Spurred by Government support in the form of subsidies, enhanced awareness, and increasing product launches, the electric vehicle (EV) segment in India has seen a significant upturn in prospects over the past two years. A confluence of factors such as improving product portfolio, charging infrastructure, and financing availability and a gradual decline in battery prices are likely to aid in the acceleration of EV penetration across segments over the medium term. EV penetration reached 4.7% in FY2024, with much of it driven by the electric two-wheeler (2W) segment, although e-three-wheelers (e-3Ws) and electric buses have also contributed to the same.

At present, only around 30-40% of the EV supply chain is localised. Chassis components that require minimal technology upgradation are manufactured locally. There has been substantial localisation in traction motors, control units, and battery management systems over the years. However, advanced chemistry batteries, which remain the most critical and the costliest component, accounting for almost 35-40% of the vehicle price, are imported. The low localisation levels give rise to manufacturing opportunities for domestic auto component suppliers. For parts that are already used in internal combustion engine (ICE) vehicles, there could be technological advancements in certain cases, resulting in higher content per vehicle.

Giving more details, Shamsher Dewan, Senior Vice President and Group Head – Corporate Ratings, ICRA Limited, said: “Battery cells are currently not manufactured in India, and thus most original equipment manufacturers (OEMs) rely on imports. Manufacturing operations in India are limited to the assembly of battery packs. To achieve mass-scale penetration of EVs and a competitive cost structure, India will need to create its own ecosystem for developing battery cells locally. The battery manufacturing space is thus garnering a lot of attention. In ICRA’s view, the demand for EV batteries in India (for domestic sales alone) is expected to reach ~15 GWh by 2025 and ~60 GWh by 2030. However, multiple challenges exist for the establishment of a cell manufacturing ecosystem, the primary ones being technological complexity, high capital intensity, and raw material availability. The ability of battery manufacturers to enter into agreements/alliances with players across the value chain to mitigate these risks, coupled with the creation of a robust framework for recycling, would remain key.”

ICRA expects EVs to account for around 25% of domestic 2W sales and 15% of passenger vehicle sales by 2030, translating into strong market potential for EV components. Accordingly, the rating agency projects the Indian e-2W component market potential to exceed Rs. 1,00,000 crore by 2030, while the e-passenger vehicle (e-PV) component is foreseen at another Rs. 50,000 crore at least, in terms of revenue potential for ancillaries. The actual growth for domestic auto component suppliers would depend on localisation levels and value addition.

On investments by auto component suppliers, Dewan added, “Auto ancillaries have started investing in the EV components space to capitalise on this opportunity, and companies have entered into collaborations/joint ventures (JVs) in cases of technological impediment. ICRA expects at least Rs. 25,000 crore of capex for EV components in the next three-four years, for capacity building, technology and product enhancements. About 45-50% of this would be towards battery cells. The PLI scheme, recent e-vehicle policy and state incentives would also contribute to accelerating capex. The larger projects (especially for battery cell localisation) are expected to be funded partly by debt initially. There is also substantial private equity interest in this space. Capex for components other than batteries is expected to be funded largely through internal accruals.”

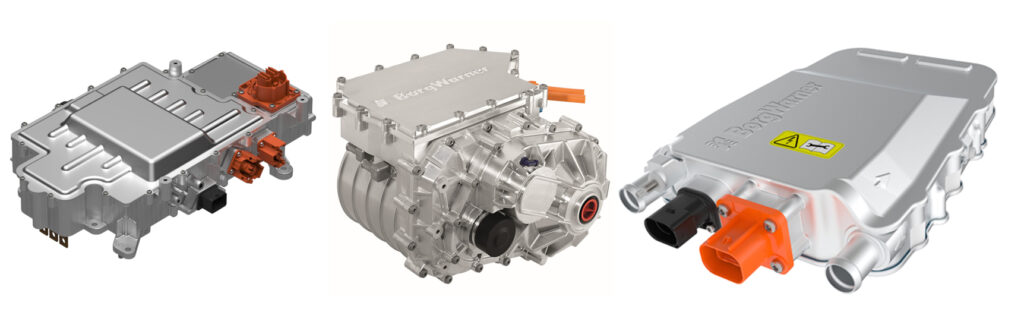

Engine and drive transmission components would be impacted by the EV transition. EV adoption could also have a bearing on aftermarket demand because of fewer moving parts. However, supplies to alternate applications, new products, and export opportunities are likely to mitigate the impact to an extent. Further, migration to EVs is expected to be gradual, and ICE components will continue to have sizable demand over the medium term.