Bosch Limited ended fiscal year 2021-22 with total revenue from operations of INR 11,781 crores, thus registering an increase of 21.2 percent compared to the previous fiscal year. “2022 marks 100 years of Bosch in India, and this significant landmark and heritage was complemented by a positive revenue growth curve throughout FY 2021-22. Amid the multifaceted challenges faced by the automotive industry, Bosch’s mobility business demonstrated resilience and recorded a faster-than-market recovery rate on a par with the all-time high posted in 2018-19. We will continue to capitalize inorganic opportunities to expand our digital mobility business by leveraging our Mobility Cloud Platform and Mobility Marketplace for new-age mobility players while actively growing our acquisitions and mergers pipeline,” said Soumitra Bhattacharya, Managing Director, Bosch Limited and President, Bosch Group, India.

Profit After Tax (PAT) stood at INR 1,217 crores. Total investments including capital work-in-progress in 2021-22 amounted to INR 635 crores with major spend on the expansion of the Adugodi campus into a smart campus.

Q4 Results

In quarter 4 of FY 2021-22, which ended on March 31, 2022, Bosch Limited posted a total revenue from operations of INR 3,311 crores, an increase of 2.9 percent compared to the corresponding quarter in 2021. PBT for the current quarter stood at INR 432 crores, a 32.6 percent decrease over the same period of the previous year.

“We acknowledge and appreciate the various initiatives like PLI and scrappage policy implemented by the Government of India towards supporting the auto industry. It is vital to create a clear roadmap to support the industry to further invest and create a stable environment. While these policies have provided an impetus for the auto sector to accelerate growth, the constant changes in regulations have caused challenges for the industry in working towards achieving the set targets. It is imperative for the Government of India and the mobility ecosystem to align their vision and insights, and take steps in the direction of streamlining the auto industry’s future.” Bhattacharya added.

Total product revenue of Bosch Limited’s Mobility Solutions business sector decreased by a marginal 0.8 percent in the quarter ending on March 31, 2022. The total product revenue of business beyond the Mobility Solutions sector increased by 30.5 percent, with the Consumer Goods business sector increasing by 28.4 percent. This is mainly on account of increased e-commerce sales, increased demand for entry-level tools, and network expansion.

FY22 Business Development

Bosch Limited’s Mobility Solutions business sector increased product sales by 22.6 percent in fiscal 2021-22, primarily on account of strategic changes in supply chain, higher order fulfilment and a low base in FY 2020-21. Domestic sales increased by 22.2 percent. Within the Mobility Solutions business sector, the Powertrain Solutions division in India registered an increase of 21.1 percent and the Automotive Aftermarket division increased by 26.5 percent. Business beyond the Mobility Solutions sector recorded an increase in sales of 31.6 percent. The Board of Directors recommended a dividend of INR 110 per share for this twelve-month period. Additionally, to commemorate the centenary celebration of Bosch India, a special Dividend of INR 100 per share has been proposed. The overall Dividend payout for FY21-22 is proposed at INR 210 per share.

Outlook for FY23

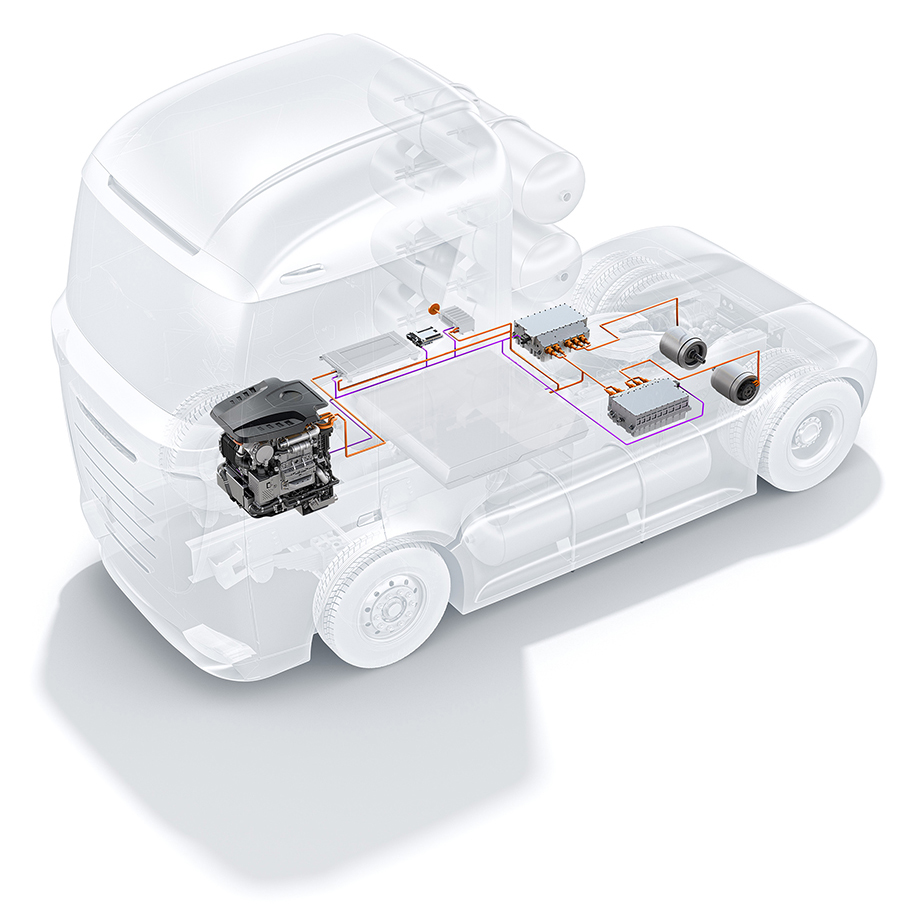

Speaking about the outlook for the upcoming fiscal year, Bhattacharya commented: “Bosch Limited is investing in hydrogen-based technologies – both for mobility and stationary applications. We are in discussion with customers and partners in India to bring advanced hydrogen-based powertrain and fuel-cell technologies to the market. With electromobility set to go mainstream, Bosch has taken the first step towards introducing low-carbon transportation and aiding the construction of a sustainable and carbon-neutral mobility ecosystem in India. Having turned carbon neutral (scopes 1 and 2) globally in 2020, Bosch will continue to shape climate actions beyond its immediate sphere of influence and systematically induce a 15 percent reduction in upstream and downstream emissions (scope 3) by 2030.”

2022 Outlook and Strategic Course

In 2021, the Bosch Group achieved significant growth in sales and result despite a difficult environment. In the first quarter of 2022, the sales revenue of the supplier of technology and services rose 5.2 percent. For the year as a whole, Bosch expects sales to grow more than 6 percent, and to achieve an EBIT margin in the range of 3 to 4 percent – and this despite the likelihood of considerable burdens, especially due to rising costs for energy, raw materials, and logistics. “The successful outcome of the 2021 business year bolsters our confidence as we tackle the challenging environment of the current year,” said Dr. Stefan Hartung, chairman of the board of management of Robert Bosch GmbH. One of the considerable uncertainties is the war in Ukraine and all its implications. In his view, the current situation highlights the pressure on policymakers and society to become less dependent on fossil fuels and to vigorously pursue the development of new sources of energy. For this reason, he said, the Bosch Group is systematically continuing its efforts to mitigate global warming, despite the challenging economic environment. In addition, Hartung announced Bosch will be investing some three billion euros over three years in climate-neutral technology such as electrification and hydrogen.

He believes electrification is the fastest route to climate neutrality, provided it is based on green electricity. That is why Bosch is driving sustainable mobility forward: in 2021, the company’s orders relating to electromobility exceeded ten billion euros for the first time.

But Hartung also stressed that hydrogen is needed as well. “Industrial policy should focus on making all sectors of the economy hydrogen-ready,” he said. In the interest of effective climate action, Bosch is also entering the components business for hydrogen electrolysis. The company plans to invest nearly 500 million euros in this new area of business by the end of the decade, half of it by the time of market launch, which is planned for 2025. At the same time, the Bosch chairman announced that, over the next three years, the company will be investing another ten billion euros in digitally transforming its business. “Digitalization also has a special role to play in sustainability – and our solutions start from this premise,” Hartung said. This year alone, moreover, Bosch plans to take on 10,000 new software engineers worldwide.