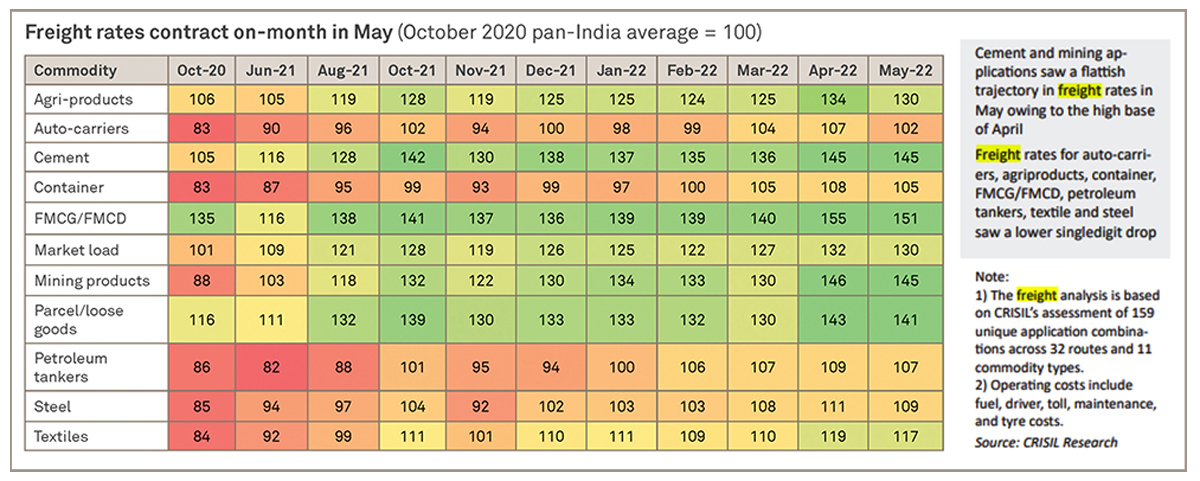

In May, transporters passed on the drop in diesel prices by decreasing freight rates on several routes.

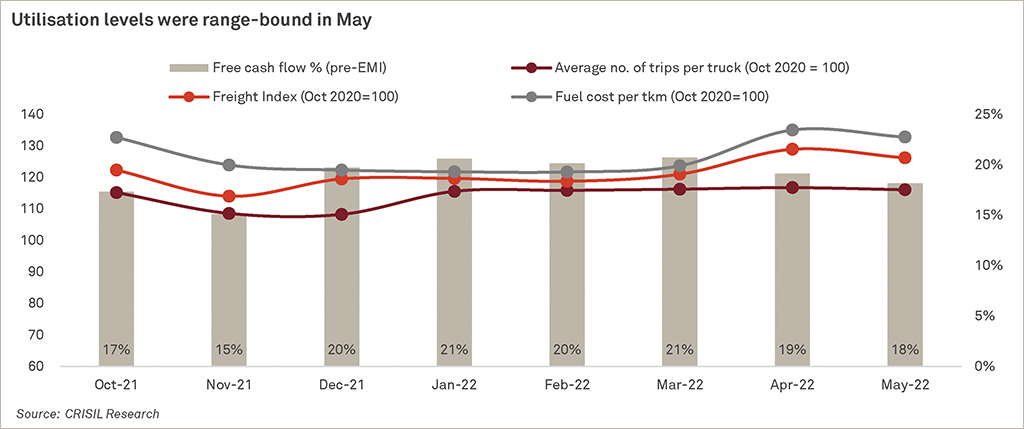

However, fleet utilisation was flat on-month. While utilisation for market load was higher, this was offset by slightly lower utilisation for parcel/loose goods, mining (largely coal and iron ore), and agri-products.

The remaining commodities, including auto-carriers, container applications, fast moving consumer goods (FMCG)/ fast moving consumer durables (FMCD), steel, textile, and petroleum tankers, saw flattish trajectory in utilisation.

The complete effect of this duty cut would be visible in the index from next month. This is because the central government set an extrinsic decline in excise duty at the end of the month, whereas CRISFrex represents freight rates and fuel prices for the entire month.

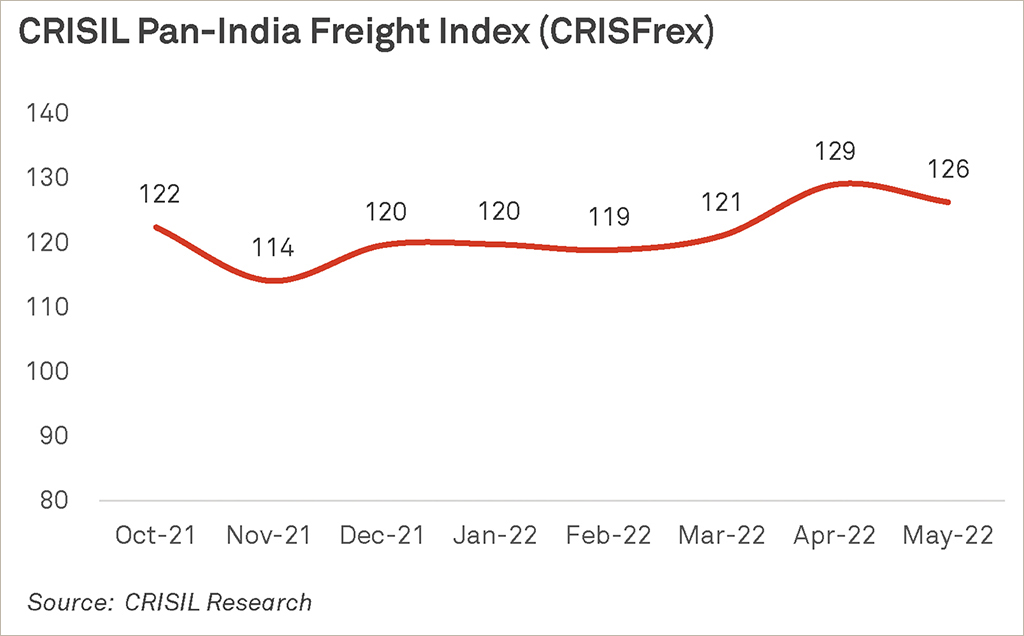

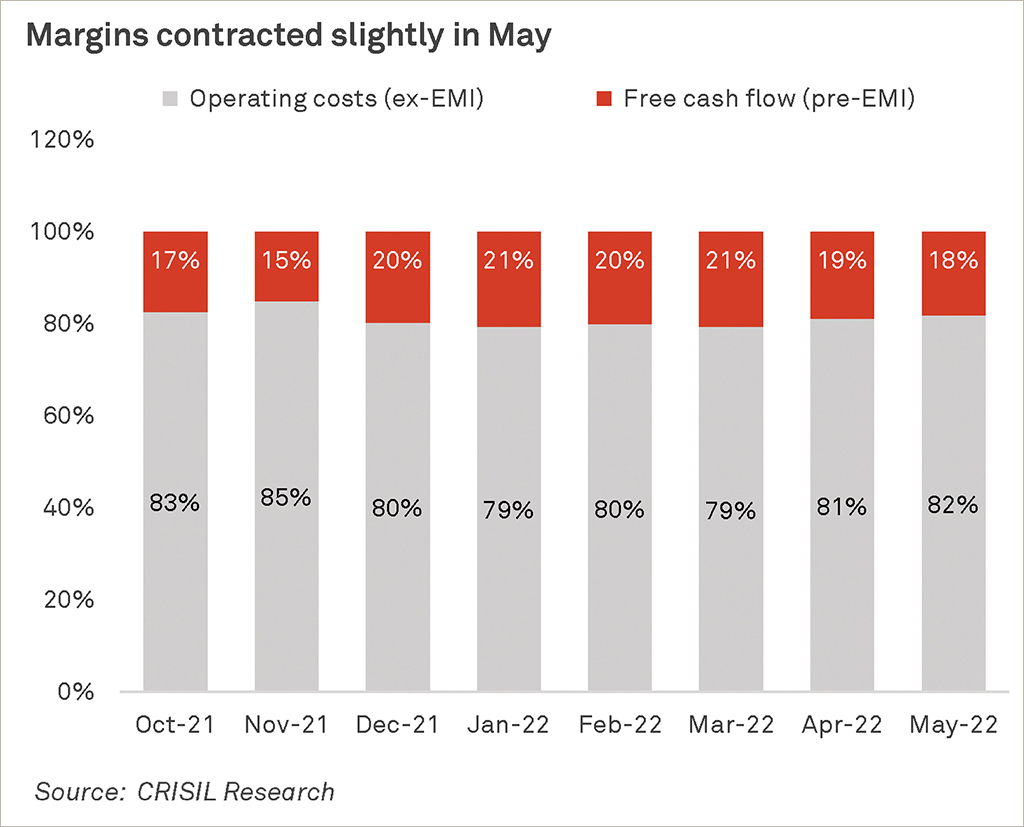

CRISFrex indicates that freight rates have dropped onmonth, with free cash flow (FCF; pre-equated monthly instalment) decreasing 100 basis points.

CRISFrex and FCF signals

Fleet utilisation for cement, agri-products, loose goods, and mining (largely coal and iron ore) application decreased marginally on-month in May. However, it increased marginally for market load and remained flat for autocarriers, textiles, containers, FMCG/FMCD, steel, and petroleum tankers.

Freight rates, too, declined for most commodities, but were stable for mining and cement. Freight rates declined on-month for consumer essentials such as agri-products, FMCG/FMCD, loose goods and discretionary goods (automobiles, textiles), and bulk commodities (container, petroleum tankers and steel).

This translated into the CRISFrex rising on-month to 126 in May from 129 in April.

Flat utilisation levels, a decrease in freight rates, and lower diesel prices resulted in the industry’s FCF contracting slightly to ~18% in May compared with ~19% in April.

Methodology

CRISIL incorporates the views of 100-150 transporters to understand freight dynamics as well as operational aspects such as number of trips undertaken and key cost heads (fuel, driver, toll, tyre, and maintenance).

This exercise is conducted on a closed sample of 159 route-commodity combinations, spanning 32 routes, 11 commodity types, and five truck platforms with differing load bodies, depending on the commodity carried.

CRISIL’s analysis provides an aggregated view of inputs collected to arrive at a holistic picture pertaining to the overall Indian trucking scenario.