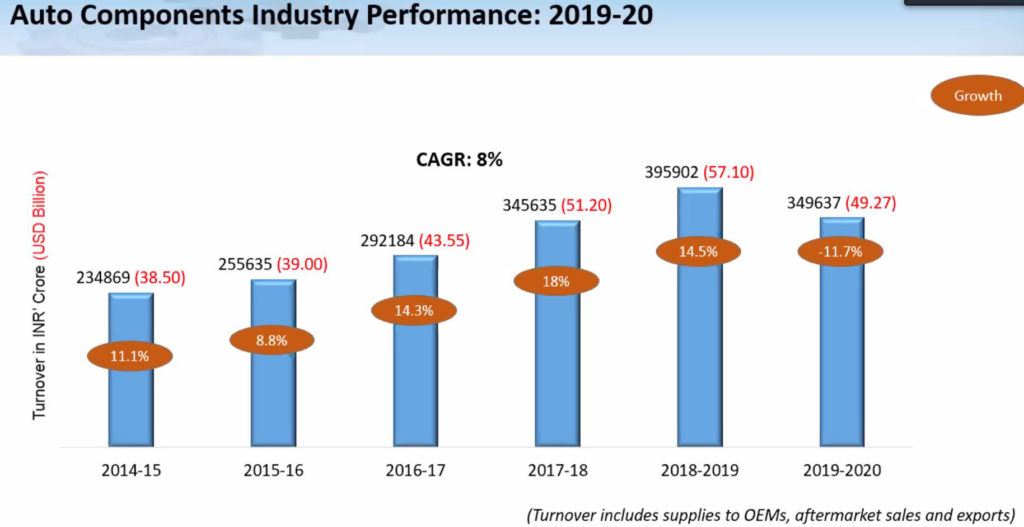

The Indian auto component industry has clocked a turnover of Rs. 3.49 lakh crores (USD 49.2 billion) for the period April 2019 to March 2020, registering a de-growth of 11.7 per cent over the previous year, reported Automotive Component Manufacturers Association of India (ACMA), while sharing results of the auto component industry performance review with the media.

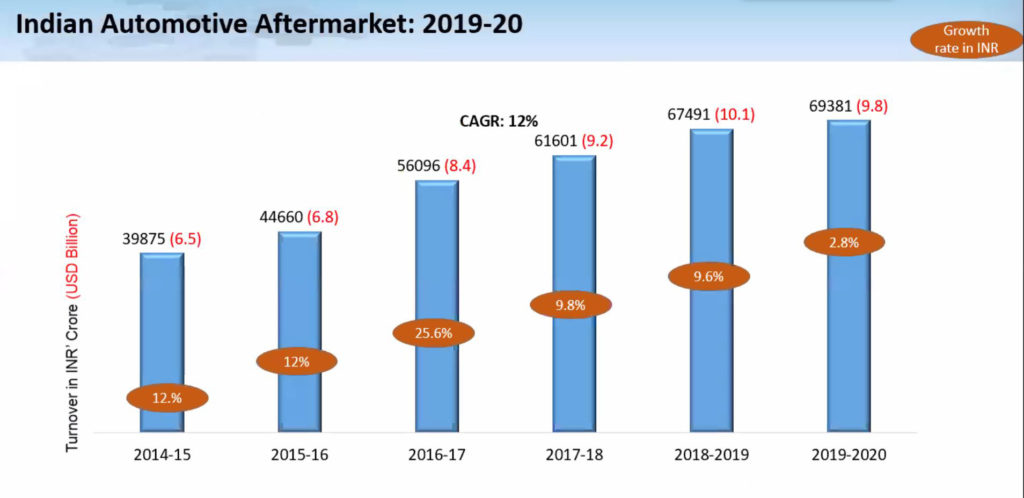

Commenting on the performance of the auto component industry in India, Vinnie Mehta, Director General, ACMA, said: “The overall vehicle industry witnessed a severe downturn in 2019-20 that saw its sales slump by 18%. The component industry, in tandem, posted a subdued performance with de-growth of 11.7 per cent over the year, registering a turnover of Rs. 3.49 lakh crores (USD 49.2 billion). Auto Component Aftermarket at Rs. 69,381 crores (USD 9.8 billion) remained stable while sales to OEMs in the domestic market at Rs. 2.87 lakh crores (USD 40.5 billion) declined 17 per cent. Both Imports and exports declined by 11.4 per cent and 3.2 per cent respectively; Imports stood at Rs. 1.09 lakh crores (USD 15.4 billion), while exports at Rs. 1.02 lakh crores (USD 14.5 billion)”.

Sharing his insights, Deepak Jain, President, ACMA, said: “The automotive industry faced a prolonged slowdown in FY 2019-20 with vehicle sales in all segments plummeting significantly. Subdued vehicle demand, investments made for transition from BSIV to BSVI, liquidity crunch, lack of a clarity on policy for electrification of vehicles and slow-down in key export markets, among others, had an adverse impact on the performance of the components sector in India as also on its expansion plans”.

Speaking about the current situation, Jain elaborated: “The auto component industry has displayed remarkable resilience in wake of the lockdown; the industry faced acute challenges on the front of working capital, production and dysfunctional logistics. However, with the unlocking of the economy, growth seems to be returning to the industry with uptick in vehicle consumption especially in the two-wheelers, passenger vehicles and the tractor segments, although sales of commercial vehicles continue to be challenged. The component industry’s performance is expected to return to pre-COVID levels by the festive season should the ramp-up be not stymied by lockdowns in manufacturing zones and lack of availability of manpower. Going forward, to allow for uninterrupted production in the automotive value chain, despite local lockdowns, ACMA has recommended to the Government to accord ‘continuous production industry’ status to the automotive industry”.

“The long-term prospects of the Indian auto component industry continue to be bright, especially with focus of the Government on ‘Atma-nirbharta’ and global competitiveness of the industry. The auto component industry and the vehicle industry are closely working together for ‘deep-localisation’ and import substitution, which will result in higher value-addition by the auto component manufacturers making the sector exports competitive”, added Jain.

ACMA continues to support the vehicle industry in their request to the government for enhancing vehicle demand in the country through reduction in GST on all vehicle categories to 18 per cent and introduction of an incentive based scrappage policy.

For the components sector, ACMA continues to recommend a uniform 18 per cent GST rate across the auto component sector; currently 60 per cent of the auto components attract 18 per cent GST rate, while the rest 40 per cent, majority of which are two-wheelers and tractor components, attract 28 per cent. The latter high rate has led to flourishing grey operations in the aftermarket. A benign rate of 18 per cent will not only ensure better compliance but will also ensure a larger tax base.

Key findings of the ACMA Annual Industry Performance Review for 2019-20:

• Exports: Exports of auto components witnessed degrowth of 3.2 per cent to Rs. 1.02 lakh crores (USD 14.5 billion) in 2019-20 from Rs. 1.06 lakh crores (USD 15.2 billion) in 2018-19. Europe accounting for 30 per cent of exports, saw a decline of 11 per cent, while North America and Asia, accounting for 30 per cent and 27 per cent respectively remained stable.

The key export items included drive transmission & steering, engine components, body / chassis, suspension & braking, etc.

• Imports: Slowdown in the domestic market also reflected on imports of components into India. Component imports fell by 11.4 per cent to Rs. 1.09 lakh crores (USD 15.4 billion) in 2019-20 from Rs. 1.23 lakh crores (USD 17.7 billion) in 2018-19. Asia accounted for 65 per cent of imports followed by Europe and North America at 26 per cent and 8 per cent respectively. Imports from Asia declined by 7 per cent, while those from Europe by 22 per cent and from North America by 17 per cent.

• Aftermarket: The aftermarket in FY 2019-20 remained stable despite a downturn in the vehicle industry. The turnover of the aftermarket stood at Rs. 69.381 crores (USD 9.8 billion) growing marginally by 2.8 per cent over the previous year.

Indian Auto Component Industry Performance Review FY19-20: Click here for report PDF

Note: Turnover data represents the entire supplies from the auto component industry (ACMA members and non-members) to the on-road and off-road vehicle manufacturers and the aftermarket in India as well as exports. This also includes component supplies captive to the OEMs and by the unorganized and smaller players.