Resultant higher cash accruals and lower inventory will bolster credit metrics

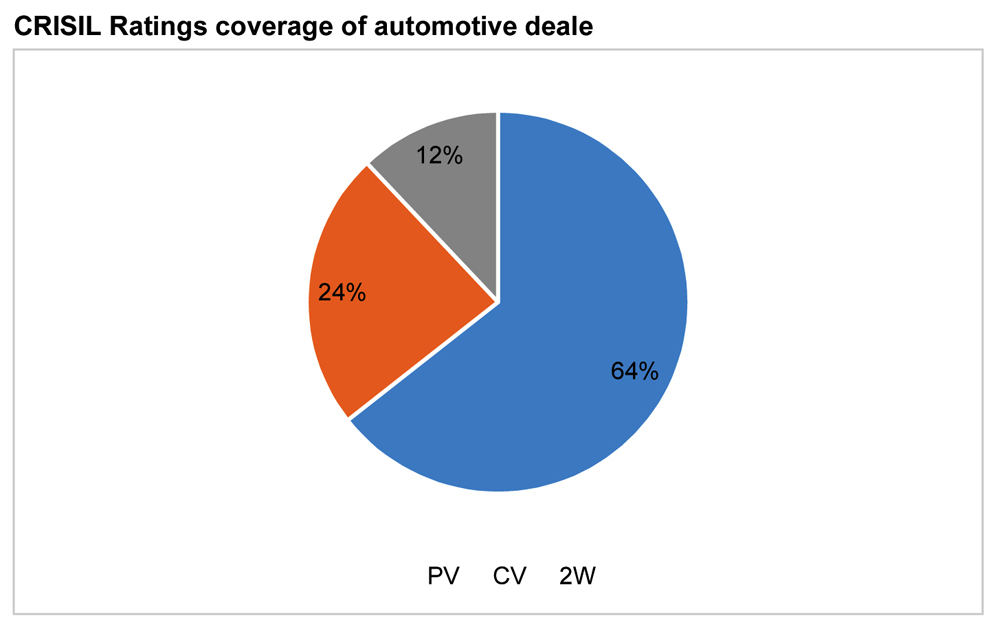

With 20-22% revenue growth and 50-100 basis points (bps) improvement in operating margin expected for next fiscal, overall revenue and operating profits of automobile dealers are set to scale back to pre-COVID levels, a study of 191 rated by CRISIL Ratings Ltd. shows.

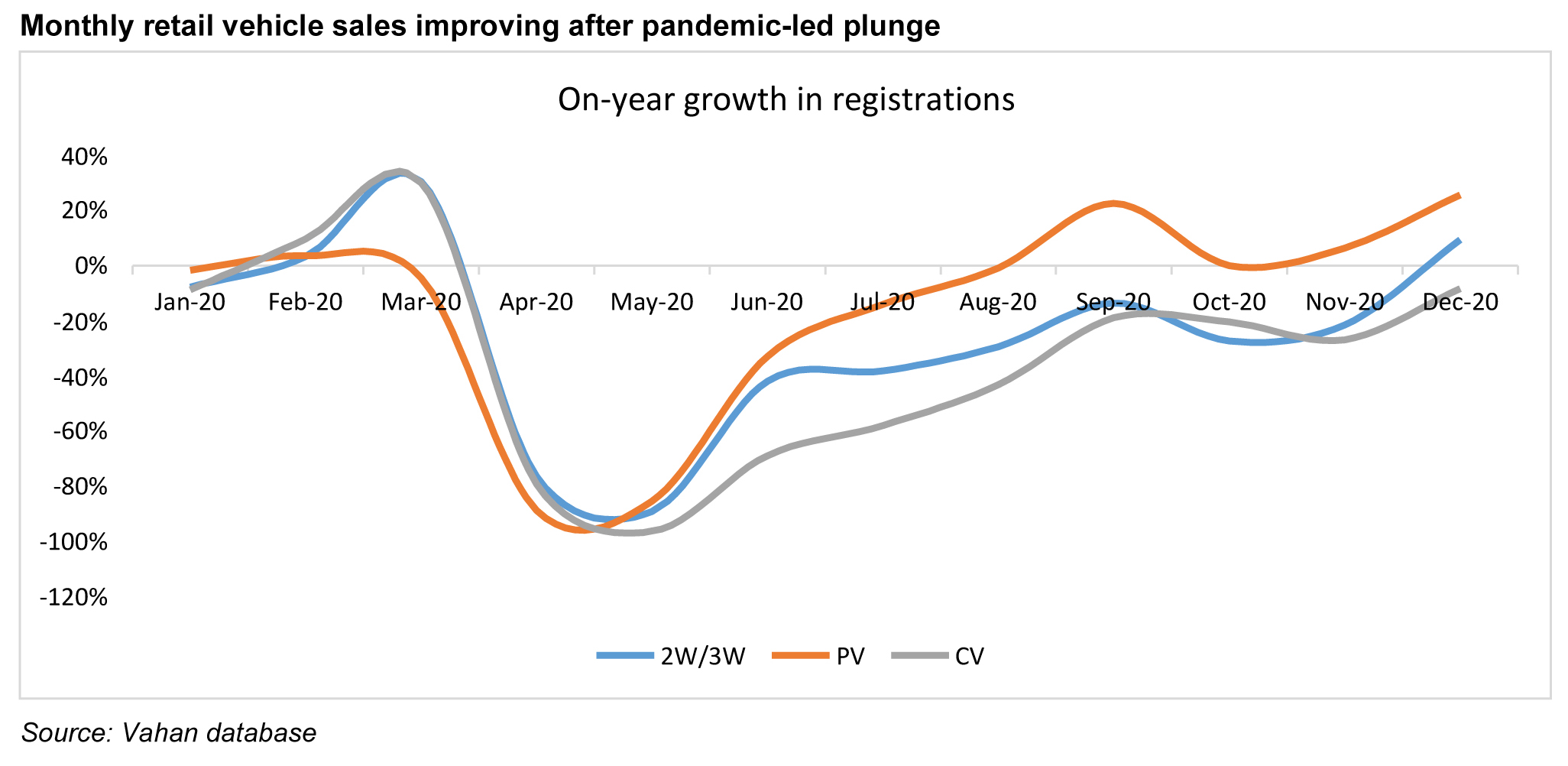

Revenues, which were significantly impacted in fiscals 2020 and 2021, will see a steep recovery due to improved demand for automobiles across segments. This, along with improved ancillary revenues, which is more profitable than vehicle sales, will support overall operating profitability for automobile dealers, and boost cash accruals.

Over the past 12 months, the cost of ownership of passenger vehicles (PVs) and two-wheelers (2Ws) has risen 8-10% following a 15-17% surge in fuel prices, price hikes by original equipment manufacturers (OEMs) to cover Bharat Stage (BS)-VI costs, and costlier raw material. While that affected sales, the nationwide lockdown also slammed the brakes on ancillary revenue.

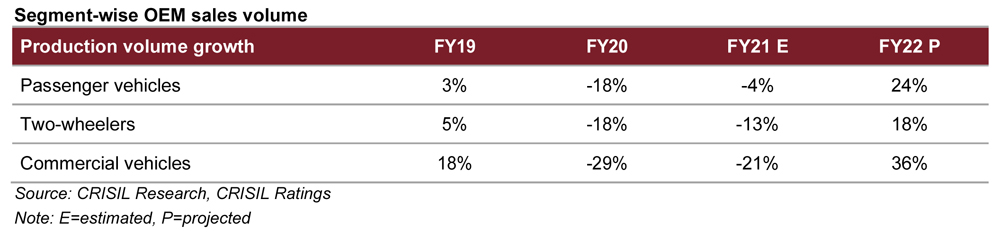

Says Gautam Shahi, Director, CRISIL Ratings: “We are seeing a turnaround. PV and 2W dealers are expected to see revenue growth of 20-22% and 15-17%, respectively, in fiscal 2022. Healthy rural demand and increasing preference for personal mobility will drive growth for PVs and 2Ws. Revenue growth for commercial vehicle (CV) dealers is expected at 35-40% in fiscal 2022, supported by improving economic activity, increase in budget allocation for infrastructure, and low base effect.”

Recovery in new vehicle sales, and ancillary revenues (through service, spare parts and insurance at 10-12% of revenue and ~25% of operating profit) would also help restore operating profitability to pre-pandemic levels of 3-4% for automobile dealers.

With improving operating performance, credit ratio (ratio of number of rating upgrades to downgrades) is expected to improve next fiscal. This is after two years of weak operating performance which impacted the credit metrics of CRISIL Ratings’ rated automobile dealers. This was evident in credit ratio declining to 0.3 time for the sector for April 2020-January 2021, the lowest in the past five fiscals. Increased support from OEMs and moratorium availed by automotive dealers helped manage liquidity pressures.

Says Sushant Sarode, Associate Director, CRISIL Ratings: “We expect cash accruals of CRISIL Ratings’ rated automotive dealers to improve next fiscal, supported by better sales and profitability, including due to lower carrying costs. Inventory levels are expected to stabilise at 3-4 weeks from almost 1.5 months seen earlier this year, obviating balance sheet pressures and stabilising credit profiles. Interest coverage and gearing are expected to improve to ~2.5-3.0 times and ~1.2-1.3 times, respectively in fiscal 2022, from 1.9 times and 1.4 times, respectively, in fiscal 2021.”

Automotive dealers should benefit from continued OEM support and strong demand recovery post the lockdown. Sustenance of recovery in demand across segments, normal monsoon and inventory level at dealers’ end will remain monitorables.