Rating agency ICRA highlighted that the marketing margins on retail sales of auto fuels for the Indian oil marketing companies (OMCs) have improved in recent weeks with the reduction in crude prices. The rating agency anticipates that there is headroom for the downward revision of retail fuel prices if crude prices remain stable at current levels. ICRA’s outlook on the refining & marketing sector remains Stable.

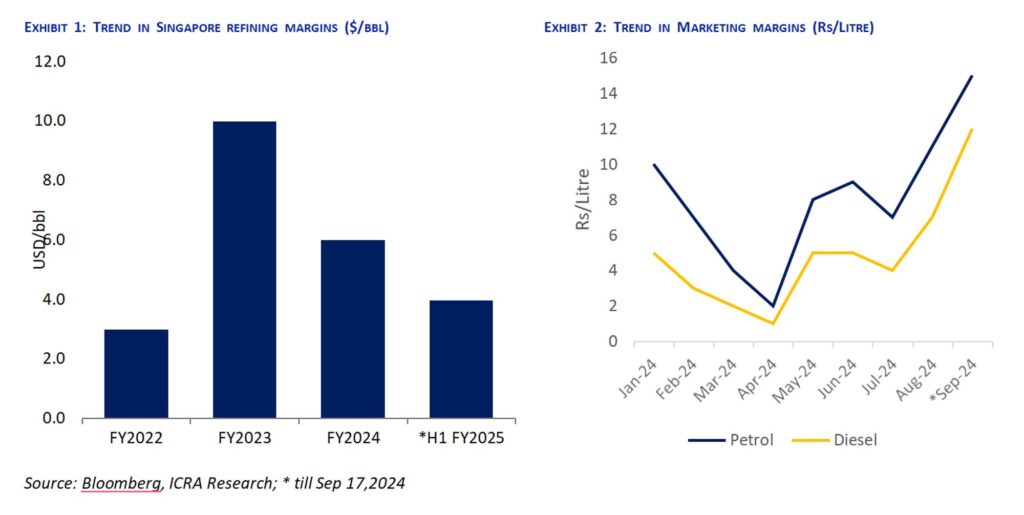

Commenting on the marketing margins, Girishkumar Kadam, Senior Vice President and Group Head – Corporate Ratings, ICRA, said: “ICRA estimates that the OMCs’ net realisation was higher by ~Rs.15/litre for petrol and ~Rs.12/litre for diesel vis-à-vis international product prices in September 2024 (till September 17). The retail selling price (RSPs) of these fuels have been unchanged since March 2024 (Rs. 2/litre was reduced on petrol and diesel on March 15,2024) and there appears to be headroom for their downward revision by Rs.2-3/litre, if crude prices remain stable”.

Crude prices have witnessed a sharp decline in the last few months, primarily due to weak global economic growth and high US production and the OPEC+ has pushed the rollback of its production cuts by two months to combat the declining prices.

The Singapore GRMs witnessed significant moderation in H1 FY2025 to ~$4/bbl due to a drop in crack spreads with higher product output and reduced demand. The impact is mainly on account of weak demand from China due to rising electric vehicle (EV) sales, muted industry demand and real estate downturn. Further, demand in Europe has also been subdued due to weak industrial activity and a structural shift in vehicle fleet towards EVs.

A marketing gain of Rs.1/litre on petrol and diesel would compensate for the GRM loss of 0.9 $/bbl for the domestic refining and marketing industry. Commenting on the OMCs’ profitability, Kadam said: “The OMCs reported healthy operating margins in FY2024, recouping the losses incurred during FY2023.

Despite moderation in the GRMs, the improvement in marketing margins is likely to result in the OMCs maintaining their profitability in H1 FY2025”. However, inventory losses due to a sharp decline in crude prices could impact profitability to an extent in Q2 FY2025. Further, the profitability for standalone refiners would take a hit with the declining GRMs.

ICRA’s outlook on the refining & marketing sector remains Stable. Petroleum, oil & lubricants (POL) consumption in India witnessed YoY growth of 5% in FY2024 and is likely to witness a 3-4% growth in FY2025, driven by economic progress, increasing mobility and air travel. The OMCs have planned a significant capex in the refining segment. The domestic refining capacity is expected to increase to 306 million MT over the next three to four years from the current capacity of 256.8 million MT as of March 2024 to support the increased consumption and exports. ICRA expects the capacity utilisation of the PSU and the private refiners to remain healthy in FY2025.