By Dr. Wilfried Aulbur, Managing Partner, Roland Berger Strategy Consultants Pvt. Ltd., Mumbai

The mid- to long-term prospects of the Indian commercial vehicle market are encouraging enough. Growth for MHCVs stands at a CAGR of six per cent over the last five years and for LCVs at a very impressive CAGR of 21 per cent.

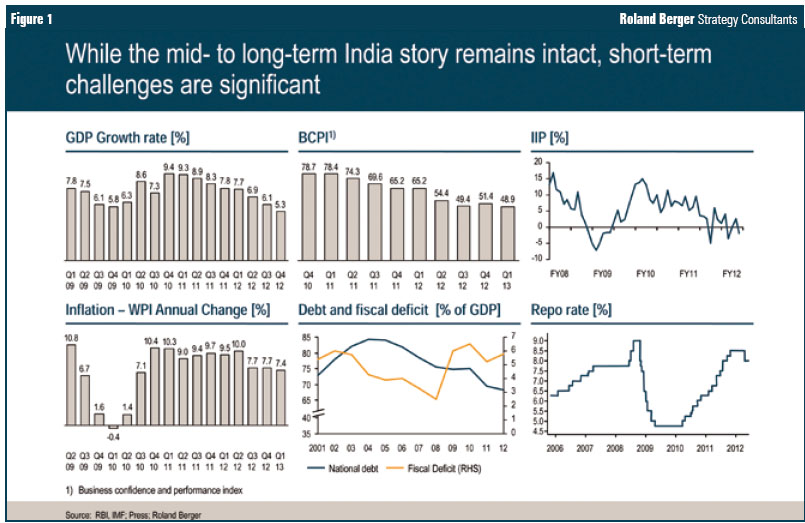

However an extended period of European readjustment, slower growth in key markets such as the US and China as well as a period of misguided policy decisions in India lead to significant short-term challenges. As shown in figure 1, quarterly GDP growth has come down to an unsatisfactory level of 5.3 per cent, the Index of Industrial Production (IIP) is weak, inflation and interest rates are high as is the fiscal deficit, and business confidence is at a record low.

This is very well reflected in a contraction of the MHCV market. Sales this financial year have fallen by about 13 per cent. LCVs have grown by 18 per cent driven by strong demand in the sub-3.5T segment, while the 3.5-7.5T segment has witnessed a significant contraction.

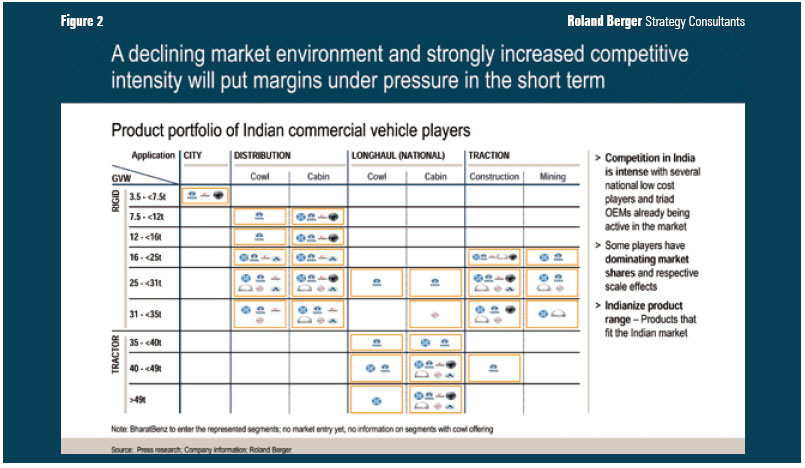

Market weakness coincides with a dramatic increase in competitive intensity. From a duopolistic market, India has evolved to a stage where nearly every international player of repute is present across segments, as shown in figure 2. While some new entrants such as Scania or Hino follow niche strategies, all other entrants – MAN, Mahindra Navistar, AMW, Volvo-Eicher and BharatBenz – have volume aspirations.

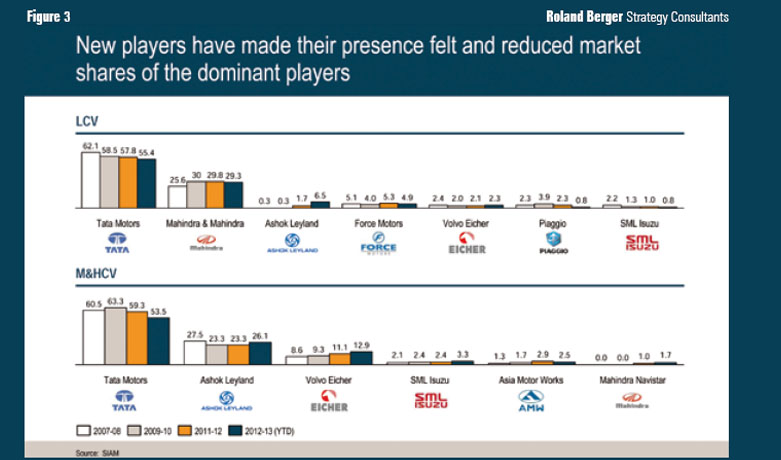

As figure 3 shows, new players have made their presence felt and somewhat reduced market shares of the dominant players. However, aspirations regarding market share have perhaps not been met so far. Ambitious targets – BharatBenz’ strategic objective to become the No.2 in the Indian commercial vehicle space or Mahindra Navistar’s announcement to grow to 50,000 MHCVs over the next few years – are clear indications that competitive intensity will remain high over the next three-five years.

As figure 3 shows, new players have made their presence felt and somewhat reduced market shares of the dominant players. However, aspirations regarding market share have perhaps not been met so far. Ambitious targets – BharatBenz’ strategic objective to become the No.2 in the Indian commercial vehicle space or Mahindra Navistar’s announcement to grow to 50,000 MHCVs over the next few years – are clear indications that competitive intensity will remain high over the next three-five years.

Players such as Volvo-Eicher have revamped their product portfolio with a firm view to gaining market share in the MHCV segment. Moreover, India has been chosen as the global hub for Volvo’s 5 and 8l engines – a move that not only strengthens India’s global relevance for the company, but also positively impacts Volvo-Eicher’s competitiveness within India. MAN has brought out a new LITE range of trucks for rated load applications, while BharatBenz will launch 16 trucks over the next 1.5 years.

Established companies such as Tata Motors and Ashok Leyland react with product offensives of their own. While Tata Motors announced investment of about Rs. 2,000 crores, Ashok Leyland will invest about Rs. 800 crores.

Established companies such as Tata Motors and Ashok Leyland react with product offensives of their own. While Tata Motors announced investment of about Rs. 2,000 crores, Ashok Leyland will invest about Rs. 800 crores.

Leading Indian players are under attack not only from a product but also from a service perspective. New networks are being rolled out with considerable speed. BharatBenz, for example, has rolled out about 70 dealers in the first phase with a strong focus on southern India where it intends to challenge Ashok Leyland’s dominance. Mahindra Navistar has set up state-of-the-art dealerships across the country and invests in service innovations such as 24×7 hotlines, a 48-hour response guarantee to get trucks back on the road, extended warranties and the like.

With a market contraction and a lot of new capacity being added in the market, margin pressure is likely. Companies will resort to discounts to achieve market shares. Even today, discounts in the industry are reported to be in the range of Rs. 60,000 per truck.

Financial pressures will not remain limited to OEMs. With large new investments and volume pressures coming their way, dealers may find their viabilities challenged as well.

Financial pressures will not remain limited to OEMs. With large new investments and volume pressures coming their way, dealers may find their viabilities challenged as well.

The winners in this complex and challenging environment will be companies that combine strong cost focus, superior execution capability and relentless focus on customer needs. Cost and superior execution are vital to protect margins in an environment in which escalating input costs and investments as well as sales measures to support volume targets prevail.

Also, the change in consumer preferences is likely to be slower than anticipated in certain areas. As a matter of fact, resilience of truck customers has forced a number of new entrants to introduce cowl versions of their trucks.

Thus, the Indian consumer will benefit from an industry that will move up on the efficiency curve. However, to fully reap the benefits of a trucking revolution, strong support from the Government (GST, infrastructure investments, etc.) is absolutely necessary.