By Shyam Sundar, Industry Analyst, Mobility, and Saideep Sudhakar, Associate Director, Mobility, Frost & Sullivan

Commercial vehicle (CV) sales are continuing to recover in major global markets, after battling through pandemic-related headwinds and high interest rate cycles. As of July 2024, CV stakeholders in developing markets have been experiencing subdued freight activity. Promisingly, however, the market looks set to bounce back, assisted by positive tailwinds, including interest rate cuts in the US and Europe as well as the revival of the Chinese economy.

Meanwhile, the global commercial trucking industry is in the midst of dramatic transformation, sparked by powertrain advancements, regulatory change, and a dynamic economic environment. The demand for efficient, sustainable, and intelligent transport solutions is increasing, catalysing industry growth. Accordingly, Frost & Sullivan estimates the overall global commercial truck industry to achieve 14.2 million total unit shipments in 2024. Of this, India is projected to hold a market share of 13.8% in the medium- and heavy-duty segment and 4.9% of the light-duty segment.

As one of the world’s fastest-growing economies, India’s CV industry offers significant potential. Substantial infrastructural investments, central government initiatives, surging industrial activities, and enhanced freight availability are poised to support significant growth in the Indian commercial trucking market. Frost and Sullivan anticipates India’s CV industry to reach 1.2 million units in total by 2030, growing at a CAGR of around 3.6% from 2024 to 2030.

Electrification Imperatives, Infrastructure Investments, and High Demand

Multiple applications across a range of different industries impact the demand outlook for India’s CV market. For instance, the boom in e-commerce – expected to be a $350 billion market in India by 2030 – is spurring demand for cheaper, on-time transportation solutions. Concurrently, the Indian government’s Open Network for Digital Commerce initiative will enable small traders to enter the e-commerce space. This combination of soaring demand and intensifying competition will trigger notable growth and disruption. It will create massive demand for last-mile delivery trucks, led by under 3.5 tonne trucks that currently account for over 19% of demand from the e-commerce sector, and by the between 3.5 to 18.6 tonne trucks that fulfil nearly 48% of the demand.

In a convergence of objectives, electrification in last-mile delivery is being driven by e-commerce companies aiming to achieve sustainability goals through zero-emission transportation. The last-mile segment is already seeing widespread electrification with offerings like the Tata Ace, Eicher Pro EV, and Switch Mobility’s (a subsidiary of Ashok Leyland) electric mini trucks. Large e-commerce firms will continue to place sizeable orders for a range of electrified last-mile delivery trucks, as consumer appetite for online retail flourishes.

Another trend that will impact India’s CV industry is road infrastructure development. Budgetary outlays are expected to grow to $50 billion by FY2030, with the ongoing Bharatmala and Gati Shakthi projects continuing to drive road construction works. This will boost demand for trucks in the 28-35 tonne GVW category. Stronger axles and higher carrying capacity mean that trucks in the GVW segment, which already account for more than 65% of trucks in the road construction sector, will strengthen their dominance.

Demand from the energy sector is also set to provide growth impetus to India’s CV industry. In parallel with intensifying decarbonization efforts, demand for coal is also continuing to rise. In 2023, coal constituted close to 15% of overall global energy demand, with the Indian government having set a target of 1 billion tonnes of coal production by 2030. This ambitious target will spur the need for both surface and deep mining trucks above 35 tonne GVW. Currently, the above 35 tonne category is led by manufacturers like Tata, Ashok Leyland, and BharatBenz, while the above 55 tonne segment is dominated by Volvo Trucks. The entry of Chinese players, such as Sany with its dump trucks and above 70 tonne carrying capacity, is likely to shake up the competitive landscape in the mining end-user sector. The demand for above 35 tonne category trucks is expected to increase, following the market introduction of stronger hub reduction axles.

Evolving Regulations on Safety, Efficiency, and Driver Comfort

Over the past decade, India has been introducing regulations for the CV industry. The implementation of emission norms in 2017 and 2020, alongside axle load regulations, have had a significant impact on market development. Despite the dampening effects of the pandemic on sales, the industry has shown tremendous resilience and has achieved emission levels comparable to those of developed countries. This is reflected in the widespread availability of innovative, high-performance, fuel-efficient trucks that have a superior environmental profile to older models.

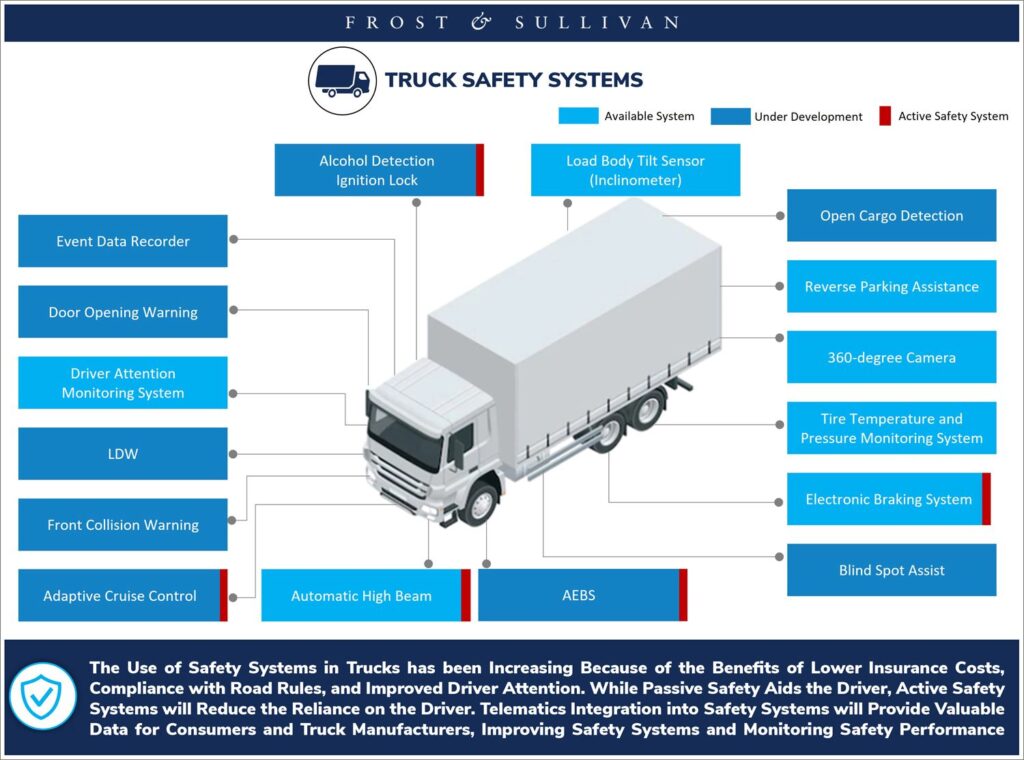

While Europe has introduced the General Safety Regulation focused on active and passive safety in CVs, India has been preparing a series of mandates on the same theme. One of the initial mandates will be the Driver Drowsiness and Attention Warning System, which requires systems to alert drivers when their attention is compromised. Another crucial mandate expected in the coming years is advanced emergency braking, where brakes are automatically applied if an object is detected ahead of the vehicle. This helps in collision avoidance. Such systems are already available in some passenger cars and could revolutionize road, vehicle, and passenger safety.

Besides safety, another major area of focus is transport efficiency. The logistics industry in India is expected to generate $550 billion by 2030, necessitating heightened investments and infrastructure capacity expansion. In line with its efforts to enhance road transport efficiencies, the government is considering a regulation that would permit the operation of road trains up to 25 meters in length. This could be a game-changer for high-volume transporters. Some OEMs and suppliers have already begun testing road trains on select routes to assess their feasibility, and the rollout of this concept is anticipated soon.

The bedrock of the trucking industry is the truck driver, without whom the industry and the nation’s economy itself would grind to a halt. Accordingly, features that support driver comfort and well-being are emerging as key focus areas. OEMs are emphasizing truck ergonomics and cabin amenities that enhance the driving experience. With driver comfort, convenience, and safety at the forefront, a key mandate – the provision of air-conditioned cabins – is set to come into effect from October 2025. This will dramatically improve driver comfort as well as fuel efficiency due to the advantages of operating in a completely closed cabin environment. The government is deliberating other mandates, including fixed driving hours and mandatory rest periods, similar to the Electronic Logging Device (ELD) regulations being followed in Western countries. Fixed driving hours will notably improve road safety and reinforce more efficient driving practices, besides indirectly contributing to superior overall operations and productivity metrics. However, implementation might pose a challenge if there is pushback from the trucking industry and fleet owners over adhering to restricted driving hours.

The introduction of FASTag has dramatically reduced waiting times at toll gates, from over 10 minutes down to an average of less than a minute. The government is now evaluating the potential of GPS-based tolling systems, where an onboard unit attached to the vehicle calculates its exact location. This system will eliminate waiting, as no stopping will be required. Implementing and transitioning completely to this new technology will take a few years, until which time both FASTag and GPS-based tolling will operate in unison.

Sustainability and Path Towards Zero Emission

The transport sector is indicted as one of the major culprits in spiralling carbon emission levels and air pollution. This has underlined the concerted push towards lower emissions, paralleled by the growing emphasis on alternative fuels such as compressed natural gas (CNG) and liquefied natural gas (LNG). Natural gas is viewed by many fleet owners and OEMs as a transition fuel before the more widespread switch to pure battery electric or hydrogen-based powertrains. In 2023, the central government revised CNG pricing mechanisms based on 10% of India’s crude basket’s monthly average, resulting in lower CNG prices.

Indeed, to reduce dependence on diesel and lower carbon emissions, the government has been promoting various initiatives and subsidies that boost CNG and LNG usage in CVs. The National LNG policy seeks to establish new LNG storage terminals as strategic reserves, regulate pricing, deploy long-term import contracts, and foster the use of LNG as a fuel in trucks.

The central government has also launched a green hydrogen policy to advance the production, distribution, and use of green hydrogen in sectors that use trucks and buses. The National Hydrogen Mission roadmap for 2030 endeavours to spur the adoption of hydrogen as a fuel in trucks. Major OEMs have exhibited keen interest in hydrogen powertrains, particularly in hydrogen internal combustion (IC), as it is cost-effective compared to fuel cell trucks. Indicative of the appeal of hydrogen-powered trucks, Tata Motors is partnering with Cummins on hydrogen IC engines, while Ashok Leyland and Reliance are collaborating on hydrogen-based powertrains. Having launched hydrogen IC engines, homegrown startups such as Triton have emerged as early first-movers. While such trends clearly demonstrate the industry’s growing interest in zero-emissions alternatives, targeted government policies, investments, and incentives will be crucial to sustaining the development and uptake of hydrogen-based powertrains by the CV industry.

Road Ahead

Following years of varying demand, India’s CV market is now on a steady path of growth and recovery. Technological innovations, regulatory changes, sustainability initiatives rooted in the transition to low and zero-emission powertrains, and government-backed incentives, investments, and infrastructure development are boosting market prospects. Collaborations across the ecosystem are accelerating the deployment of advanced features and functionalities, while creating a mutually beneficial value chain. By embracing its role as a lynchpin of economic growth and a champion of environmental sustainability with efficient, reliable, and responsible solutions, India’s CV industry is positioned to set new benchmarks in the global CV landscape.