By S. Muralidharan, President, Lucas Indian Service

GST is by far one of the most important legislations affecting Indian industry as a whole and its impact is no doubt felt in the automotive aftermarket. The impact will not just be in the immediate term but also short term and long term. To understand the implications, one will have to see the various members of the value chain in the automotive aftermarket and see how they are impacted.

At the one end of the value chain are the end-users who thought prices will come down post-GST and immediately postponed purchase. So the impact in the immediate term is very clear – postpone purchase. In the short term they will go in for repair with a significant level of overhaul. Since most of the items come under 28% GST, prices may or may not come down. Though to some extent they will, there will also be the disadvantage of an added service tax on the labor bill.

As a result of all this prices may or may not change. But what will certainly happen in the short and long term is that they will be assured of genuine parts because there might have been people selling sub-standard parts without a bill. So the end-user might not see very evident changes in prices but in the long term will see the advantage of a proper bill and get genuine parts.

Impact on garages & retailers

Just above the end-users are the garage mechanics. This is the most amorphous group in the entire country where people of all skills, all sizes, all business levels are involved. The big question is whether the small fish – those who have a turnover of less than Rs. 20 lakhs annually – get eaten by the big fish – the jury is still out on this!

The other medium-sized independent car and truck garages would certainly have a temporary pain of getting registered and comply with the regulations. Though this category of people might undergo a lot of difficulties in the immediate and short term, they are likely to gain the most in the long run because they would get the full benefit of the input tax while charging the customer and hence their cost of repair would come down, leading to a rise in their profitability. Will they have the support of educated people in their system and the patience to wait for all this to happen? The answer is possibly yes because m +edium-sized garages in this country have always adapted themselves to situations – be it from a carburetor car to a multi-point fuel injection, so there is absolutely no reason why they cannot adapt themselves to GST.

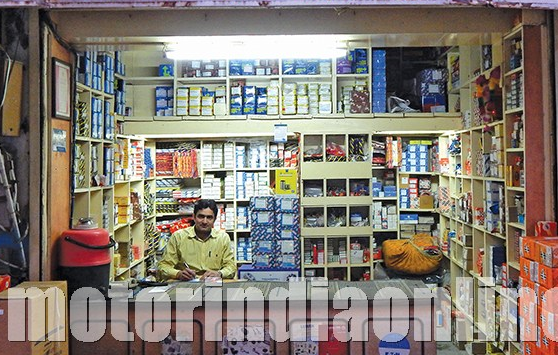

Above the garages in the value chain are the small retailers and dealers who are going to be an affected lot, no doubt about it; the immediate term is going to be a huge challenge since they are all used to working on credit, small paper slips in place of invoices, driven by trust, etc. Many of them are not VAT compliant and some are not even VAT registered, so it is difficult to see these people change even in the short term. They may have to reorganize themselves to be able to survive over the long term.

Not having GST is not a solution simply because if they don’t get the input tax credit of 18 or 28 per cent, their business is not going to be viable. Since the input tax credit has to go right through the value chain, garages would prefer buying from retailers who provide proper invoices in order to avail the input tax credit.

Also, retailers destocking, which may continue for three months or even more, would make it difficult for the pipeline stock to be filled, so organizations as a whole might find it challenging to record turnover.

Distributors set to gain

Above the retailers in the value chain are the distributors who are bound to gain. If they do legitimate business, they would have got into GST straight away and will be able to sell straight away. The only area where these people might be affected is in the working capital because once they pay GST of 28 per cent, the input credit may take around three months to flow in. So somewhere down the line these people have to block working capital for three months. So if they have access to legitimate funds, either through banks or through their own sources, they may be able to tide over it.

That said, there is no doubt that these people are set to gain the most because the cumulative taxes, including CST, excise duty, ad valorem duty, etc., get subsumed in one GST and once the input tax starts pouring into their coffers after three to four months, they are going to gain. How many of them continue servicing the garages, go on increasing their reach and continue to service the retailers, we need to wait and watch.

Boost for Make-in-India

If the manufacturers pass on the benefits of GST, the prices of products in the aftermarket should come down, be it 2 per cent or 3 per cent. It is important that prices come down because this is one of the biggest ways in which the overall ‘Make in India’ campaign can become a reality. With such an advantage, cheap imports, under-invoiced imports, sub-standard products and all of this which enters the country in the name of parts as per aftermarket specs, will find it difficult to compete with genuine made-in-India products, especially if the local aftermarket companies get the input tax credit and if the manufacturers get a cost advantage due to the elimination of various other taxes not being there in the value chain.

So organized players certainly will gain. Here comes the big question again – will these players be the big fish who will eat the small fish down the line and become the Auto Zones and Quick Fits of the world? The answer is possibly yes. In short, if we look at the entire value chain of the aftermarket – from manufacturers, distributors, retailers, small garages – there is a distinct possibility that we are in the midst of a huge structural change which will encompass all aspects of distribution.

Warehousing and logistics

One major aspect of distribution that is going to be affected is warehousing. Gone are the days when from one State to another small warehouses were set up just for the sake of saving CST. Now is the time when certainly the warehouses in the States will shrink, some may even disappear, and bigger warehouses will come up. There would no longer be a need for smaller warehouses in different States. The logistics companies also stand to gain, not in the immediate or short term but certainly in the long term, by sensible planning – where to have stock points, what kind of transport service or vehicles to use, etc.

So looking at the whole aspect of logistics affecting the aftermarket, either physical logistics such as warehouse or transport companies, is something which would be worth watching in the Indian scenario and will affect the structural changes happening in the market.

Bundling all this across the value chain – the product, the service, warehousing, and transport logistics – GST is certainly going to be a gainer in the long-term. Yes there will be a lot of immediate and short-term pain, but the question is, do we have the patience to swallow the short-term turnover drop and issues of working capital and then wait to play? This is not going to be T20 cricket, this is going to be the traditional five-day cricket! Let’s wait and watch.