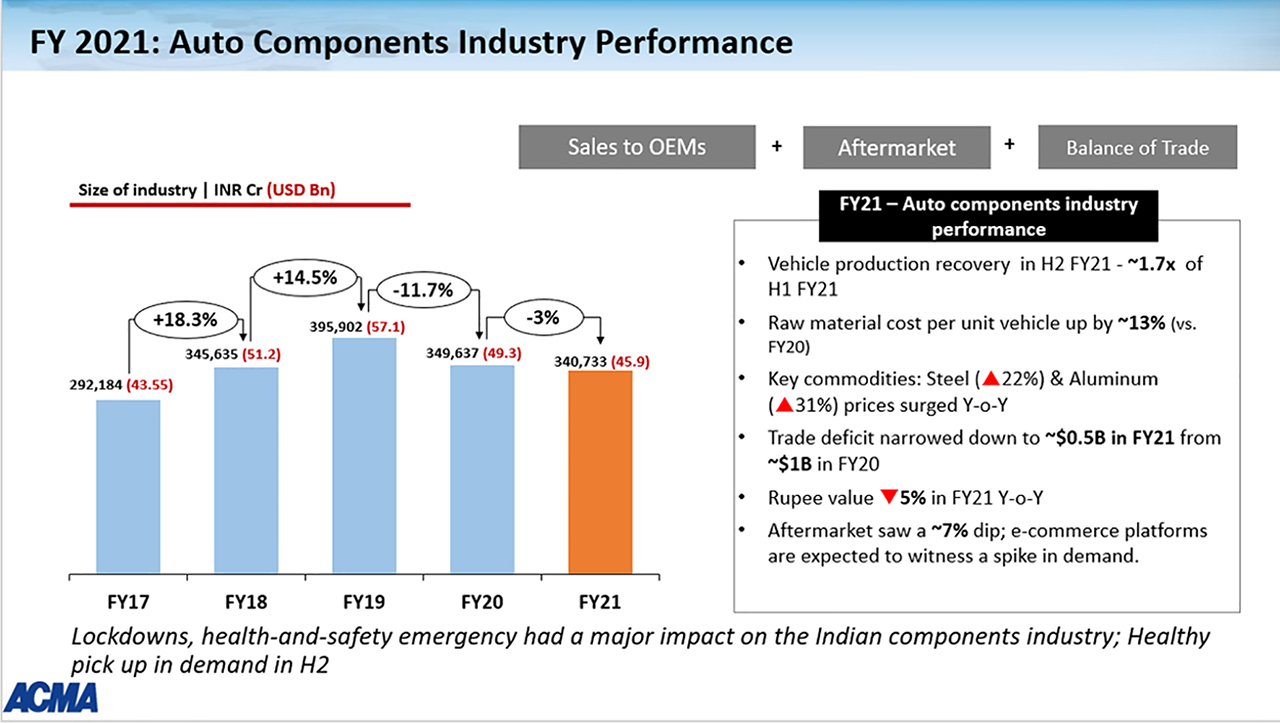

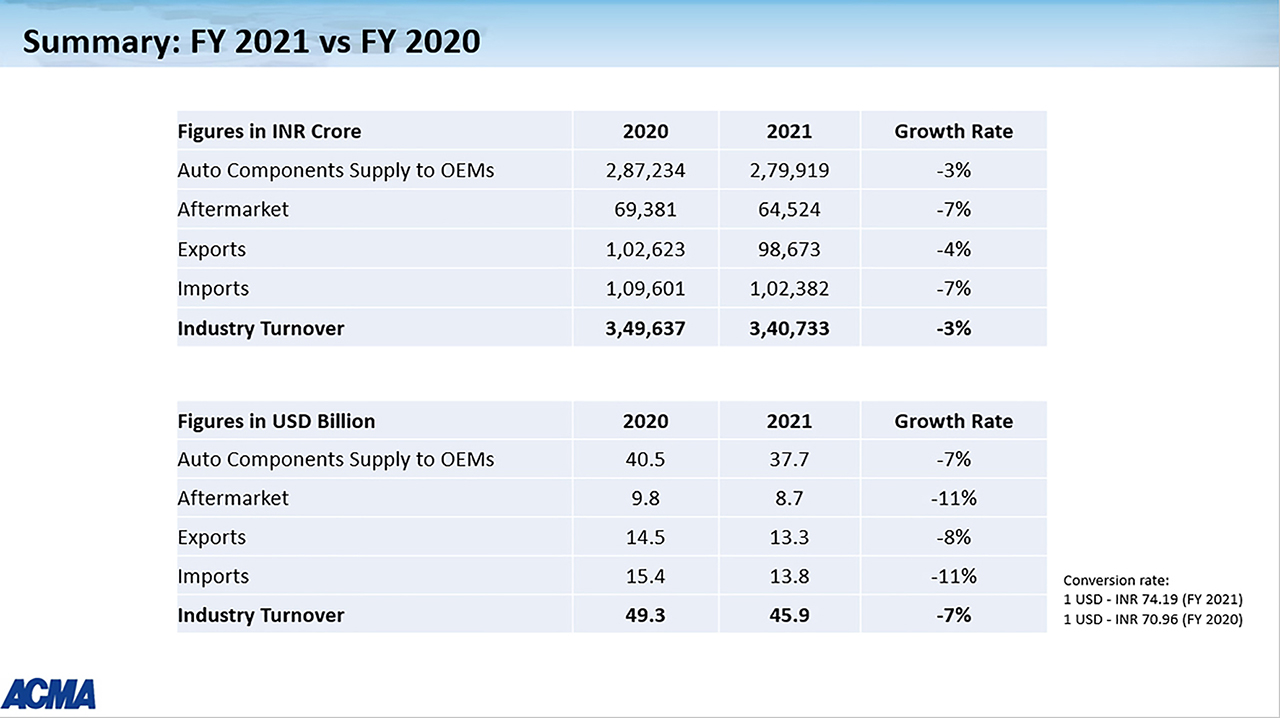

ACMA has announced the findings of its Industry Performance Review for the fiscal year 2020-21. The turnover of the automotive component industry stood at Rs. 3.40 lakh crore (USD 45.9 billion) for the period April 2020 to March 2021, registering a de-growth of 3 per cent over the previous year.

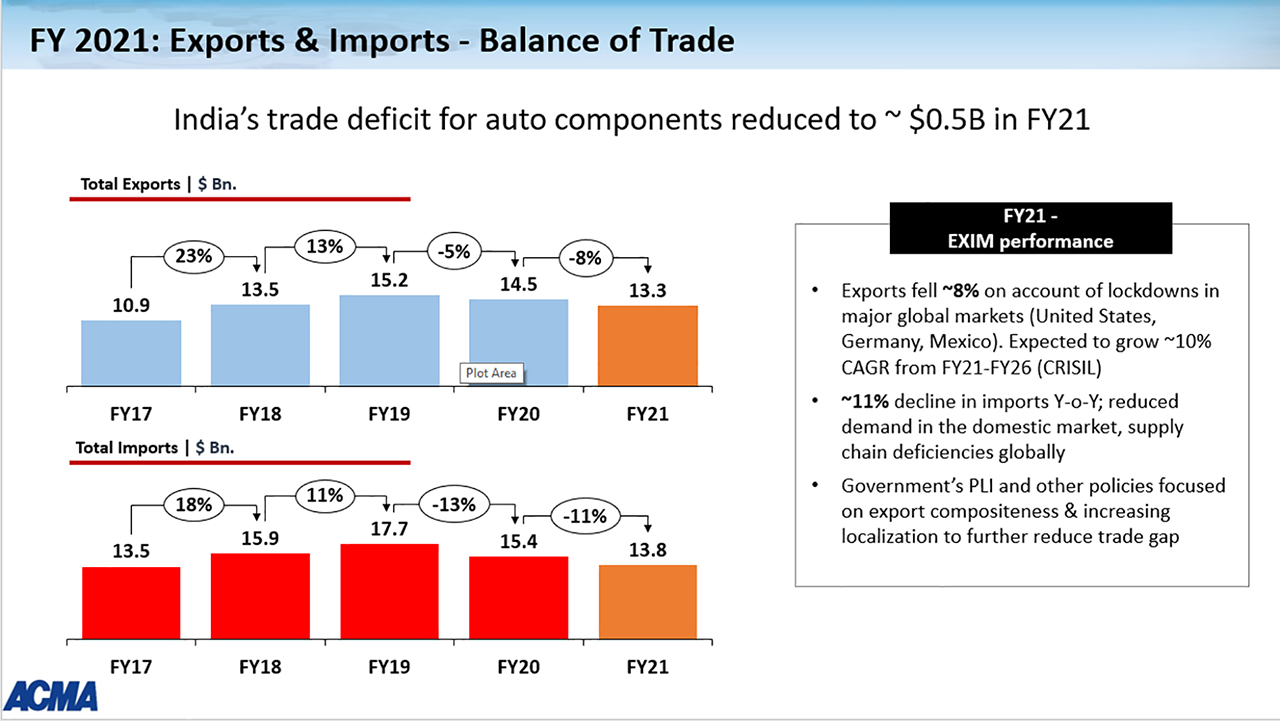

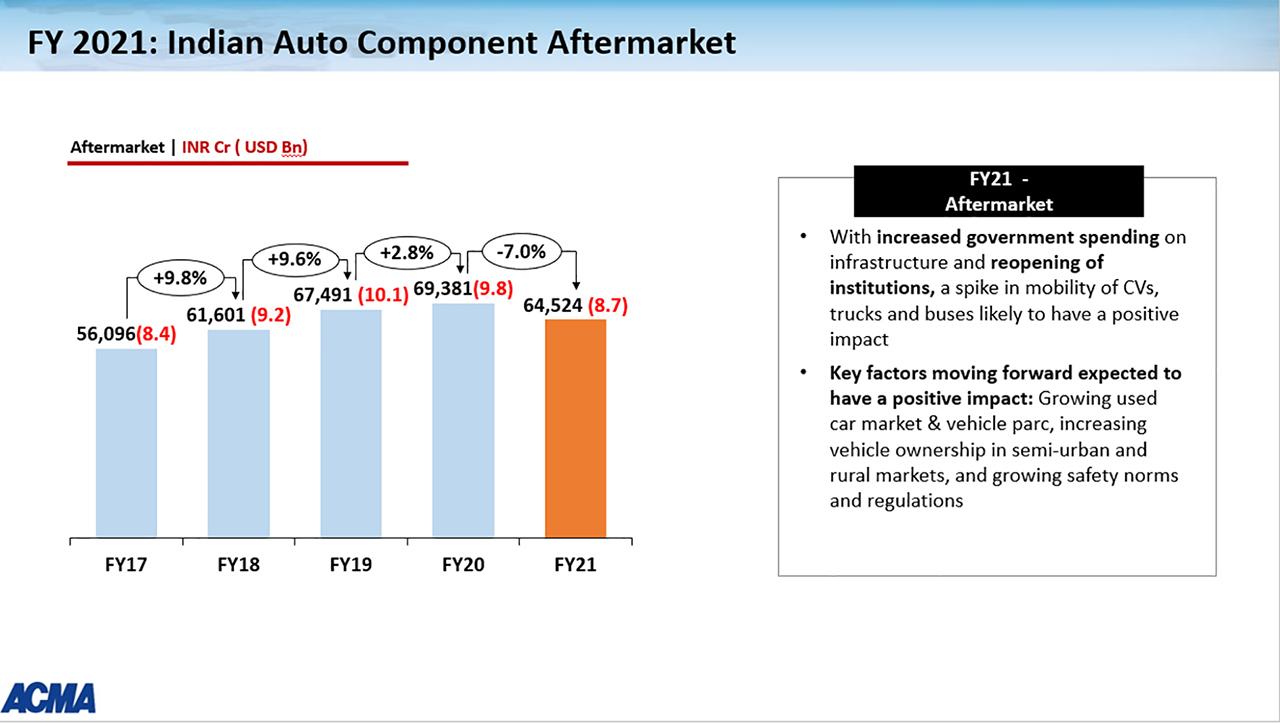

Commenting on the performance of the auto component industry, Vinnie Mehta, Director General, ACMA, said: “The vehicle industry in India witnessed two successive years of de-growth of 14.6 per cent in FY19-20 and thereafter of 13.6 per cent in FY20-21. The economic slowdown of FY19-20 was compounded by the challenges of a pandemic led national lockdown in FY20-21 resulting in decline in vehicle production and consumption. While the first quarter of FY20-21 was a complete washout, the industry regained significant ground second quarter onwards. The component industry, in tandem, posted a subdued performance in FY20-21 with de-growth of 3 per cent over the previous year, registering a turnover of Rs.3.4 lakh crore (USD 45.9 billion). In the domestic market, auto component sales to OEMs at Rs. 2.79 lakh crore (USD 37.7 billion) declined by 3 per cent while the Aftermarket at Rs. 64,524 crore (USD 8.7 billion) declined by 7 per cent. Exports and imports stood at Rs. 0.98 lakh crore (USD 13.3 billion) and Rs. 1.02 lakh crore (USD 13.8 billion) respectively, thus reducing the trade balance to USD 500 million, the lowest ever; exports declined by 8 per cent while imports by 11 per cent.

Sharing his insights on performance of the industry and how it managed the supply-chain disruptions, Deepak Jain, ACMA President, said: “The automotive value-chain faced significant disruptions in FY20-21. The nationwide lock-down in wake of the pandemic, one of the severest in the world, put the entire supply chain in a disarray. The entire industry took a significant time to stabilise again post the gradual unlocking of the economy. While vehicle sales and production improved quarter-on-quarter from second quarter of FY20-21 onwards, however the first quarter of FY21-22 was once again confronted with another round of disruptions due to the second wave of the pandemic. While this wave was a much severe humanitarian crisis, the lockdowns, however were regional, in line with the Government’s ethos of ‘Lives and Livelihoods’ resulting in lesser adverse impact on economy and production.”

“In this environment of volatility, despite disruption of production in supply chain, the industry displayed remarkable resilience and evolved in a spirit of collaboration. Whilst the OEMs gave consistent direction and visibility, the component industry supported well in ensuring smooth ramp-up and business continuity. It is also noteworthy that despite several challenges, many ACMA members undertook relief measures by setting up hospitals and oxygen camps, donating ventilators and concentrators, and contributing generously towards community service”, added Jain.

Speaking about the headwinds being faced by the industry, Jain elaborated: “With economy progressively returning to normal and as vehicular demand picks-ups, we are cautiously optimistic about the performance of the industry for this year. The challenges on the front of availability of semiconductors, escalating prices as also availability of raw materials, challenges on the front of logistics including non-availability and high prices of containers, among others, continue to hinder a smooth recovery. We are also wary of a third wave of pandemic and hope that the current revival in demand will be a sustained one. We are optimistic that the lessons learnt in managing the first two will stand us in good stead in managing the third one as well.”