Daimler can look back on a tradition covering more than 125 years that extends back to Mr. Gottlieb Daimler and Mr. Carl Benz, the inventors of the automobile and features pioneering achievements in automotive engineering. Today, the Daimler Group is a globally leading vehicle manufacturer with an unparalleled range of premium trucks, vans and buses. The product portfolio is rounded out by a range of tailored financial and mobility services.

Said Mr. Dieter Zetsche, Chairman of the Board of Management, Head of Mercedes-Benz Cars: “2014 was a very good year for Daimler. Never before have so many customers decided in favour of our vehicles. We sold more than 2.5 million of them. As a result, we generated total revenue of 129.9 billion euros, 10 per cent more than in the previous year. The Group’s EBIT amounted to 10.8 billion euros, and our EBIT from the ongoing business increased at almost three times the rate of revenue growth to 10.1 billion euros. So we achieved what we promised you – profitable growth”.

In 2014, Daimler increased its revenue by 10 per cent to €129.9 billion. The individual divisions contributing to this total are: Mercedes-Benz Cars 55 per cent, Daimler Trucks 23 per cent, Mercedes-Benz Vans seven per cent, Daimler Buses three per cent and Daimler Financial Services 12 per cent. At the end of 2014, Daimler employed nearly 2,80,000 people worldwide.

Daimler Trucks, growing stronger

As the biggest globally active manufacturer of trucks above 6 metric tons gross vehicle weight, Daimler Trucks develops and produces vehicles in a global network under the brands Mercedes-Benz, Freightliner, Western Star, FUSO and BharatBenz. The division’s 27 production facilities are located in the NAFTA region, of which 11 are in the US, three in Mexico, seven in Europe, three in Asia, two in South America, and one in Africa.

In China, Beijing Foton Daimler Automotive Co. Ltd. (BFDA), a joint venture with Beiqi Foton Motor Co. Ltd., has been producing trucks under the Auman brand name since July 2012.

Daimler Trucks’ product range includes light, medium and heavy-duty trucks for local and long-distance deliveries and construction sites, as well as special vehicles used mainly in municipal applications. Due to its close links in terms of production technology, the division’s product range also covers buses of the Thomas Built Buses and FUSO brands. Daimler Trucks’ most important markets in 2014 were Asia, with 34 per cent of unit sales, the NAFTA region (33 per cent), Western Europe (12 per cent) and Latin America, excluding Mexico, with nine per cent.

Daimler Trucks is today more broadly and strongly positioned than ever before with its six own brands and 54 models. In addition, it has trucks produced and distributed in joint ventures with local partners. This allows the OEM to offer appropriate products to its customers in every region of the world.

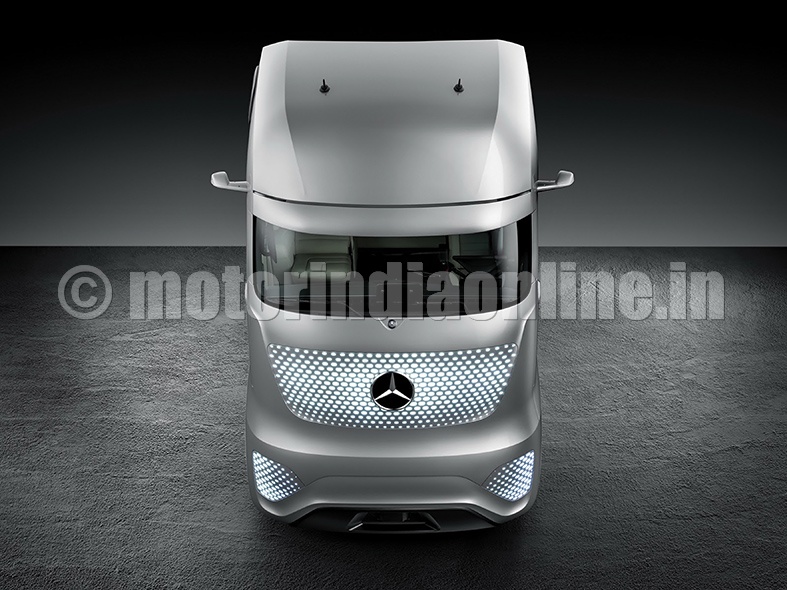

The most exciting new vehicles from the company last year included the Mercedes-Benz Future Truck 2025. In business terms, the year 2014 differed widely from region to region. In Europe and Latin America, political uncertainty had its negative impact on market development. But the company profited from growing demand for trucks in Japan and North America. In India, it built a new brand, BharatBenz, within a very short time, at a new production site and with a new sales network.

In Russia, Europe’s biggest truck market, Daimler continues co-operation with its partner Kamaz. The previously separate Mercedes‑Benz Trucks Vostok (MBTV) and Fuso Kamaz Trucks Rus (FKTR) joint ventures will be merged into a new company in the future. Since the second half of 2013, Mercedes‑Benz Vans has been manufacturing the Sprinter Classic in Russia in co-operation with the commercial vehicle manufacturer GAZ.

Mercedes-Benz Vans and Buses, far ahead

The focus at Mercedes-Benz Vans in 2014 was on the launch of the new generation of mid-size vans. The manufacturer has the new V-Class and the travel and leisure vehicles of the Marco Polo product series on the market for its private customers. On the commercial side, the new Vito was launched. The attractive product range brought the vans division record unit sales of 2,95,000 vehicles, an increase of nine per cent compared with 2013.

Daimler Buses will focus over the next few years on achieving further growth and efficiency gains. To this end, the OEM not only plans to increase sales of the Mercedes‑Benz and Setra brand buses but also wants to grow globally through new innovative services. The buses product range stands out through its great fuel efficiency, economy, environmental friendliness and safety. The conversion of its model program to the Euro VI standard makes it the leader in fuel economy today.

This year, the company plans to once again set new standards with the introduction of the emergency braking system Active Brake Assist (ABA 3) in the Mercedes‑Benz Travego coach and the new Setra Series 500 coaches. The Setra MultiClass product range has been extended with low‑entry long‑distance buses which combine economy and functionality. With the new Mercedes‑Benz Citaro G articulated bus and the Mercedes‑Benz CapaCity L, it offers variants that can transport a large number of people. This means that the company can supply vehicles with ideal passenger capacities for worldwide Bus Rapid Transit (BRT) systems.

Daimler Buses sold 33,200 buses and chassis of the Mercedes-Benz and Setra brands worldwide in 2014. It also significantly extended its market leadership in its core markets in the segment for buses above 8 metric tons. Its business with complete buses in Western Europe developed well. With the very positive response to the new city-bus generation Citaro and the new Setra TopClass 500 and ComfortClass 500, sales increased by 13 per cent to 7,600 buses (2013: 6,700), while the market share in Western Europe reached an all-time high of 34.4 per cent (2013: 30.9 per cent).

In Germany, sales increased by 17 per cent, and the market share of 57.1 per cent was significantly higher than in 2013. At 17,600 units sold in Latin America, the company was able to strongly expand its already leading market share in the region to 48.6 per cent (2013: 41.6 per cent). At 3,600 units, sales in Mexico were significantly higher than in the previous year.

Region-wise sales

In Western Europe, Daimler increased its market share slightly to 24.4 per cent (2013: 24.1 per cent) in a difficult market environment. However, at 57,400 units, sales were 13 per cent lower than in the previous year. This was due not only to advance purchases made in 2013 prior to the introduction of the Euro VI emission standard, but also to the generally sluggish economy in the region during the year under review. Eastern Europe registered a sale of 33,900 units.

Daimler’s market share of 37.2 per cent in the NAFTA region (2013: 38.2 per cent) once again made it the undisputed market leader in the segment for Class 6–8 medium-duty and heavy-duty trucks. Sales in the region rose by 19 per cent to the record level of 161,500 units. The Freightliner Cascadia Evolution, which was added to the product portfolio in March 2013, played a major role in its sales success in North America.

Overall business development in Asia was positive, but the situation varied from region to region. Whereas unit sales increased in Japan and India, they declined in Indonesia. Nevertheless, the company was able to improve its market position in both Japan and Indonesia and also gained marketshare in India with its BharatBenz trucks. Overall sales in Asia increased by three per cent to 167,200 units. Through Beijing Foton Daimler Automotive Co. Ltd. (BFDA), the company sold 99,200 Auman brand trucks (2013: 103,300), which are not included in the Daimler Group’s unit sales.

Euro VI emission standard

Daimler continues to lower the fuel consumption of its trucks and buses as well. Compliance with the Euro VI emission standard that went into effect for trucks and buses in 2014 necessitated the use of complex exhaust‑gas treatment technologies, which, by themselves, led to an increase in fuel consumption. However, with the help of different measures such as improved engine efficiency and vehicle aerodynamics, Daimler was able to offset this effect and actually lower the average fuel consumption in 2014.

The Actros, for example, demonstrated the pioneering role it plays in fuel efficiency in numerous fuel economy tests. It also works to further reduce fuel consumption with technologies such as the innovative Predictive Powertrain Control (PPC) assistance system. The Freightliner Cascadia Evolution is currently the most fuel‑efficient heavy‑duty truck on the North American market.

Daimler has also achieved fuel savings of as much as eight per cent with its new Euro VI bus models. It is the world leader for hybrid technologies in commercial vehicles. The Canter Eco Hybrid, for example, boasts fuel savings of as much as 23 per cent and owners are able to recoup the additional cost for the hybrid model in just a few years. With the emission‑free FUSO Canter E‑CELL, which is being tested by customers, Daimler is already responding to the emerging challenges with more restrictive emission standards in metropolitan areas in the future.

The company intends to reduce the fuel consumption of its fleet of trucks in Europe by 20 per cent between 2005 and 2020. It has already achieved a 10 per cent reduction in fuel consumption and CO2 emissions with the launch of the new Actros series in 2011, and is now working hard to achieve the other 10 per cent.

Investing for the future

In the coming years, Daimler will continue to move ahead systematically with its investment offensive in order to implement its growth strategy through the introduction of new products and new technologies. It will therefore invest approximately €11 billion in property, plant and equipment in 2015 and 2016, as well as more than €13 billion in research and development projects.

During 2012 and 2020 it proposes to launch more than 30 new car models and also systematically develop its range of commercial vehicles.