Vinay Piparsania, Global Consulting Director, Counterpoint Research, provides a global update on how vehicle sales have been impacted due to the virus outbreak

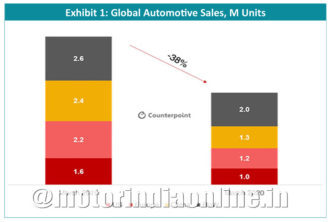

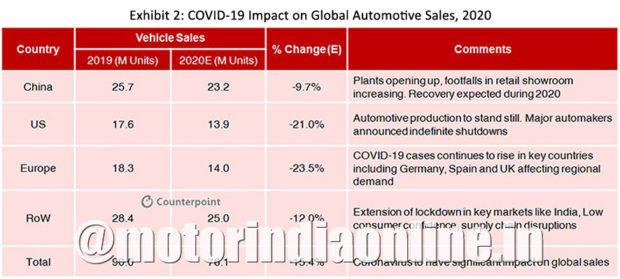

With almost all the countries having initiated varying levels of virus pandemic-related lockdown measures in March, a significant decline in global vehicle sales for the month was to be expected. Sales numbers from key markets confirm the impact, tracking the growing severity as well as subsiding of the outbreak.

United States

With automotive production having stopped mid-March, US’ car sales for the month have dropped by over 39% YoY to around 1 million units, the lowest volume for March in over a decade. The biggest losers in relative volume terms are Chevrolet, followed by Toyota, Nissan, and Honda which have declined by over 60,000 units each. In most states, however, sales figures for the first week of March were relatively normal, so the reported figures may not yet provide an accurate picture of the full virus impact. April and May will continue to be dismal in light of extended lockdowns. Counterpoint Research expects full year US’ sales forecast to 13.9 million units.

China

Day-to-day life is now reportedly gaining some normalcy in China with automotive plants cautiously resuming manufacturing operations and consumers slowly coming back to showrooms. Most dealers, however, continue to face inventory shortages. The Honda-Guangzhou JV plant in Wuhan is currently operating overtime to meet demand. According to the China Association of Automobile Manufacturers (CAAM), car sales declined 42% YoY in 1Q20 largely on the near 80% drop in February, which saw only 310,000 unit sales. Overall, the Chinese automotive market remains weak and fragile, with last month having seen 1.3 million vehicles sold – a 46% decline over March 2019.

In a normal year, China would have sold more than 6 million new cars in the first quarter; this year, the figure is around 3.6 million. As automakers restart production, boosting demand is now the industry’s main priority. The government has announced cash incentives to stimulate demand and support the industry’s recovery. Several metro cities and provincial administrations are offering cash subsidies of as much as USD 1,400 per vehicle. Earlier in April, Beijing announced extending subsidies and tax breaks for new energy vehicles (NEVs) for two more years. It is now evident that electric vehicles have suffered more than the broader market.

In March, only 53,000 NEV cars were sold, less than half compared to a year earlier. It should be noted, however, this number excludes Tesla, which is pushing hard to deliver to its Chinese customers, resulting in some replacement effect. In any case, while the car market may rebound slightly in the second quarter, it is unlikely to sustain or be able to make up for the first quarter losses. Counterpoint Research analysts are holding to their estimates that China’s automobile sales decline this year will be approaching double digits, close to 9%.

South Korea

The one bright spot in the global automotive market is South Korea. The country saw its domestic industry – comprising Kia, Hyundai, Renault-Samsung, GM Korea, and SsangYong – bounce back nearly 10% in March after seeing big declines in February, when it was down nearly 20% YoY, on automaker shutdowns.

Europe

The situation in Europe remains critical. With Spain and France having gone into lockdown in mid-March, new vehicle sales fell by almost 70% in each market. Sales in Germany, the largest market in the region, dropped by nearly 40%. In the UK, where March is traditionally the strongest selling month with new number plate series being registered, passenger cars and SUV sales declined nearly 45%. Figures for West Europe as a whole showed an over 50% sales decline in March. Counterpoint Research analysts expect April sales to be far worse, with lockdowns remaining until at least the end of the month, and likely into May.

Note

The unprecedented and unpredictable nature of the current global health crisis means that we cannot rule out further revisions to the global 2020 automotive forecast.