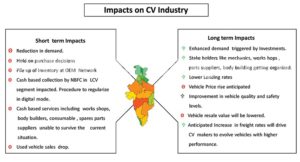

The Indian commercial vehicle segment has been witnessing inclement progression of late. The recent announcement by the Prime Minister to demonetise high value currency, is expected to create short-term impact owing to crippled liquidity, and withhold of purchase decisions within transport community. The commercial vehicles user group (transporters), one of the largest unorganised cash-based sectors in the country, experienced major operation hassles. On the contrary an unified supportive response has been observed on digitalisation, GST implementation which could aid them to have seamless, harassment free movement of goods across various state boundaries and toll nakkas.

A recent survey by IFRT post demonetisation shows that over 90% market load carriers, fleet companies controlling 75% of the cargo moved by road have already shifted to net banking / e-payments mode, tolls payments thru e-tags. Out of the total 4.5 million trucks (5-49t gvw) plying in India 1.3 million trucks operate on National Permit on chosen routes for decades where the issue of cash was required to address fuel, food and wages which is now been taken care via petro card for fuel, dependency on bank withdrawal or credit adjustments in enroute for food and wages.

The other 2 million trucks plies on the intra-state, balance 1.2 million on district level has a smaller level cash demand which will be set right in the upcoming weeks when situation at banks improves. It is quite clear the cash demand arises in transport business only on areas pertaining to corruption by crews, enforcement agencies at various entry check points, RTO’s, toll points. It is also quite evident the stoppage, congestions, slow movement reflects in vehicle productivity, fuel loss which can be ideally eliminated with digitalisation of toll collections or alternate methodology to collect the lost revenue.

A recent survey by IIM Kolkata reveals that around Rs. 1,470 billion is lost per year on fuel burnt due to congestions, waiting at tolls. Also to support the statement one of the country’s leading bus operators stated that his savings on fuel were in the tune of Rs. 350,000 per day during the days when our Prime minister had waived off the toll charges, with his buses moving seamlessly at the tolls with no congestions.

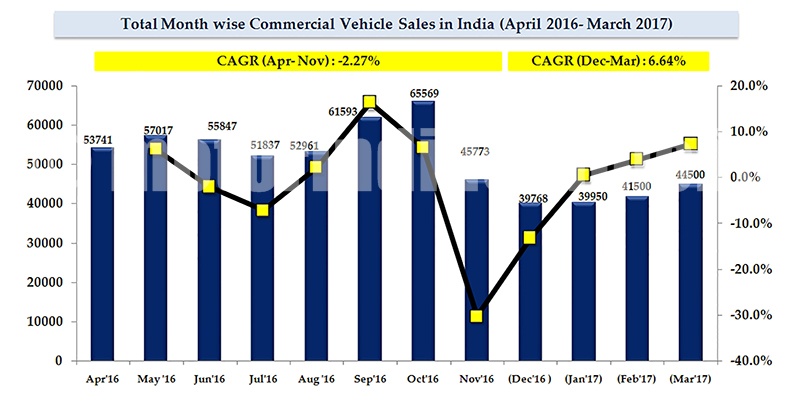

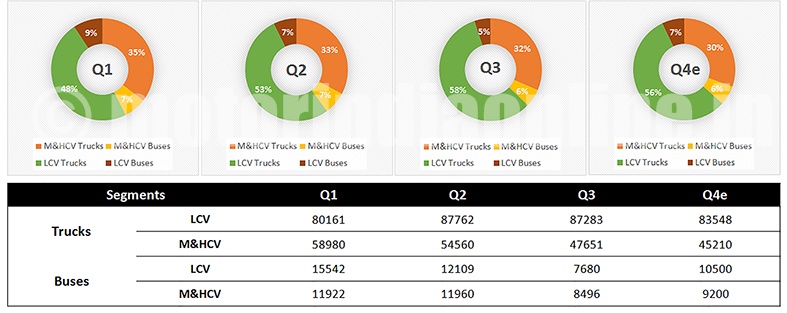

In the truck segment, the M&HCV segment demand has been waning under pressure over the last four months except for September, owing to weak industrial activity, deferred purchase decision on account of expected price decrease on GST implementation and 2017 model change. In contrast, the LCV segment witnessed a steady growth during the pre-demonetisation period, followed by a short pause, further which it is expected to continue with similar sentiments in the last quarter of the current fiscal (FY17). However, the bus segment would be the least impacted by the demonetisation move in the near-term owing to a higher proportion of sales to institutional clients, which is expected to correct by fiscal end.

At the onset the entire industry, stake holders view the situation gloomy, pushed back in time on the growth front, a detailed examination of the current situation bestows a path for comprehensive transformation of the commercial vehicle industry and their related stake holders in line with their counterparts in the developed world.

Post demonetisation, curbs on cash transactions refines the unorganised transport community and related stake holders like the drivers, mechanics, body builders, end users to get organised, consolidate their position display professional outlook in delivering quality output. On a long term, revival in investment opportunities expected to fillip infrastructure, manufacturing sector with supportive interest rates. Anticipated Incremental price impact on account of vehicle modernisation, scrapping, emission norms, safety and regulatory addictive’s will get neutralised with the improvement in lending costs (vehicle EMI cost).

Post demonetisation, curbs on cash transactions refines the unorganised transport community and related stake holders like the drivers, mechanics, body builders, end users to get organised, consolidate their position display professional outlook in delivering quality output. On a long term, revival in investment opportunities expected to fillip infrastructure, manufacturing sector with supportive interest rates. Anticipated Incremental price impact on account of vehicle modernisation, scrapping, emission norms, safety and regulatory addictive’s will get neutralised with the improvement in lending costs (vehicle EMI cost).

By Rajesh Khanna, Chief Operating Officer, RACE Innovations Pvt. Ltd.