Indian market contributes with record numbers

Global construction equipment sales hit an all-time high of 1.1 million units in 2018, with a retail value of some $110 billion. This eclipsed the most highs of 2011 – the peak of the Chinese stimulus spending boom – and 2007.

Continuing the trend seen in 2017, there was a widespread improvement in equipment sales around the world last year, with increases in North America, Europe and emerging Asia, including both China and India.

In China sales of construction equipment, including mobile cranes, grew 37 per cent in 2018. This followed on from the 81 per cent surge seen in 2017, and took the market to 343,817 units. This was the highest Chinese equipment demand since 2012, and established the country once again as the largest market in the world.

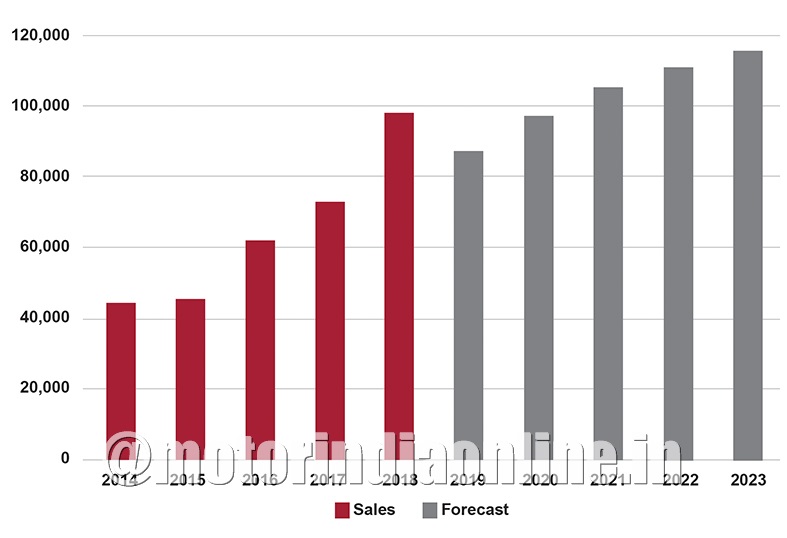

India also had a remarkable year. Sales of construction equipment, including mobile cranes, grew 35 per cent, the third successive year of robust growth. This took the market to a record high of 98,204 units – some 44 per cent above the previous high seen in 2011, and more than double the demand seen just three years previously during the cyclical low point of 2014 and 2015.

Meanwhile, sales in Western Europe hit their highest for a decade in 2018, with a 10 per cent rise to 177,694 units. Demand increased in 14 out of the region’s 15 largest markets, with sales in Germany and the UK in particular reaching impressive levels. The only time the German market has been as strong was at the height of the post-reunification building boom in the early 1990s.

North American equipment sales also improved last year, with growth of 13 per cent taking demand to some 195,500 units.

The only disappointment among the world’s largest markets last year was Japan, where sales fell 5 per cent to 63,700 machines.

While 2018 is likely to represent the peak in the current cycle, Off-Highway Research forecasts only a moderate decline in global demand this year. Sales are expected to remain above one million units, which would be only the fourth year in history this has been achieved.

The outlook for the following years is for demand to stay at good levels. However, this bright outlook could of course be threatened by negative and unexpected political and economic events.

Indian equipment market clocks record sales

Sales of construction equipment, including mobile cranes, grew 35 per cent in India last year. It was the third successive year of robust growth and took the market to a record high of 98,204 units. This level of demand was some 44 per cent above the previous market high, seen in 2011.

Off-Highway Research Managing Director Chris Sleight said: “It would be hard to overstate how buoyant the Indian market has been over the last three years. Demand has more than doubled in just three years from the low point in 2014 and 2015. It is now comfortably the third largest equipment market in the world after China and the US. Inevitably, the general election will be disruptive this year, but over the medium to long term we expect the Indian equipment market to keep growing.”

In volume terms, the most important factor last year was a huge and somewhat unexpected surge in backhoe loader sales. They leapt from 32,728 units sold in 2017 to an unprecedented 45,552 machines – a near 40 per cent rise.

Backhoe loaders have been hugely popular in India for decades and have always been the country’s highest selling construction machine. In recent years there has been evidence of contractors moving more towards crawler excavators, and Off-Highway Research believes this is still the case for professional construction companies on larger contracts.

However, the backhoe loader remains the quintessential entry-level production in the Indian industry, and the boom in construction in the last three years has encouraged entrepreneurs to enter the segment. In addition, backhoe loaders are increasingly being sold to customers in rural areas for small-scale construction and water resources schemes.

In addition, the Indian crawler excavator segment saw strong growth last year, with sales rising 27 per cent to more than 25,000 units. Notwithstanding the continued popularity of the backhoe loader, crawler excavators are becoming increasingly important in the Indian industry and are selling in volumes which have never been seen before.

Off-Highway research forecasts an 11 per cent decline in sales this year due to the disruption that the general election will cause. However, the longer-term trajectory for India is for growth in equipment sales and demand is expected to surpass 100,000 units by 2021.

Another strong year for Chinese equipment market

Sales of construction equipment, including mobile cranes, grew 37 per cent in China last year. This followed on from the 81 per cent surge in sales seen in 2017, taking the market to 343,817 units. This was the highest Chinese equipment demand since 2012, and established the country once again as the largest equipment market in the world.

Off-Highway Research Managing Director Chris Sleight said: “There has been a remarkable surge in equipment sales in China since late 2016 in response to the ‘One Belt, One Road’ initiative and other infrastructure investment programmes. Off-Highway Research believes the peak in equipment sales has now passed. Although the projects themselves may have years to run, they have largely moved on from the earthmoving and site preparation phases, or at least there is enough equipment available to execute this work.”

The excavator segment was a key driver of growth once again in 2018. Crawler excavator sales grew 41 per cent, while mini excavator sales rose 42 per cent. As a result, the various types of excavators together accounted for 56 per cent of total equipment demand.

There was also growth in the wheeled loader segment, but with a 27 per cent rise in sales, this was at a slower rate than the market as a whole. The fact that the growth rate was behind the market average for the second year running underlined the Chinese industry’s structural change. With a large population of wheeled loaders already active, pressure from economical wheeled loaders – essential cheap, low technology farm equipment – and the rising popularity of more productive machines such as excavators, the relative importance of this segment is diminishing.

Crawler dozer sales grew 32 per cent last year, but overall volumes remain much lower than the historical peak, and their share of the total demand fell to below 2 per cent.

Mobile cranes experienced another good year with sales surging by 61 per cent. Meanwhile the rigid dump truck sector finally returned to a growth, but volumes still remained low by historical standards.

On the down side, road building machinery such as asphalt finishers, compaction equipment and motor graders all saw modest falls in sales as a result of the levelling-off in of road construction investment.

The Chinese equipment market is now believed to have reached their peak in the current cycle. However, sales are only forecast to fall 3 per cent this year. The market is expected to stabilise around 250,000 units from 2021 onwards.

Courtesy: Off-Highway Research