With BS-VI success, real driving emissions for passenger cars in 2023 and OBD 2 for commercial vehicles is going to be another challenge for OEMs and suppliers. But with significant learnings, availability of infrastructure for verification and validation, the task is likely to be easier, says Navin Paul of IP Rings

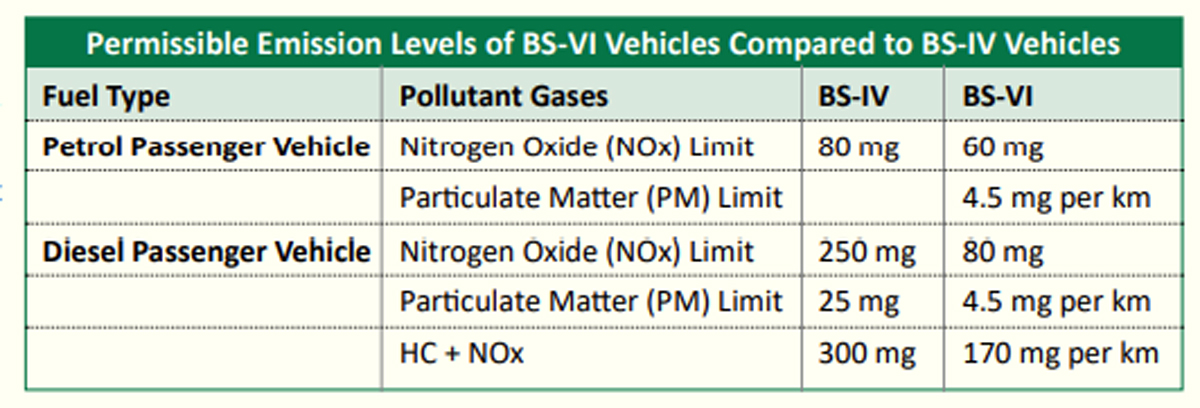

On April 1, 2020, India transitioned from BS-IV straight to BS-VI emission norms, skipping the BS-V stage. These norms are expected to impact the whole automobile industry barring the tractor segment and it places India in a select group of economies with Euro VI-compliant fuels. What is the significance of BS-VI norms? BS-VI emission norms have many implications, the most important being the adoption of a lower permissible level for sulphur content in transport fuel. BS-VI fuel has lower sulphur content than BS-IV fuel. The sulphur content in BS-VI fuel is five times lower (10 ppm) as compared to sulphur content in BS-IV fuel (50 ppm). Also, the nitrogen oxide level for the BS-VI diesel engine and petrol engine will be brought down by 70% and 25% from the earlier levels.

Impact of Change to BS-VI Norms

While cleaner environment and addressing growing concerns about global warming are the most obvious advantages of BS-VI adoption, the other critical impacts are as given below:

1. Technology upgrade and investments by OEMs and their entire supply chain.

* Transitioning to BS-VI norms needed significant engine technology changes including improvements in engine combustion and calibration, increased injection and cylinder pressures, NOx and PM after-treatment solutions and transitioning to electronic controls. New emission norms had to be met in all conditions in future and not just the ideal testing conditions. Two engine fitments were typically required for up-gradation of passenger cars to BS-VI norms from BS-IV norms.

* Diesel particulate filter (DPF) for reduction of PM in diesel vehicles

* Selective catalytic reduction (SCR) module for reduction in NOx emissions

* All these meant additional costs and significant research and development spends by automotive ancillaries and OEMs.

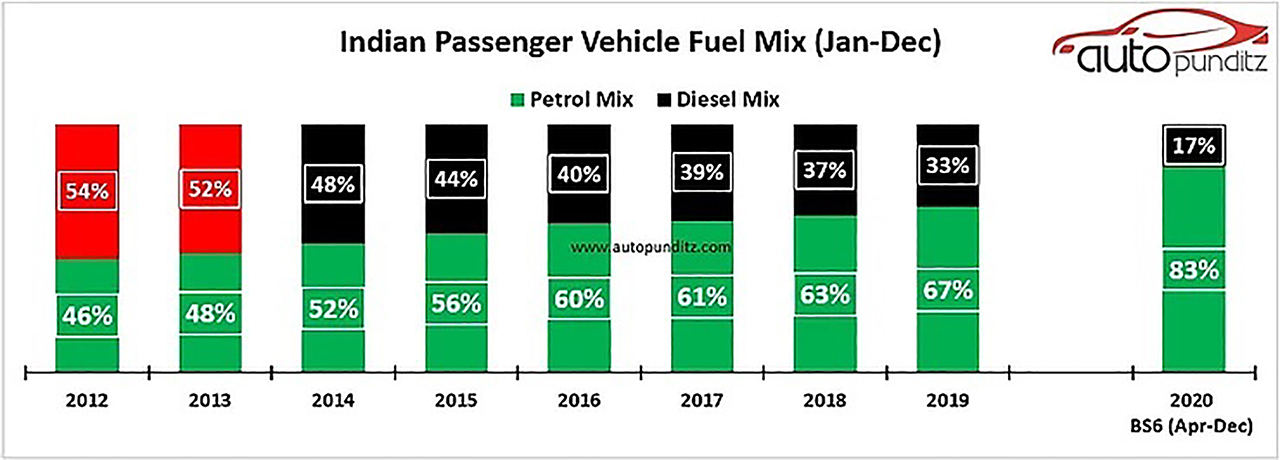

2. Passenger vehicles – shift from diesel to petrol or CNG vehicles.

From diesel being the dominant fuel in 2012-2013 at 52%, it has dipped continuously year on year and now stands at just about 17% in February 2021. The complexity involved in exhaust gas treatment of diesel engine to meet BS-VI criteria has led to a higher price gap between petrol and diesel engine purchase price for customers, and the shrinking petrol-diesel price gap is nudging more and more customers towards petrol variants or models. Many OEMs have completely dropped the diesel option from their portfolio post BS-VI. Maruti, Renault, Nissan, Skoda, VW and Datsun do not have any diesel models.

3. Commercial vehicles – BS-VI EGT a new chemical factory below the chassis.

Commercial vehicles have predominantly relied on diesel as their mainstay fuel and this continues with BS-VI as well except SCVs which are seeing diesel, petrol and CNG as their fuel options. Commercial vehicles have successfully transitioned to BS-VI and their users have also learnt to adapt to them. A major role in BS-VI is played by the exhaust gas treatment system. This includes the after-treatment manufacturers, substrate suppliers, coaters, selection of the right product architecture especially for small diesel engines and packaging the same in multiple vehicle variants – all of which was a challenge.

Most of the know-how and equipment were imported. However, many of the global suppliers have invested in local engineering facilities and are localising their offerings to meet the affordable price expectations of the market. The SCR system was fairly well-adopted by medium and heavy commercial vehicles during 2017 with the launch of BS-IV and so user awareness and dealer network was well-established. There were lessons learnt from BS-IV OBD and hence adoption of BS-VI after-treatment systems was relatively smooth with no major complaints from the marketplace. DPF is new in BS-VI where soot regeneration has been fairly validated. Cleaning internal ash or cleaning of DPF for ash is an area to watch because the vehicles need to be taken to the dealer workshops. Presently, since most vehicles on road have not clocked the requisite number of hours for cleaning of DPF, adequate information is not yet available.

4. Supply pressure on oil marketing companies (OMCs).

For India’s state-owned oil marketing companies, this move was challenging, given that the government was keen on a ‘single-phase’ rollout of BS-VI fuel. This meant more capital investments upfront and shortened periods to adequately reform supply lines. In the case of earlier transitions, the implementation was done in phases, Tier I cities were targeted first followed by the lower tiers.

On an industry level, oil marketing companies invested a total of Rs 3.5 billion to ensure supply prior to the April 1, 2020 deadline. Since December 2020, the OMCs have been lobbying with the government to aid cost recovery through price hikes. While the prices are deregulated, most state-owned OMCs function on moving day average (15 days) as opposed to a cost-plus model. If the hike is agreed to, it could bring upward pressure on inflation.

5. Price increase for the buyers.

* BS-VI-compliant engines are the cleanest engines up till now. The new cars with BS-VI engines come with a ton of upgrades, not just cosmetics but also in terms of performance and built quality. Diesel particulate filter (DPF) and selective catalytic reduction (SCR) came up with a role in BS-VI norm, whereas it wasn’t available with BS-IV.

* With the introduction of BS-VI emission norms, the real driving emission (RDE) will also be implemented to measure a vehicle’s pollutant emission in real-time conditions. Onboard diagnostic (OD) feature is another change that came up with BS-VI.

* All these definitely have increased the price of vehicles for the buyers by about about 10% compared to the earlier BS-IV models.

6. Timing of BS-VI introduction and the road ahead.

The introduction of BS-VI unfortunately clashed with the dreaded corona virus pandemic. The lockdowns and complete production halts have definitely dented the margins of OEMs and automotive ancillaries. However, as the economic situation improves and with sales picking up, FY22 is likely to be more promising.