By RACE Innovations

Rising fuel prices, mounting inflation and high interest rates have together dampened the general investor confidence. In line with the deteriorating economic growth, the Indian automotive sector has been witnessing a dramatic drop in growth in the past few quarters. This is quite evident in the recent dip in bus sales from 78,843 units to 74,728 units, a fall of around five per cent as compared with the previous year. Also during the period, several bus majors were forced to reduce the number of working days to avoid inventory pile-ups and also to streamline their sales forecast for 2012-13.

However, bus OEMs breathed a sigh of relief as the ICV (7.5-12 T) category recorded a double-digit growth of 13.7 per cent during April 2012 to February 2013. In the last two years, the ICV segment has been registering a good growth, thanks to its operating economics, and LCV demand is slowly diminishing, though limited to specific applications.

“Despite the economic slowdown and slump in bus sales, coupled with negative sentiments, global bus manufacturers seem unscathed and are fully equipped to foray into India, the world’s second largest bus market. Bus majors are looking to tap the fast-growing high-end/luxury segment, where the market is expected to witness a double-digit growth of 12 per cent during the next five years. With the Volvo and Mercedes Benz having already established dominance in the country, new entrants need to fathom the evolving high degree of competition by adopting ‘Glocal’ strategies” – A.S. Udaykumar, AGM, Research and Consulting.

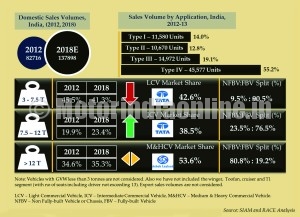

According to the Society of Indian Automobile Manufacturers (SIAM), bus sales during April 2012 to February 2013 totalled 74,728 units, and Race Innovations expects the year-end volumes to touch around 82,716 units. It also forecasts the total bus market to grow at a CAGR of nine per cent during 2012-2018.

Analysts foresee the poor demand outlook in the commercial vehicle industry to continue until the second quarter of 2013-14. Once the demand picks up and with the Union Budget reform realization, support from private players will moderate the gloomy scenario and provide a fillip to bus market growth. On the other hand, failure of JnNURM-II implementation before the elections in 2014 may adversely impact the bus market, and the industry is expected to revive only during the second quarter of 2014-15.

Traditionally Ashok Leyland has a stronger foothold in the bus segment, with a highest market share in the M&HCV segment. Especially, Ashok Leyland chassis are the most preferred due to the ruggedness, ease of body-building and maintenance-friendly capabilities. On the other hand, Tata Motors is retaining its dominance in the LCV and ICV segments by rejigging its aggregates and offering a wide range of innovative bus variants, thereby enabling customers to choose from a bigger lot based on their application needs. Tata Motors has also been retaining the brand loyalty in the school & staff bus segment in spite of stronger competition from MNAL, SML and Eicher brands.

However, the road ahead does not seem to be smooth either. In the luxury bus segment, Volvo buses have established the brand in the city segment by offering low-cost buses. In the past few quarters, regional disparities in bus sales in the northern region accounting for major demand slump have largely affected the bus segment.

SRTUs: A sneak peek

Today, the Government has been funneling adequate funds and resources into the public transportation systems to ensure a safe and comfortable travel, thereby improving the accessibility of road transport services. However, majority of the SRTUs are still unable to generate sufficient funds to augment their fleet capacity in terms of addition of new buses or replacement. As a result, majority of the rural population is catered to by the unorganized modes of public transport systems.

Also to be noted is that the several policy reforms proposed by the Central and State Governments have not made any positive impact on the overall operational efficiency of SRTUs. Such delays/failures are caused by the ineffective policy implementation, half-way scrapping of reforms, etc.

It is estimated that there are 35,000 over-aged buses that need to be replaced over the next three-five years.

Amid these concerns, the JnNURM scheme was focused to bring in a series of urban reforms, of which urban transport sector necessitated austere attention to be paid for improvements. Under the JnNURM-I scheme, 15,000 buses rolled out with a majority of them bagged by Ashok Leyland, Tata Motors and VECV.

The bus market witnessed a substantial growth during 2011-12, while delay in JnNURM-I delivery orders and pay-outs to OEMs once again led to implementation bottlenecks during 2012-13, thereby upsetting the bus market growth schedule.

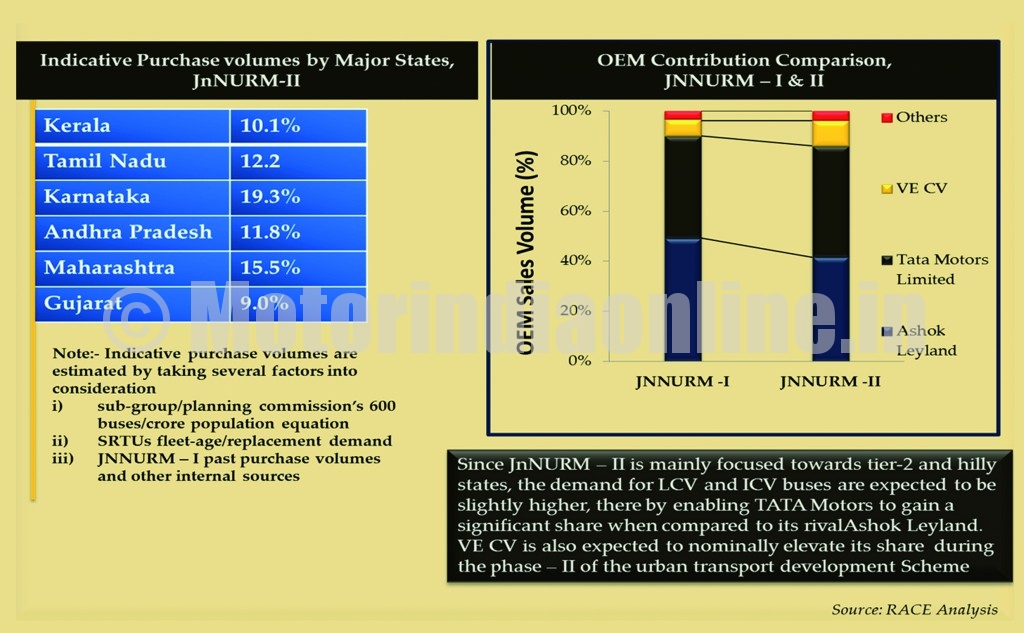

However, amid the teething problems related to inauguration of phase-II of the flagship scheme, the much-awaited boost for the bus market as through JnNURM-II has been extended till March 31, 2014. In the Union Budget for 2013-14, a sum of Rs. 14,873 crores has been allocated for the scheme, with a significant portion of it for purchase of 10,000 buses, mostly favoring Tier-II cities (4-10 lakhs population) and hilly States. Municipalities, corporations and SRTUs are expected to submit the City Development Plan (CDP) and Detailed Project Report (DPR) to CSMC within three-four months. The final draft version on the bus specifications will be ready by August.

Southern and western States are in the forefront in getting approval under the JnNURM scheme, and they are expected to purchase a considerable number of buses. Northern and eastern States have shown least interest in the scheme. This tepid response will surely delay project approvals.

Despite the Government’s optimistic estimate, Race Innovations foresees a dull progression towards the complete implementation of the scheme by the end of the next fiscal year. However, a partial roll-out is definite to happen during the period.

Snapshot on bus-body building industry

In recent years, fully-built vehicles are gaining greater traction as compared to the chassis/non fully-built, due to changing trends. In the case of the LCV segment, demand for chassis has been weakening in the past few years, mainly due to the limited customization requirement. On the other hand, OEMs are concerned more about quality deliveries. They focus on vertical integration to survive the intense competition and enhance the total cost of ownership (TCO), thereby switching on to in-house bus body building facilities. The other trivial triggers such as excise duty advantage on fully-built vehicles and SRTUs’ initiative towards single window purchase model to reduce the sourcing costs and bottlenecks are clearly spurring the FBV market demand.

Weakening chassis/NFBV demand and diminishing profit margins in the highly fragmented bus body building industry are clearly showing signs of decline of the chassis/NFBV market. Also to be noted is that the unorganized bus body builders are facing an intense competition in the industry and feel constrained to standardize and enhance their capabilities in every sphere of business activity for sustainable business growth. A number of strategies are being adopted by market players to sustain in the competitive marketplace, including tieing up with global chassis manufacturers to cater to domestic and export business and carrying out trial and feasibility studies on in-house chassis manufacturing programs to restructure their business models. In the next three-six years, bus-body builders are poised to graduate from the traditional body building business to that of integrators providing completely-built units with value-added solutions.

“Today, there are around 2000+ bus-body builders in India and majority of them are considered as small/unorganized players heavily competing in a moderately cyclical industry. In the emerging market, industries moving towards maturity stage are likely to embrace consolidation strategy or creating value proposition in the market through innovative differentiation, thereby creating plethora of opportunities for the stronger players to clearly outnumber the weaker market players”.

– Mr. Rajesh Khanna, Chief Operating Officer, RACE Innovations Pvt. Ltd.