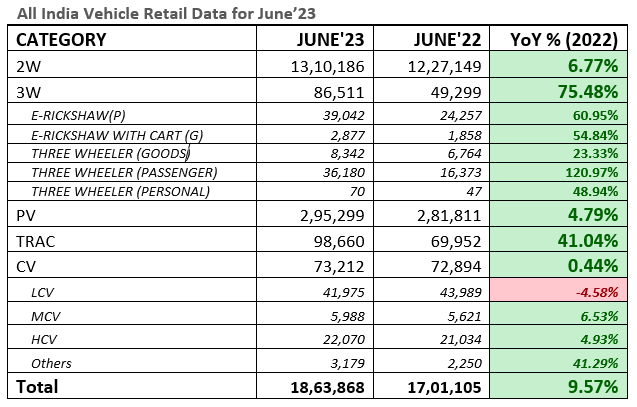

Auto retail sales in June demonstrated a 10% year-on-year (YoY) growth, showcasing positive performances across all vehicle categories, including 2W, 3W, PV, Tractor, and CV. The respective growth rates for these categories were 7%, 75%, 5%, 41%, and 0.5%.

While the overall retail figures have relatively improved compared to previous months, there was a slight decline of -3% when compared to pre-COVID levels. The primary segment facing setback was 2W sales, which experienced a decline of -14%. However, CV sales grew by 1.5% compared to June’19, marking the first time it surpassed pre-COVID levels.

June’23 recorded all-time highs in multiple segments, with 3W, PV, and Tractor showing maximum strength compared to previous June’s.

However, there are challenges ahead for the two-wheeler market, including economic pressures and supply constraints. Additionally, the reduction in FAME subsidies casts a shadow over electric vehicle (EV) sales.

The passenger vehicle segment is facing inventory pressures and demand-supply mismatches, impacting profitability. However, the anticipation of a boost from the upcoming festive season beginning in end-August offers a hopeful outlook.

Erratic monsoon rainfall in India is raising concerns about crop yields, potentially impacting automobile sales, especially in rural areas. However, the anticipation of evenly spread rains going forward may revive rural demand and positively influence retail sales.

Commenting on the performance in June 2023, FADA President Manish Raj Singhania stated, “Despite a 10% YoY growth, the auto retail sector has seen an 8% month-on-month (MoM) dip, indicating a short-term deceleration in sales. Analyzing individual categories on a YoY basis, 2W, 3W, PV, Tractor, and CV segments observed growth rates of 7%, 75%, 5%, 41%, and 0.5%, respectively. In comparison to pre-COVID levels, the overall auto retail marked a marginal decrease of 3%, with 2W as the sole laggard. Conversely, the CV segment experienced a 1.5% growth compared to June’19, surpassing the pre-COVID levels for the first time.”

Despite some short-term contraction, India’s growth narrative remains resilient. The month of June’23 registered all-time highs for 3W, PV, and Tractor segments when compared to all the previous Junes.

The two-wheeler sector faced supply constraints from certain OEMs and softer demand due to economic conditions and higher entry-level bike costs. Despite new model introductions, festive promotions, and seasonal factors, sales couldn’t be significantly boosted. There was a 12% MoM drop in two-wheeler sales, with electric vehicle sales witnessing a 56% MoM decline primarily due to the government reducing FAME subsidies, which triggered extreme price hikes.

June’23 witnessed robust growth in the 3W market, primarily due to the low base effect from the previous year and positive market sentiment. The shift towards alternative fuels, predominantly EVs, continues to play a significant role in driving this growth, despite potential supply concerns due to the non-availability of OBD2 vehicles.

The passenger vehicle segment navigated through a mixed landscape characterized by variable demand, dynamic product portfolios, and oscillating market sentiments. FADA commends Maruti’s swift action to facilitate the clearance of slow-moving model stockpiles by underwriting dealer interest costs, contributing positively to the segment. Although dealers noted sporadic supplies of popular models and aging product concerns for slow-moving variants, the segment still experienced an uptick in demand for new models and anticipates further pick-up in rural sales.

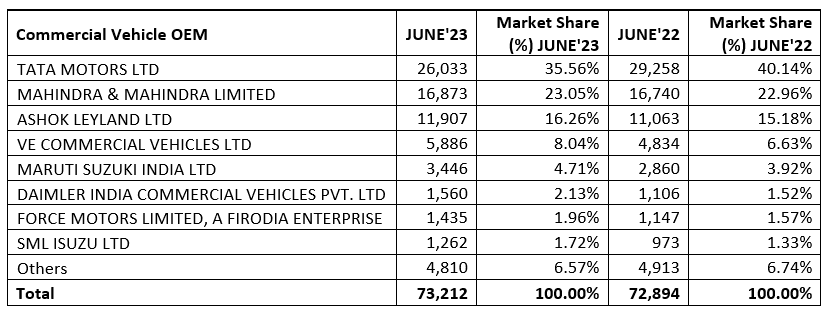

The commercial vehicle segment confronted mixed dynamics influenced by inconsistent demand, supply issues, government policies, and external market factors. Despite fluctuating demand and vehicle availability issues, the government’s infrastructural push and coal mining growth spurred demand for heavy commercial vehicles. However, high-interest rates and rising prices acted as counteracting factors.

Near Term Outlook

The auto retail outlook for July’23 signals mixed trends. The two-wheeler market anticipates continued supply challenges and economic pressures, despite new schemes and expectations of monsoon-boosted sentiment. Meanwhile, the cutback in FAME subsidies casts a shadow over EV sales. On the other hand, the three-wheeler market predicts growth, underpinned by favorable market responses and rising demand.

The passenger vehicle segment faces a dichotomy of factors. While the launch of new models and the potential rise in rural sales lend optimism, dealers navigate inventory pressures from OEMs and demand-supply mismatches, impacting profitability. However, the anticipation of a boost from the upcoming festive season in end-August offers a hopeful outlook. The commercial vehicle sector contends with a balance of positive market sentiment and potential monsoon impacts, with demand spurred by infrastructural projects and improved financing options.

On the agricultural front, erratic monsoon rainfall in India is hindering crop sowing. The delayed and uneven rains may reduce crop yields, shorten crop cycles, and cause a delay in future crop arrivals. Such developments may affect the sales of automobiles, particularly in rural areas, where a weak agricultural season could lead to a reduction in disposable income, thus affecting demand for two-wheelers and entry-level cars. However, upcoming rains may potentially boost agricultural prospects, revive rural demand, and positively influence automotive sales. FADA hence remains cautiously optimistic about the near-term outlook.