By Jeffry Jacob, Principal, Roland Berger Strategy Consultants India, and Dr. Wilfried Aulbur, Managing Partner India, Chairman – Middle East & Africa and Head Automotive Asia, Roland Berger Strategy Consultants

The construction equipment industry in India is still reeling under the prolonged slowdown faced by its major end use customers – infrastructure and mining. Contraction in real estate demand, delays in construction and ban on mining had impacted investment in these sectors in the past few years. Developers had stopped launching new products, and several existing projects were stalled as the investment climate turned unfavorable. Under-utilization of the existing assets, uncertainty in growth and increasing labor/input costs together drove the industry to a virtual standstill. Poor financial condition of equipment owners led to high delinquencies and increasing NPAs which, in turn, left the financiers facing the brunt.

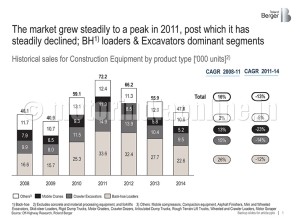

The industry volumes kept falling continuously from an all-time high of over 72k units in 2011 to ~48k units in 2014, leading to massive under-utilization of capacity as most OEMs had set up or increased domestic capacities based on peak volumes achieved in 2011.

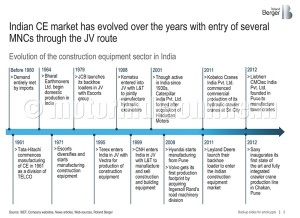

The Indian CE industry has come a long way since 1961 when Telcon was established and then in 1964 when BEML set up indigenous capacity to manufacture construction equipment, primarily dozers, dumpers and scrapers for defence requirements. Today we have almost all the global players operating in India – Case, Caterpillar, Hitachi, JCB, John Deere, Ingersoll Rand, Komatsu, Volvo, Terex, etc. – in nearly all key segments, either on their own or through JVs. The positive long-term view of these majors in the Indian economy is visible through the significant investments in establishment of full-fledged manufacturing facilities and many advanced products being offered in the market.

However, the current adoption rate of CE in India continues to be a challenge, with the per capita number of construction equipment still significantly low at 30 units per million compared to 325 in North America and 155 in China.

The Indian CE customer has today evolved and is increasingly demanding more sophisticated and specialized machines. While the ratio of backhoe loaders to excavators has decreased from 2.6:1 in 2013 to 2.2:1 in 2014, it is expected to decrease even further to 1.5:1 by 2020. This is in line with advanced economies where excavators outsell backhoe loaders by a large margin (sales of excavators are 3.75 times of backhoe loaders in North America and ~30 times in Western Europe).

The construction industry in India is slowly but steadily shifting to more mechanized formats to optimize project time and overall costs while simultaneously improving quality. While a first time buyer still continues to look at initial cost as the primary buying criteria, experienced users and corporates focus on total cost of ownership. After-sales accessibility, availability and price of spares are becoming more important in the buyer’s purchase criteria. Further, as most machines today operate in hot and humid conditions, and coupled with the huge demand gap for skilled labour that India is set to face in the coming years, buyers are increasingly demanding better driver comfort and insulation from the external harsh operating conditions.

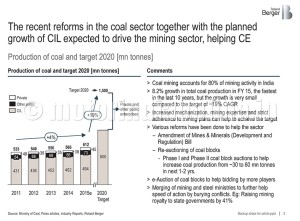

However, key challenges continue to impact the industry. The visibility on resurgence of key end use sectors, infrastructure and mining, continues to be low. While there has been some uptick in coal mining activities, the other areas such as iron ore mining have not yet rebounded. Ballooning real estate prices have led to an increase in housing stock in major metros, resulting in subdued demand for residential real estate.

Hurdles in land acquisition and procedural delays continue to impact large infrastructural projects. Current low utilization of equipment and consequent high NPAs have made financiers more cautious, in turn decreasing access to finance, especially for first-time buyers.

The key structural challenges include:

- According to ICEMA, by 2020 the CE industry is estimated to need one lakh trained operators and three lakh trained mechanics

- Low penetration of rental market in India, at less than 10 per cent compared to over 60 per cent in the US and over 30 per cent in China, primarily due to unfavourable tax regime which hinders movement across States

- Under-developed market for used equipment, largely dominated by the unorganized sector

- High level of discounting expected to continue in the short to medium term as OEMs are stuck with inventory and idle capacity

A major concern among Indian OEMs today is also the huge idle capacities in China, forcing companies there to look outside the domestic market. This has already been witnessed in the steel sector where the domestic market was flooded with Chinese imports, in turn affecting viability of domestic producers and forcing the Government to take action. While the Indian market for CE had dropped by 14 per cent in 2014 vis-à-vis 2013, the Chinese market dropped by 24 per cent in the same period, and this represented the third year of consequent decline.

Compared to its peak of 434k units in 2011, last years’ sales in China were far lower at ~208k units. The domestic market is expected to only grow modestly going forward, which in turn increases the pressure on the local companies to look aggressively at other growth options, viz., exports, to sustain their unutilized capacities.

Chinese companies are also globally creating markets via State funding for large infrastructure projects. Chinese equipment manufacturers already have a strong presence in some segments in India such as wheel loaders and dozers with over 10 per cent market share. Other segments could also increasingly face the onslaught as Chinese equipments turn out to be an attractive value proposition for several small construction companies.

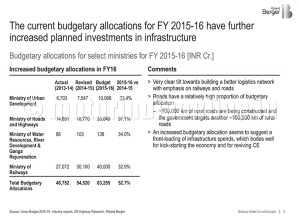

Going forward there is room for optimism. The Modi-led NDA Government has made clear policy announcements and directives signifying its strong intent to drive economic growth. As per the 12th Five-Year Plan, infrastructure spending is expected to grow from 7.2 per cent in 2012 to 9 per cent of GDP by 2017. This spans investment in roads, airports, bridges, urban and rural infrastructure.

The Union Budget for 2015-16 earmarked Rs. 2.8 tn for the infrastructure sector, which is an increase of 1.5 times over the previous Budget. The ‘100 Smart cities’ program is expected to increase construction activities in the prioritized cities over the next few years.

The other enablers such as increasing FDI in defence and railways, merger of Coal and Power Ministries, facilitation of environment clearances, including exemption for irrigation projects with area of 2,000 hectares, joining of rivers to counter the drought situation and availability of banking loans for 25 years, will all help to increase the pace of infrastructural activities and consequently spur the revival of the CE industry.

OEMs need to proactively take steps to ensure they protect their domain while focusing on growth by offering a superior value proposition to the Indian customer. As the focus of infrastructure shifts to relatively less developed regions and States, OEMs need to further strengthen their distribution network to improve penetration across the country.

Increasing competition in new equipment sales would mean that OEMs focus on increasing their profit pools by focusing on after-sales to offer a superior overall lifetime experience for the customer. Equipment renting and leasing offer significant growth potential going forward. OEMs can offer refurbished equipments to attract the first time buyer with limited budgets and also provide guaranteed buybacks for new equipments which provide a positive signal while reinforcing the product quality and resale value. Demand from rural areas and first-time buyers can be further harnessed through appropriate financing mechanisms or tie-ups.

The Government and OEMs need to work together to improve adoption rates of CE in India. Mandating use of construction equipment by the Government in key infrastructure projects and imposing safety and quality requirements will promote usage of CE. OEMs should communicate the benefits of CE adoption and its impact on improving quality, better efficiency/planning and reduction in project completion time leading to higher savings for equipment buyers. This can be done effectively through sharing of best practice examples of such deployment internationally and also closer home in India.

Undoubtedly, the CE industry is currently going through a turbulent phase. While initial signs of recovery are visible, speed of implementation and on-ground execution needs to significantly improve further to ensure sustainable growth. It is no longer a matter of ‘if’ but rather ‘when’ the CE industry will get back on its growth trajectory. OEMs should take this opportunity to focus on improving their cost position to become more competitive, improve product quality and after-sales thereby offering a superior value proposition to the customer, so that they can be ahead of the curve and reap the benefits when growth returns.