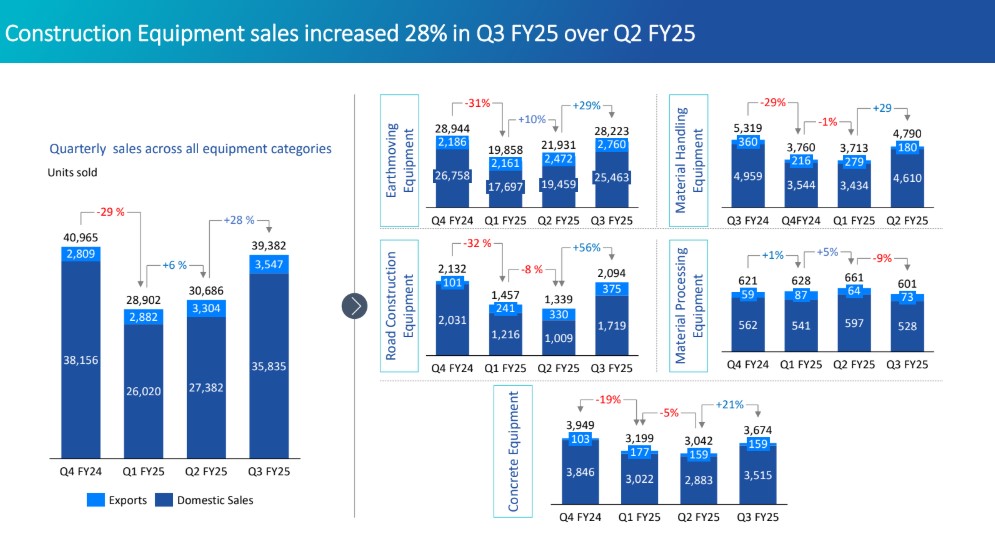

The Indian Construction Equipment (CE) industry recorded a significant improvement in the third quarter of the current fiscal (Q3 FY25) compared to the previous quarter, with sales surging 28% to reach 39,382 units between October and December 2024. On a year-on-year basis, Q3 FY25 sales registered an 8% increase over Q3 FY24.

Several factors contributed to this robust growth, including the government’s continued focus on infrastructure development, the end of the monsoon season, pre-buying ahead of the implementation of CEV V emission standards in January 2025, and the introduction of advanced and sustainable construction equipment variants, attracting customers seeking greater efficiency and environmental benefits.

“The results for the third quarter of FY25 reflect the steady momentum in infrastructure development, driving sustained demand for construction equipment. With the recent budget maintaining a strong focus on infrastructure spending, there is optimism that demand will continue to strengthen in the coming quarters,” said Mr. V. Vivekanand, President, ICEMA, and Managing Director, Caterpillar India Pvt. Ltd.

“As the Indian CE industry moves towards achieving the targets outlined in the CE Vision Plan 2035 and aligns with the government’s Viksit Bharat@2047 objectives, the industry is actively exploring new technologies and developing a range of efficient and sustainable products. This transformation is further fueling demand for construction equipment across the country,” he added.

Segment-wise Performance

Of the 39,382 units sold in Q3 FY25, 35,835 units were delivered in the domestic market, while 3,547 units were exported. With the exception of Material Processing Equipment, which saw a 9% decline, all major equipment segments recorded strong quarter-on-quarter growth.

Construction Equipment Sales Data (Q3 FY25)

| Equipment Category | Units Sold | Q-o-Q Growth (%) |

| Earthmoving Equipment | 28,223 | 29 |

| Material Handling Equipment | 4,790 | 29 |

| Concrete Equipment | 3,674 | 21 |

| Road Construction Equipment | 2,094 | 56 |

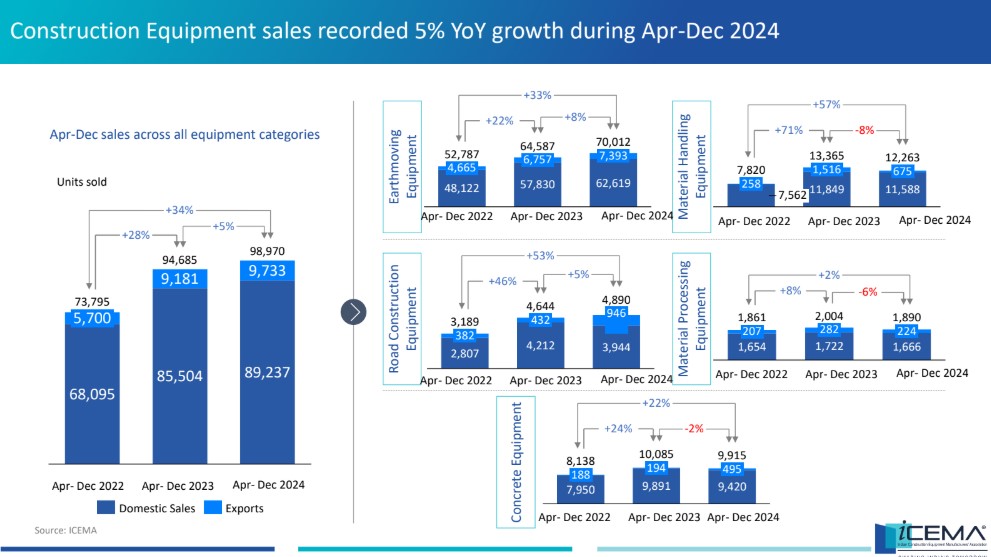

In the first nine months of FY25 (April to December 2024), overall construction equipment sales increased by 5% year-on-year, a notable achievement given the usual market slowdowns during election years. In December 2024 alone, total CE sales stood at 12,793 units, a 4% rise compared to November 2024.

“The Q3 results are very encouraging, with positive growth even on a year-on-year basis, despite the usual industry slowdown during election years. Besides the rise in construction activity from ongoing and new infrastructure projects, demand for construction equipment was also boosted by pre-buying, as customers sought to avoid expected price increases following the implementation of CEV V emission norms in January 2025,” said Mr. Jaideep Shekhar, Convener, ICEMA Industry Analysis & Insights Panel, and Vice President & Managing Director, Terex India Pvt. Ltd.

“Given the strong momentum in Q3 and the overall 5% growth from April to December 2024, the industry anticipates closing the current fiscal with a growth rate of approximately 5% to 8%,” he added.

Industry Outlook and Future Prospects

Expressing confidence in the industry’s future, Mr. Vivekanand emphasized the need for higher localisation, innovation, technology adoption, and sustainability. He also highlighted the importance of targeted policies to create a more enabling environment for MSMEs, technology integration, and stakeholder collaboration, which could position India as a major exporter and global manufacturing hub for construction equipment.