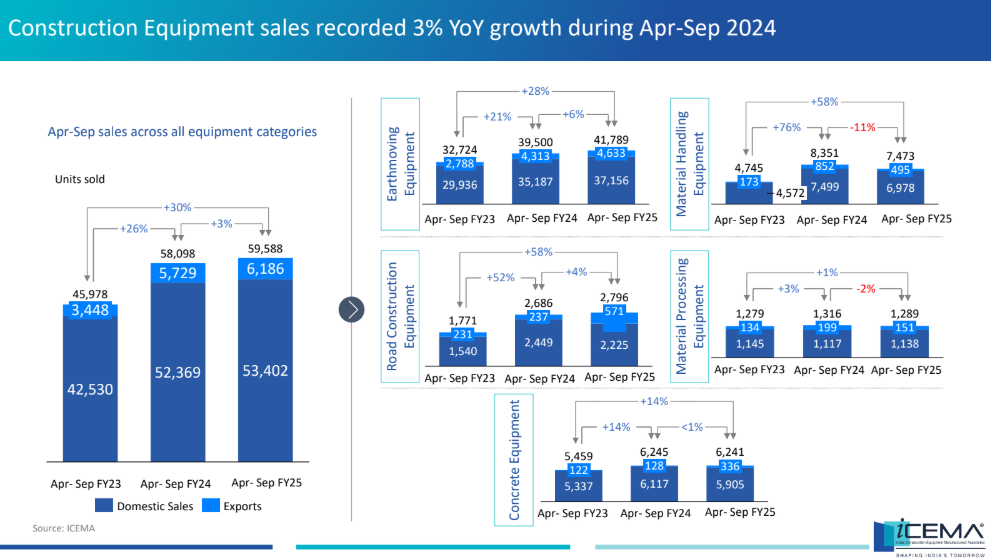

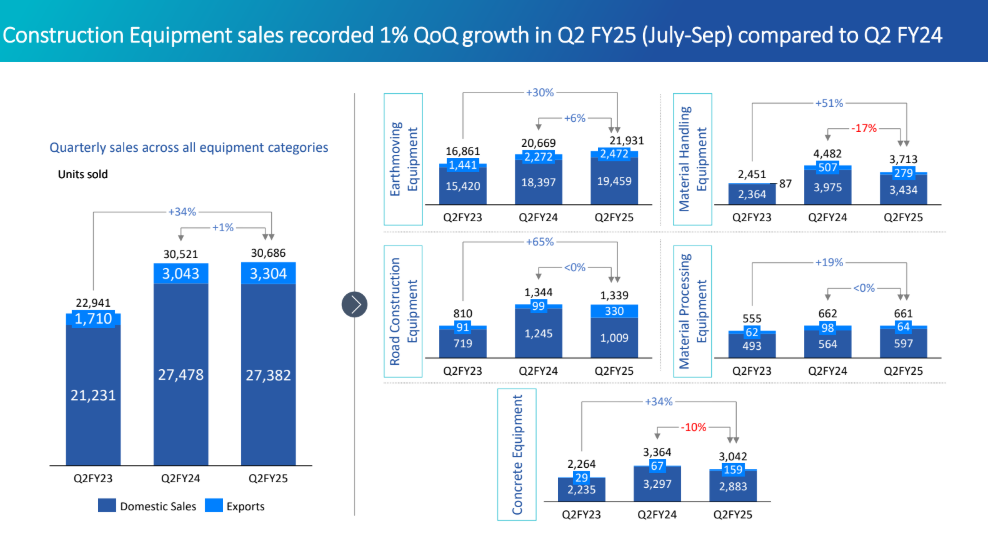

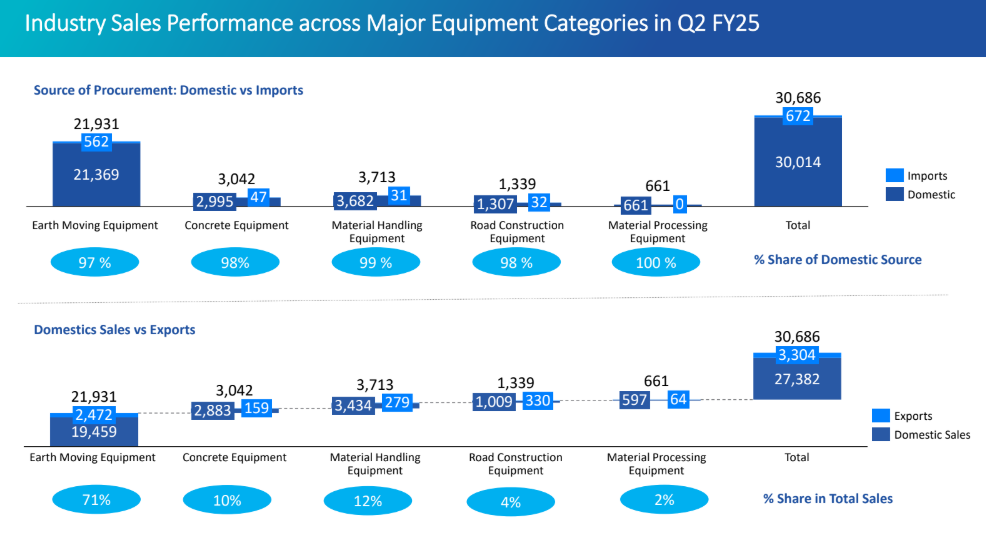

The Indian Construction Equipment (CE) industry saw a 3% year-on-year increase in sales during the first six months of the current fiscal year (FY25: April – September 2024) compared to the same period in FY24 (April – September 2023). The sector experienced a modest 1% year-on-year growth in sales during the second quarter of FY25, reaching a total of 30,686 units. Domestic sales accounted for 27,382 units, while exports totaled 3,304 units. The Earthmoving Equipment segment witnessed a 6% increase in sales during the same period. However, growth in the Road Construction and Material Processing Equipment segments remained relatively unchanged, and the Material Handling and Concrete Equipment segments experienced declines of 17% and 10%, respectively.

“The industry has seen moderate growth year-on-year, which aligns with expectations due to general elections and seasonality,” said Mr. V. Vivekanand, President, ICEMA and Managing Director, Caterpillar India Pvt. Ltd. “This has been possible due to ongoing construction activities in the country, which have helped maintain demand for construction equipment compared to the historically best previous year,” he added.

Compared to Q1 FY25, the CE industry witnessed a 6% increase in overall sales, rising from 28,902 units in the first quarter to 30,686 units in the second quarter of the current fiscal year. This growth was primarily attributable to a 10% increase in sales of Earthmoving Equipment, which constitutes approximately 70% of total CE sales. Q2 sales of Earthmoving Equipment reached 21,931 units—an increase of 10% from Q1 FY25. Material Processing Equipment, with sales of 661 units, registered a 5% growth, while sales in the remaining three segments declined in Q2 compared to Q1: Material Handling Equipment decreased by 1% to 3,713 units, Concrete Equipment fell by 5% to 3,042 units, and Road Construction Equipment dropped by 8% to 1,339 units.

34% MoM; 5% YoY Growth in September’24

The industry performed well in September 2024, with sales reaching 12,639 units compared to 9,427 units sold in August 2024, exhibiting an impressive 34% month-on-month growth. Domestic sales accounted for 11,318 units, while exports totaled 1,321 units. Furthermore, compared to September 2023, these sales figures represent a 5% year-on-year growth in September 2024.

Of the five primary equipment segments within the Indian CE industry, only Material Processing Equipment experienced a modest 2% decline in sales on a month-over-month basis in September 2024. The remaining four segments demonstrated robust growth: Earthmoving Equipment recorded a 32% increase, reaching 9,089 units; Material Handling Equipment grew by 47%, totaling 1,491 units; Road Construction Equipment experienced a 55% increase, reaching 598 units; and Concrete Equipment saw a 33% growth, with sales of 1,232 units.

“The overall sales recovery in the second quarter, after relatively slow growth in the first quarter, is encouraging for the industry. The sales recorded in September have largely driven this growth,” said Mr. Jaideep Shekhar, Convener of the ICEMA Industry Analysis and Insights Panel, and VP & Managing Director, APAC & EMEAR, Terex India Private Limited. “With ongoing and some new infrastructure projects being announced in recent months, the industry expects the market for construction equipment to expand further this year, helping us to achieve positive growth in FY25,” he added.