The Indian economy is at a turning point. This was the consensus view of the panelists at the session on “India’s Growth Outlook” at the India Economic Summit organized by the World Economic Forum and the Confederation of Indian Industry (CII) in New Delhi on November 6. Positive sentiment among investors is now clearly visible though more needs to be done to maintain a strong growth momentum.

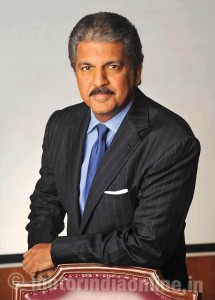

Speaking at the session, Mr. Anand Mahindra, Co-chair, India Economic Summit, and Chairman and Managing Director, Mahindra and Mahindra Ltd., said it would take some time to feel the real impact of the reforms being undertaken. Of course, the Government has to necessarily introduce steady, consistent reforms rather than big bang ones.

He said that the macro-economic conditions in the country are now conducive for the Reserve Bank of India to seriously consider the issue of reducing interest rates. Core inflation has already come down, oil prices are falling, and a stable Government is in place at the Centre. All this has created ideal conditions to reduce interest rates. This would help fuel demand in the economy and spur growth. Further, the Goods and Services Tax (GST) needs to be implemented forthwith to help create a common market in the country, he added.

Roadmap for GST

It may be recalled that the Government had announced a roadmap to roll out the GST regime by April 2016. The Centre and the States are believed to have agreed on a broad consensus on the issue of revenue losses with a $6 billion compensation plan spread over three years for reimbursing the States after phasing out the Central Sales Tax (CST). The Government has gradually brought down the level of CST, a proportion of which goes to the States over the last few years from 4 per cent to 2 per cent as a precursor to rolling out GST. As an interim measures, the Government has also periodically compensated the States for revenue losses.