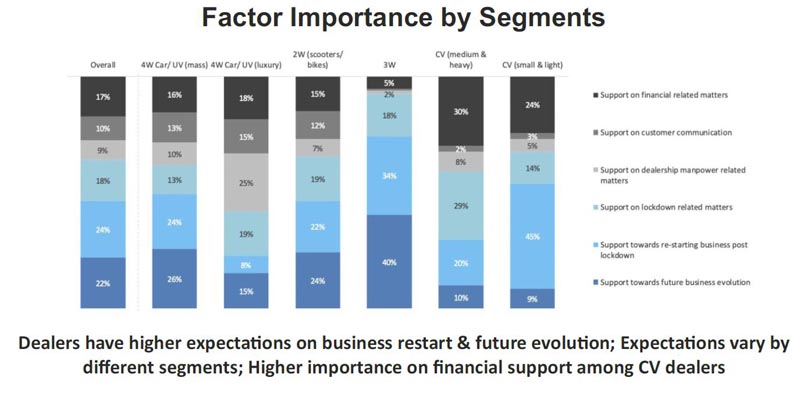

Up to 46% dealers had two big concerns – support towards future business evolution and support towards restarting business post the lockdown

Federation of Automobile Dealers Associations (FADA), the apex national body representing the automobile retail sector in India, has released a pandemic dealer support satisfaction study in association with Premon Asia, a consumer-insight-led consulting and advisory firm based out of Singapore.

Commenting on the release of the survey, FADA President Vinkesh Gulati said: “Even before the corona virus pandemic hit us, the Indian automobile industry was grappling with a prolonged slowdown. In fact, we were already posting de-growth for 15 odd months.”

He continued: “Against this backdrop, the pandemic has been a significant blow to the automotive industry, especially to automotive dealers – almost breaking their backbone. Many OEMs came forward during these testing times and offered support to dealers with various means. FADA hence undertook this study and our findings showed varying degrees of difference. While some dealers were better off, some received almost nothing in such trying times. It hence became very essential for FADA to gauge how the principals treated their channel partners, their first customers.”

Up to 46% dealers had two big concerns – support towards future business evolution and support towards restarting business post the lockdown. Also, what came out commonly across all the verticals was that dealers expect OEMs to improve their profitability. Post completion of the survey, Premon Asia founder and CEO Rajeev Lochan said: “The expectations of the dealers can be divided into two parts. Support during the crisis revolves around how OEMs have responded in managing aspects related to customer communication, dealer manpower engagement and training, and financial support, particularly in terms of negotiating better deals on working capital and term loans through banks.”

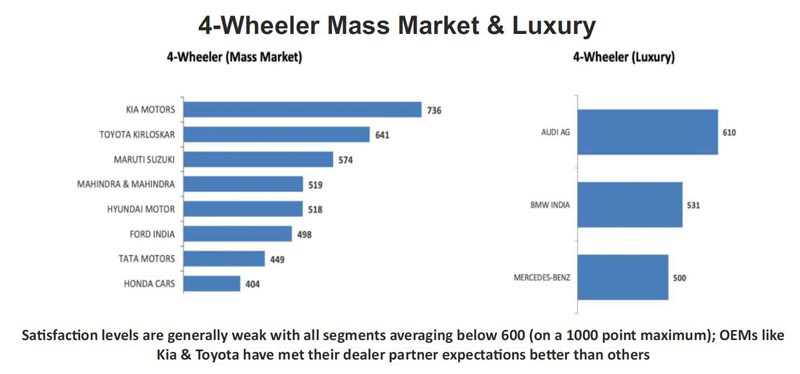

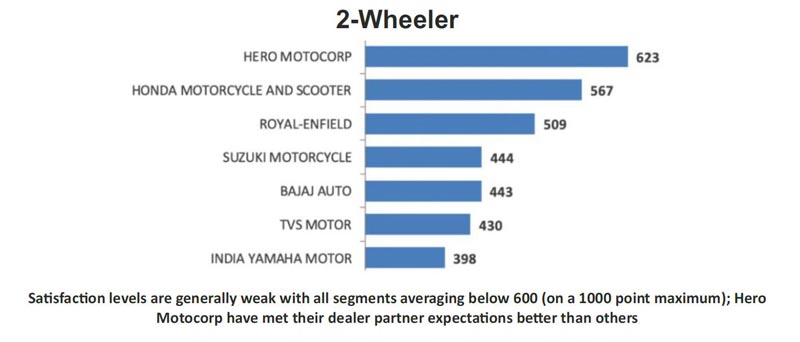

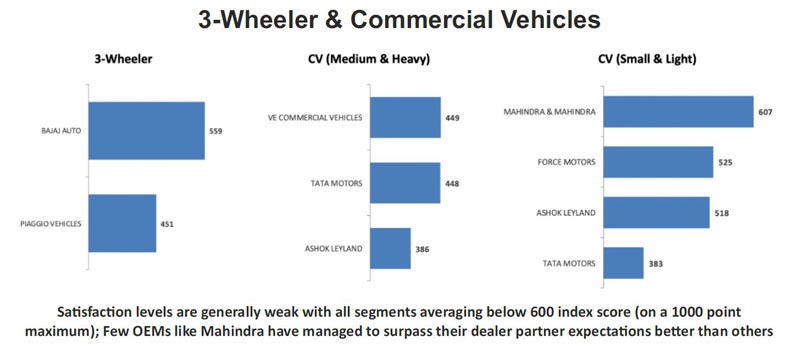

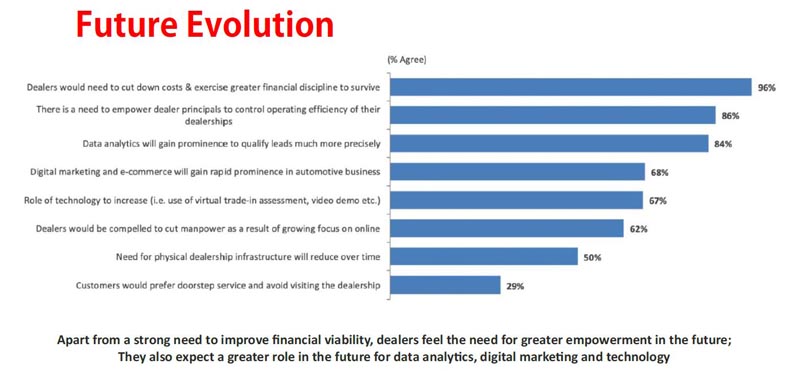

“With regard to the future, there is a common concern that the customer engagement process will get far more digitized which, in turn, will impact dealer’s manpower efficiency, processes and cost structure. Hence, OEMs who can proactively realign norms around these aspects are going to find greater traction among their dealer partners,” he added. “All segments of the market have recorded a weak satisfaction score below 600 which is understandable given that no one can be prepared in advance for handling such a calamity,” he said.

“However, OEMs like Kia Motors and Toyota Kirloskar in the four-wheeler mass market, Audi in four-wheeler luxury, Hero Motocorp in two-wheelers and Mahindra & Mahindra in small and light commercial vehicles have met the expectations of their dealers relatively better than others. A common thread lies in how these OEMs have managed hygiene issues of support on areas of customer communication and dealer manpower training, while pleasantly delighting their dealers through better term loans to tide over working capital needs,” Lochan informed.