Through the creation of numerous programmes that affect the Indian market, Dana is concentrating on improving performance and efficiency in India as well as, more critically the total cost of ownership and vehicle electrification for customers, finds out Rajesh Rajgor in this exclusive interaction with Gajanan Gandhe, Vice President, Dana India

With a legacy of over 119 years, Dana has been operating in India for more than 60 years. India unquestionably plays a crucial part in Dana’s worldwide growth strategy. The company presently supports customers in the light vehicle, commercial vehicle and off-highway segments through 18 manufacturing locations, including research and development centres spread across the country. It supports medium-duty to Class 8 commercial vehicles, off-highway vehicles (mining, agriculture, material handling and construction) and light vehicles, which are primarily SUVs and pickup trucks.

“Our operations in India span across 18 locations and provide driveline solutions for each of the three i.e. commercial vehicles, off-highway and light vehicles markets using drive systems, sealing and thermal components technology,” informs Gajanan Gandhe, Vice President, Dana India. Dana is focusing on increasing performance and in the overall cost of ownership and vehicle electrification through the development of multiple programmes that have an impact on the Indian market. “When necessary, our manufacturing and engineering teams in India use their expertise to support our worldwide operations while also creating solutions to meet the demands of local and regional clients,” he adds.

Current Growth and Market Position

Dana India has experienced high demand both in the domestic and export market following the pandemic. Up to 60% of the company’s sales come from the domestic market and 40% from exports that cater to direct customers and the company’s own sister facilities around the world. Gajanan elaborates, “We have significantly grown last year and this year we believe we are going to emulate the market which is going to be a mixed bag. The construction and mobility industry is predicted to grow massively this year. We may witness a major impact given the changes in the norms for the second phase of BS VI coming up in April.”

Dana’s light vehicle segment accounts for 45% of its global sales. It is roughly 30% in India. The company also commands a sizeable market share and continues to expand its business with new clients thanks to joint ventures. When it comes to assembled axles, synchronizers, torque hubs or electron beam-welded components, Dana India really excels. “Our competitors find it very challenging to match our level of technology in these areas. In other traditional fields like gears and shafts, we hold a leading position. In order to effectively maintain our position, we also frequently collaborate closely with our supplier base to support their expansion as well as to cut internal costs and capital expenditures,” Gajanan says.

To sustain its competitive advantage in India, Dana has deepened its relationships with OEMs and continues to deliver innovative products, helping them serve better the unique demands of Indian end-user customers. “We see a number of opportunities in this market. As more people move into urban centres that are growing into mega cities, we see opportunity in the light vehicle segment. And as the country’s infrastructure continues to develop and improve, we see opportunity in the commercial and off-highway vehicle markets. Fortunately, we are well-positioned to serve all the three types of customers from India,” Gajanan points out.

Synergies with Global Research and Development

Dana’s commitment in the creation of cutting-edge technologies that increase the return on investment for end-users gives them an edge over their competition in India and the rest of the Asia Pacific region. Both end-users and manufacturers (OEMs) appreciate the long-term value Dana’s products provide. “Our products will enable companies to maximise their output in the long run even though they might not be the least expensive in the short term. Our customers are aware that the products we provide are long-lasting and that our industry-leading support network will give excellent technical assistance, client support, product availability and delivery,” Gajanan shares.

According to him, technology, operational efficiency, customer-centricity and strong employee base has enabled Dana to attain leadership position. “We invest in growth and technology strategically, being careful to sustain our growth by taking a balanced approach that leverages our engineering expertise to grow our business across all the vehicle markets we serve. Any new products or segments we explore will be focused on our core competencies that improve the efficiency and performance of passenger, commercial and off-highway vehicles with both conventional and new energy powertrains,” Gajanan adds.

Being a market leader brings along with it the onus of having to innovate and come up with breakthrough products and customer-centric solutions. For research and development, Dana operates two technology centres in India, one each in Pune and Sanand and in total nine engineering centres globally. “Our facility in Pune supports all our product groups by developing new products with over 250 engineers while our operations in Sanand are focused on shifting solutions for the off-highway markets. Together they help us maintain our lead as a supplier of drive and motion systems,” informs Gajanan.

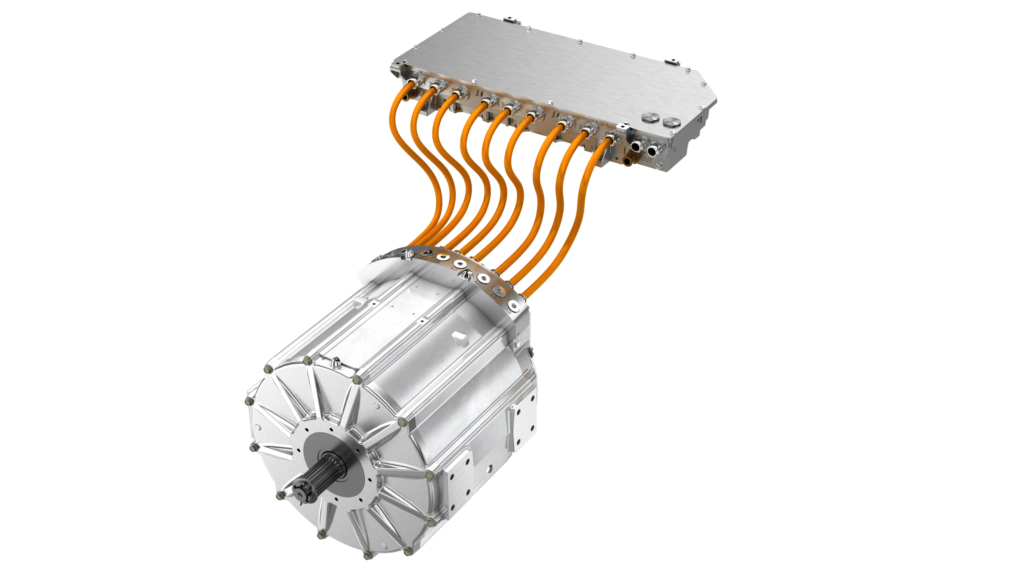

This includes motors, inverters and traditional axles, and a robust offering of sealing and thermal management offerings, including cylinder head gaskets, oil plans and thermal acoustical protective shielding. Through constant communication between engineering interfaces, technology conferences, etc. many of Dana India’s workforces are part of the global product development team. “Not everything is developed in the US and Europe. The drive shaft technology, for instance, is completely developed out of India,” Gajanan reveals.

Patented Productions

Once the technology, design and development process are streamlined, the next step is efficient manufacturing. Dana has several tools that ensure product quality, traceability and maintenance, all of which engages the latest methods of engineering. “We have started to increase the use of robots wherever possible to reduce the number of people that work in a routine mechanical job, especially in a lightweight project where exact kilograms need to be worked upon,” Gajanan shares. Additionally, there are some sectors where Dana has developed technology and brought in innovations, thus setting high standards.

“Even if you were to take a broad view of the part and claim that you could produce it in reality, there are many minute details that go into its development, whether it is design, engineering or manufacturing that make it incredibly challenging to replicate. They are so crucial for how we safeguard our technological advancements around the world. Dana is a global leader in innovation and the company’s technology centres will allow us to further leverage technology synergies across all the vehicle markets and customers that we serve globally,” Gajanan says.

Bolstering Aftermarket and EV Business

While Dana is engaged in spare part sales to OEMs, it had only an independent aftermarket unit in Hosur until 2020. Upon Gajanan Gandhe joining in 2020, he restructured the independent aftermarket into an industrial group, which offers massive potential in India. “We have diversified into all the four zones i.e. east, west, north and south and have almost tripled our non-light vehicle aftermarket from zero. We have now set ourselves very strong goals for making the aftermarket at least 5% of our total business – which until now was less than 1% – through a network of 400 channel partners across the country,” reveals Gajanan.

Dana has also combined its global aftermarket website with the Indian aftermarket website. “Our Indian channel partners have access to our global resources and book something they need. They just contact our sales people and then we can arrange a part from anywhere in the world to be brought in. This has helped in successfully strengthening our aftermarket business,” he shares.

In the electric vehicle segment, Dana divides the focus into two parts – low voltage and high voltage. Low voltage is anything that’s below 150 volts power for two-wheelers and three-wheelers and above this is for commercial vehicles. Despite the high level of risk in 2020, Dana India took a decision to invest almost USD 15 million in a plant at Chakan near Pune.

“We brought in the latest global technology for high voltage motors for buses and also low voltage motors for pretty much everything. Apart from a plant in China, India was the only plant that made high voltage motors, but globally India is one of the highest low voltage motors producing country in the world. Hence, we were ahead of our time and we were able to capture most of the bus and heavy trucks’ market. We were also able to get a lot of global business through our sister companies and create a massive export opportunity for our Pune plant,” Gajanan elaborates. Dana India has a JV called TM4, which is 100% managed by Dana and helps it manufacture the high-performance internal permanent magnet motor and not the BLDC motor that is in the highly competitive space in India.

Dana expects electrification to become a growth driver as it builds up global manufacturing of motors and inverters to support new customer projects. Further, major investments in electrification have been made by the corporation, including the purchase of Pi Innovo LLC, a market leader in embedded software solutions and electronics control units for light vehicles, commercial vehicles and off-highway vehicles. Dana can now provide a wider range of electrification products thanks to the acquisition of Pi Innovo, which gives it access to a large library of turn-key software for electric vehicle applications, vehicle level controllers and auxiliary controllers.

Sustainability Factor

Dana India is also spearheading a campaign of global sustainability and social responsibility with several initiatives like water body restoration and tree plantation. There are initiatives for lowering overall energy consumption within the company, using renewable energy wherever possible and setting up solar rooftops. “We spend more than USD 2,000,000 every year to support our corporate social responsibility goals. It’s divided in a way where 20% of that goes into technological research and development start-ups. We encourage them to come up with new technologies that will help themselves as well as the market in the future. The remaining 80% of the money is spent in the region we are present. For instance, we are in Satara and so we assist in tree plantation, building schools, toilets, restoration of ponds, etc. That’s how we support both sustainability and social responsibility in India,” concludes Gajanan.