The last two decades have witnessed a phenomenal increase in economic activity in India, and to keep pace with the development, there is the need to accommodate higher levels of transportation. Equally important is the safety of these transportation modes and means.

In last 10 years, the Indian trailer market has grown very much compared to any category because of the following important key drivers:

* Compared to rigid trucks, the trailer offers the lowest cost of transportation per tonne per km.

* Growth of third party logistics companies to ensure specialised transportation on the hub and spoke model.

* Growth of suitable road network in India which supports transportation through trailers.

* Growth of the Indian automobile industry to manufacture a large number of cars and two-wheelers which are being transported through trailers to end-customers.

The fleet customers wants 0 km reading on the odometer before taking delivery of vehicles, whether it is a rigid truck / car or two-wheelers.

With roads carrying around 65 per cent of freight goods in India, the sale of automobiles and movement of freight by road is growing at a rapid rate. Increased industrial activities, along with the increasing number of two- and four-wheelers have supported the growth of road transport infrastructure projects.

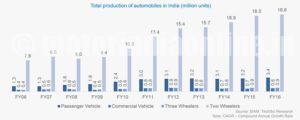

Production of automobiles increased at a CAGR of 9.4 per cent over FY06-16. During FY06-16, the passenger vehicle segment, at a CAGR of 10.09 per cent, witnessed the fastest growth, followed by the two-wheeler segment which grew at a CAGR of 9.48 per cent during the period. In 2016-17, the passenger vehicle market in India is likely to cross the three million units’ mark.

Change practices in trailer industry

Trailer manufacturing in India moved from the unorganized to the organized sector. In the past, old and used axles were being used for manufacturing of trailers without any infrastructure process or safety focus. Today, the international logistic players have entered India and big Indian logistics players have taken this opportunity in growth to have safe and reliable trailers. The Government has also supported this with the introduction of the trailer code which is aimed at improving the design of the products and process controls. Ensuring conformity of production to type approved designs would be beneficial to the end-user and the society at large.

European design vs. Indian design

The market is introducing basic European norms for the safety and environment protection which were earlier not present. Indian trailer design is slowly moving towards European standards. Trailer weight is a very important criterion in Europe, and since their road system is well developed, the norm of the industry is to have the trailers equipped with air suspension. In India, due to rough roads the trailer is being built using heavy material and mechanical suspension. Since the cost of the trailer is more important than weight in India, unlike European countries where weight is of prime importance, we are unable to utilize expensive aluminium alloy which is light in weight yet giving the same strength to the trailer.

Focus on TCO

There is an upward trend in considering product life cycle cost compared to the initial price, with the manufacturers also preferring to deliver a lowest product life cycle cost with the use of better design technology and high quality aggregates. The positive trend shall slowly change the trailer market scenario by having better design and better overall transport efficiency.

Global scenario and trend

In the case of developed markets like Europe, the road infrastructure is fully developed and there is focus on reducing the cost of logistics and large volume delivery by a range of customized trailers. The top 3 trailer manufacturers in Europe, namely, Schmitz Cargobull, Krone, Koegel collectively produce around 24,000 trailers every year. This market differs from the Indian market on the following aspects:

- All the trailers manufactured have to meet the European norms. In India the basic trailer code has recently been introduced and implementation begins from April 2017 onwards.

- They have very high level of design and engineering capability to manufacture. In India this capability is available only with few organized players.

- Most of the trailer manufacturers are not only providing trailers but they also value-added services such as telematics which are hugely popular in this market, full service contracts at predetermined prices across Europe and a variety of goods lashing systems for different types of products to reduce transit damage. They extensively use cameras to improve efficiency. India will take time to reach a similar level of service availability and demand from the customer. However, some of the early stage developments such as lashing belts with ratchets, collapsible roof covers, curtain siders, etc., are becoming popular in the Indian market.

Implementation of trailer code

One good thing about the Indian trailer market is the Government’s interest in implementing the trailer code. This will force the trailer manufacturers (a large part of them falling in the unorganized category) to standardize use of all critical components like tyres, rims, brakes, electricals, landing legs, kingpins, rear underrun protection device (RUPD), side underrun protection device (SUPD), etc. The trailer makers have to get their trailers tested for manoeuvrability, ABS and brake, following which they will be certified to manufacture and sell trailers. This implementation will play a big role in making trailers safe and more efficient products to use.

OEMs’ dilemma

Generally OEMs are driven by sales volume and vehicle contribution to fleets. However in the case of trailers, generally the contribution is from the trailer maker. As a tractor-trailer combination can have maximum payload, the growing use of trailers might eat into a share of the multi-axle rigid trucks. As none of the OEMs have their own trailer manufacturing plant, they might not be too keen to move towards trailers and might prefer to continue focusing on multi-axle rigid trucks.

The author is ex-Tata Motors (Head – Application Engineering Group and Tender Response Cell). He was instrumental in introducing many new truck applications in India and is well connected with application developers in India and abroad. Post retirement in 2014, he is working as a strategic consultant and technical advisor to many application developers in the Indian automobile industry and abroad.

By Bharat Dhruv, DHRUV MAXX GRO