Amidst the ongoing pandemic-related upheavals, one thing is clear – the industry is robust and is already on the road to recovery, signposted by digital transformation, vehicle electrification, connected and autonomous technologies, and innovative business models, opines Marshall Martin, Industry Analyst, Mobility Practice, Frost and Sullivan

The corona virus put the brakes on the commercial vehicle (CV) industry in 2020. Light commercial vehicle (LCV), medium-duty (MD) and heavy-duty (HD) truck manufacturers struggled with production lockdowns, labour shortages, supply chain disruptions and reduced demand for freight. Major markets in North America and Latin America stumbled badly even as CV sales plummeted in Europe and India. However, it wasn’t a case of unmitigated gloom. Beginning Q2 2020, China, the original epicentre of the pandemic, made a faster than anticipated recovery.

The Chinese CV industry bounced back, recording particularly strong growth at an estimated 12.1 per cent in its LCV segment and a vigorous 35.4 per cent in its MD and HD truck segment in 2020. Meanwhile, Chinese manufacturers dominated the global MD and HD truck segment with the country’s big five truck OEMs such as Dongfeng, FAW, Shaanxi Auto, Sinotruck and BeiqiFoton accounting for almost half of global sales. Drawing on the resilience of North America’s LCV segment, which remained relatively insulated from the impact of the virus, US manufacturers like Ford and GM reinforced their leadership of the LCV market, accounting for a quarter of global sales.

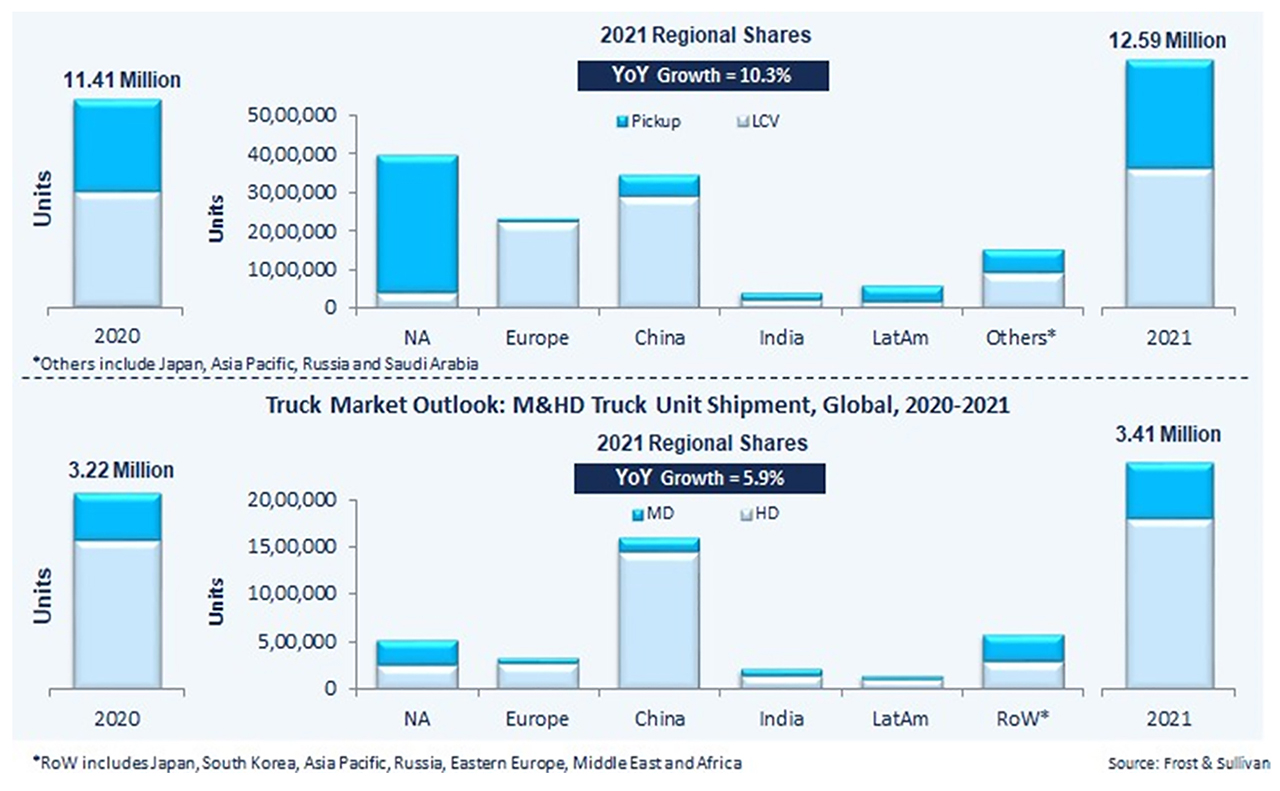

Almost halfway through into 2021 and with the pandemic still not under control, the question is how is the CV industry faring and what lies ahead? Amidst the ongoing pandemic-related upheavals, one thing is clear – the industry is robust and is already on the road to recovery, signposted by digital transformation, vehicle electrification, connected and autonomous technologies, and innovative business models. Accordingly, Frost and Sullivan is upbeat about the industry’s prospects. Its recent report titled ‘Global Truck Industry Outlook, 2021’ projects the LCV, MD, and HD truck segments to grow at a healthy 10.3 per cent and 5.9 per cent, respectively, this year.

The Post-Pandemic Landscape

Recovery in the North American CV industry in the post-pandemic phase will principally be stimulus- driven. The signs are already promising. In December 2020, the MD and HD truck segments registered sales of around 50,000 units, almost 13,000 more than the average of the previous 11 months. The MD and HD truck volumes are anticipated to grow faster than the LCV segment on the back of renewed freight movement at ports and construction activity. The surge in e-commerce and last-mile delivery resulting from the pandemic exigencies has had a ripple effect on the demand for LCVs across the North American region.

Digitalization has also received a massive fillip, courtesy of the pandemic with fleets fast-tracking a range—from data analytics for fleet management to digital freight brokerage solutions for freight matching—of digital solutions. After weathering an early battering from the virus, Europe’s CV industry made a faster than anticipated turnaround from Q3 2020. This positive momentum has carried forward to 2021. Brexit could, however, play a spoiler with potential delays and additional costs caused by supply-side disruptions over the short to medium-term. In an environment already fraught with pandemic uncertainties, this could deter CV activity and goods transport on UK routes. As elsewhere, the pandemic is likely to add impetus to digital transformation initiatives across Europe. Innovative start-ups in the digital freight brokerage and fleet management space, in particular, are set to attract huge investments in the coming years.

A Tale of Two Asian Giants

A government-promoted scrappage policy to replace older vehicles, low-interest rates, attractive financing deals and higher infrastructure spending pushed China’s CV industry to record growth levels in 2020, despite the pandemic. However, the scaling back of government support and the fact that many advance sales occurred in 2020 will create a more challenging environment in 2021, particularly for MD and HD truck participants. Post-pandemic uncertainties will be exacerbated by trade imbroglios with the US and the rest of the world, with ramifications for the country’s logistics sector and, by extension, for its CV industry.

An ongoing second wave of the pandemic has compounded the woes of India’s CV industry which suffered the steepest decline of all regions during the first wave that began in March 2020. The decline was attributed to pre-existing weakness related to credit crunch challenges as well as production stoppages in April 2020. Despite the massive disruptions caused by the second wave, India’s CV industry is expected to stay resilient, making a gradual comeback in the second half of the year. Recovery will be supported by the release of pent-up demand, improving trade, increased infrastructure spending and greater business confidence.

Looking Ahead

As it stands today, vaccination rollouts have allowed a semblance of normalcy to return in certain parts of the world. This spells good news for the global CV industry. Major regional truck markets – barring China’s MD and HD truck segment, which is expected to shrink – will experience strong growth, although volumes might still linger below 2019 levels. The pandemic has added impetus to several trends that were already taking shape before its onset. E-commerce and last-mile delivery trends are set to trigger demand for CVs like panel vans and box trucks. Electrification in the CV industry will pick up speed in 2021, fuelled by the governmental push the world over for cleaner, greener, and zero-emission powertrains.

In the US, California has passed the Advanced Clean Truck (ACT) regulation which makes it mandatory for CV manufacturers to sell increasing percentages of zero-emission trucks from 2024, before gradually increasing to 100 per cent by 2045. In India, BS-VI emission norms and truck electrification initiatives that are expected to start with the LCV segment—Tata, Ashok Leyland and Force Motors already have electric models lined up— will support the goals of lowering carbon emissions, reducing oil imports and adopting cleaner modes of transportation. Major European OEMs like Daimler, Volvo, Renault-Nissan and US OEMs, including Ford, Tesla, Rivian and GM, are all set to release a raft of new electric vehicles, stepping up the pace on vehicle electrification.

The projected increase in oil prices in 2021 will boost infrastructure investments and incentives for natural gas use in the transportation sector. It will also fast-track the adoption of alternate powertrains, especially hydrogen fuel cells. The development of hydrogen infrastructure and related mobility-based ecosystem will accelerate, particularly in Europe and North America. Chinese OEMs like Dongfeng, BeiqiFoton, Shaanxi and CNHTC will continue to drive innovations, having already developed fuel cell platforms for heavy trucks in recent years. Electrification trends apart, safety-enhancing features such as advanced driver assistance systems (ADAS) and connectivity features such as telematics in trucks will represent transformative milestones in the CV industry’s journey towards autonomous technology adoption.

And, finally, collaboration will be the lynchpin around which the industry’s recovery will revolve. TRATON – Navistar’s strategic understanding, Daimler-Volvo and GM-Nikola’s alliance on fuel cell trucking, and the Waymo-Daimler and TuSimple-ZF partnerships in autonomous trucking development highlight one key aspect of the pandemic’s impact – the importance of collaboration. The pandemic has emphasized to OEMs, suppliers and start-ups across the global CV ecosystem that complementary partnerships will strengthen their future readiness and sharpen their competitive edge in an unpredictable and highly volatile ‘new normal’.