The Federation of Automobile Dealers Associations (FADA) has released the vehicle retail data for September 2024, highlighting key trends and challenges in the Indian auto retail market.

FADA President, Mr. C.S. Vigneshwar, commented on the market situation: “The 2024 southwest monsoon’s 8% above-normal rainfall has boosted Kharif sowing by 1.5% YoY, improving agricultural productivity and positively impacting rural demand and economic sentiment. However, despite festivals like Ganesh Chaturthi and Onam, dealer reports indicate stagnant performance, with sales growth remaining flat or negative. Seasonal factors such as Shraddh further dampened retail sales across segments. While discounts and offers have been rolled out, they haven’t yet led to a significant sales turnaround.”

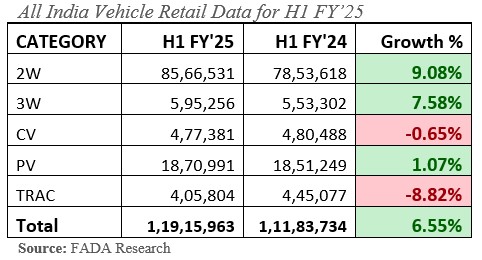

H1 FY25 Auto Retail Report

The first half of FY25 saw an overall growth of 6.55% year-on-year (YoY), with two-wheelers (2W), three-wheelers (3W), and passenger vehicles (PV) growing by 9.08%, 7.58%, and 1.07% YoY, respectively. However, commercial vehicles (CV) and tractors (Trac) experienced declines of 0.65% and 8.82%, respectively.

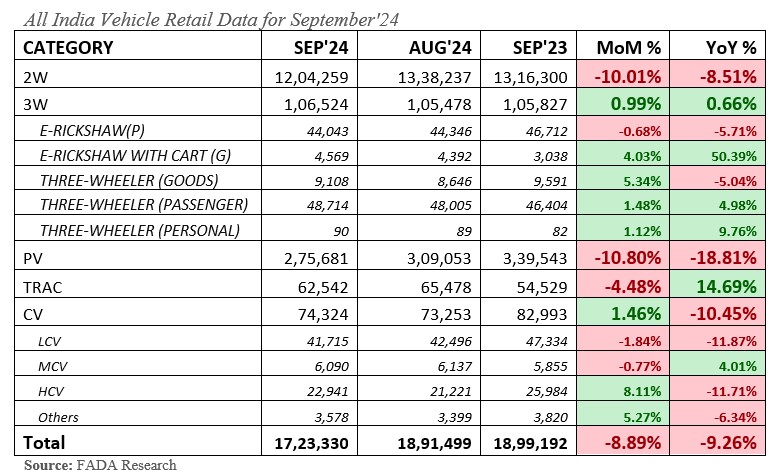

September 2024 Auto Retail Performance

– Overall Market Decline: September witnessed a significant YoY decline in overall vehicle retail, down by 9.26%.

– Segment-Specific Trends:

– Ganesh Chaturthi and Onam failed to ignite demand as anticipated.

– 2W Sales: Fell by 8.51% YoY, impacted by weak consumer sentiment, low inquiries, and delays due to heavy rains and seasonal factors like Shraddh.

– PV Sales: Dropped sharply by 18.81% YoY, reflecting a worrisome decline in consumer demand.

– CV Sales: Declined by 10.45% YoY, with only a marginal month-on-month (MoM) increase of 1.46%, indicating subdued market conditions and reduced government spending.

– 3W and Trac Sales: Showed marginal growth, up by 0.66% YoY and 14.69% YoY, respectively, due to increased demand for e-rickshaws and positive customer engagement.

Impact of Weather Conditions

The 2024 southwest monsoon recorded 8% above-normal rainfall, the highest in four years, disrupting auto retail performance across various regions. The excessive rainfall dampened consumer walk-ins and demand.

Inventory and Cash Flow Challenges

– High Inventory Levels: Passenger vehicle dealers are grappling with historically high inventory levels, averaging 80-85 days, or about 7.9 lakh vehicles worth ₹79,000 crore. This situation has been exacerbated by aggressive dispatches from original equipment manufacturers (OEMs), creating significant financial pressure for dealers.

– Financial Concerns: FADA has called on the Reserve Bank of India (RBI) to issue stricter guidelines on channel funding policies to mitigate financial risks for dealers.

Analysis of September 2024 Retail Trends

– Two-Wheelers: Sales dropped by 10% MoM and 8.51% YoY due to low consumer sentiment, fewer inquiries, and poor walk-ins. Heavy rainfall and seasonal factors, including Shraddh and Pitrapaksha, led to delayed purchases, affecting the market.

– Three-Wheelers: The segment saw a modest increase of 0.99% MoM and 0.66% YoY, driven by higher demand for e-rickshaws and positive customer engagement. Nonetheless, overall demand remained soft as many buyers postponed purchases ahead of the festive season.

– Commercial Vehicles: Sales showed a slight MoM growth of 1.46% but fell by 10.45% YoY. Mixed regional performance was noted, with positive sentiment in areas supported by infrastructure projects. However, overall demand suffered due to reduced government spending and seasonal challenges.

– Passenger Vehicles: The segment faced a significant decline of 10.8% MoM and 18.81% YoY, signaling deteriorating consumer demand. Seasonal factors, along with sluggish economic conditions and heavy rain, left dealers with unusually high inventory levels.

Mr. Vigneshwar urged OEMs to take immediate action to prevent further financial setbacks. “With the critical festive season approaching, it’s imperative that OEMs recalibrate their strategies to support market recovery. FADA also calls on the RBI to advise banks to adopt stricter channel funding policies based on dealer consent and actual collateral to alleviate financial stress from unsold inventory. This festive season is the last opportunity for PV OEMs to reset the course before market conditions worsen.”

Near-Term Outlook

The outlook for the near term remains cautiously optimistic:

– Positive Factors:

– The upcoming festive season, with Navratri and Diwali falling in the same month, is expected to boost sales.

– Favorable agricultural conditions due to improved crop yields are likely to drive rural demand for 2W, PV, and Trac segments.

– Challenges:

– High inventory levels in the PV segment pose a risk if October sales fall short of expectations, potentially leading to financial pressure on both dealers and OEMs.

– Heavy discounts and promotional offers could affect dealer profitability if festive sales fail to gain momentum.

Overall Outlook

The festive season offers a significant opportunity for market recovery, but high stakes in October make it crucial for dealers and OEMs to clear existing inventory. Strategic inventory management and well-targeted promotions are essential for capitalizing on the expected surge in demand, ensuring market stability, and setting a positive trajectory for the remainder of FY25. While there is optimism with increasing inquiries and positive dealer sentiment, the reliance on October’s performance necessitates a cautious approach. Failure to meet sales expectations could shift the outlook toward pessimism, complicating the path forward for the auto industry.