Global truck makers are targeting India’s commercial vehicle segment to tap the potential of the world’s third largest truck and bus  market. The Indian market has witnessed entry of a number of MNCs like Volvo, Daimler, Scania, MAN, Isuzu and Hino, now competing with local players like Tata Motors, Ashok Leyland, Eicher and Mahindra & Mahindra.

market. The Indian market has witnessed entry of a number of MNCs like Volvo, Daimler, Scania, MAN, Isuzu and Hino, now competing with local players like Tata Motors, Ashok Leyland, Eicher and Mahindra & Mahindra.

According to auto industry analysts, the underlying potential of the huge Indian market keeps many global players vye for a bigger slice of it. India is thus all set to experience a keener contest among the major players with an expanded range of products available for consumers.

Commercial vehicle manufacturers are now keen on enhancing their market share by investing in heavy duty products, design & development, manufacturing systems, distribution and services. They are gearing up with proactive solutions for meeting the changing customer needs. In the process, they offer an even more innovative line-up of technologically advanced and ergonomically aesthetic products ensuring that the industry becomes more efficient and environment-friendly products.

Commercial vehicle manufacturers are now keen on enhancing their market share by investing in heavy duty products, design & development, manufacturing systems, distribution and services. They are gearing up with proactive solutions for meeting the changing customer needs. In the process, they offer an even more innovative line-up of technologically advanced and ergonomically aesthetic products ensuring that the industry becomes more efficient and environment-friendly products.

Let us take a full review of the products and performance of the leading players in the field which are betting on technology.

Despite the severe slowdown in the CV industry and growing competition from a host of new players, Tata Motors has embarked on a series of new initiatives and services to keep its market share intact and has, in fact, improved its numbers in certain segments.

The country’s market leader in commercial vehicles, Tata Motors has come up with its new Tata Ultra LCV and ICV range which will be powered by new generation 3L (138 HP) and 5L (168 HP) common rail (DiCOR) 16-valve engines, offering higher aggregate life of more than 50 per cent, longer service intervals by 50 per cent and low NVH. The company feels that the vehicle, made at its assembly line in Pune, would be the best in its segment in India.

With the new platform, Tata Motors aims to move to the top-line of the LCV segment as in the case of the Prima in the HCV division. The Prima range has been very well received in the market, though it might not be completely reflected in the numbers. Started four years ago with just two units, there are now over 4,000 Primas plying on Indian roads.

Since the largest-selling segment in the industry today is the multi-axle trucks, the company is planning to launch them, may be one or two 25-ton and 31-ton models, before the end of this financial year. Forseeing specific requirements from the construction industry for higher tonnage surface transport, as well as for higher capacity mixers, Tata Motors’ new ConsTruck range is the result of the company working closely with customers with a futuristic approach in a challenging and competitive environment.

At the core of Ashok Leyland’s business strategy is the customer, and every effort made is towards hearing the customer’s voice related  to his specific requirements and engineering vehicles that suit his requirements. The third quarter of 2013-14 saw the company launch the critically acclaimed ICV truck BOSS which is available in two variants, the LE and the LX, in the haulage segment, with 9.6T, 11.9T and 12.9T and with a future launch of 8T and 14.5T.

to his specific requirements and engineering vehicles that suit his requirements. The third quarter of 2013-14 saw the company launch the critically acclaimed ICV truck BOSS which is available in two variants, the LE and the LX, in the haulage segment, with 9.6T, 11.9T and 12.9T and with a future launch of 8T and 14.5T.

The vehicle has already received an encouraging response and has gained a significant market in the ICV segment. The model exactly meets the growing need for high-productivity, high-performance vehicles in the ICV segment.

The CAPTAIN is the new offering from Ashok Leyland in the M&HCV segment. It combines the best of both worlds – the international looks and trims with Indian aggregates and driveline. The company is also looking forward for orders for vehicles under the JNNURM scheme now in progress.

Ashok Leyland will be showcasing the BOSS ‘Reefer’ application used to transport perishable products at Auto Expo 2014. The application requires the vehicle to make faster turnaround and better operating economics. The BOSS befits these requirements and ensures customer profitability.

Ashok Leyland’s partnership with the Japanese auto major Nissan in 2007 to manufacture the next-generation LCVs was a grand success with the introduction of the DOST and the STILE. The JV partners are coming together for yet another product in the LCV segment, PARTNER, which will also be showcased at the expo. The new LCV is built on the Nissan Atlas F24 platform, fitted with the BOSCH advanced common rail technology-based Nissan ZD30 engine. This is the first air-conditioned LCV in its category in the country.

Similarly, the MITR from the company, a stylish school and staff bus based on the Nissan Atlas F24 LCV platform, will also be displayed at the expo.

VE Commercial Vehicle (VECV), a joint venture between Eicher Motors and the Swedish truck major Volvo Group, is the third biggest player in the domestic medium and heavy duty truck industry. The partnership recently launched its new trucks, the PRO Series, in four different categories, covering the 5 to 49-tonne GVW range. The new heavy-duty truck range is powered by new generation engines adapted from the Volvo Group with power capacity of 180-280 hp. The company also has come up with its new Skyline Pro buses with more seats built on a new platform.

VE Commercial Vehicle (VECV), a joint venture between Eicher Motors and the Swedish truck major Volvo Group, is the third biggest player in the domestic medium and heavy duty truck industry. The partnership recently launched its new trucks, the PRO Series, in four different categories, covering the 5 to 49-tonne GVW range. The new heavy-duty truck range is powered by new generation engines adapted from the Volvo Group with power capacity of 180-280 hp. The company also has come up with its new Skyline Pro buses with more seats built on a new platform.

The Pro series covering a series of 11 trucks and buses will target different application segments, including long-haul, goods distribution, parcel and courier and construction, among others.

Scania, a global manufacturer of heavy trucks, buses, coaches and industrial and marine engines, entered India through its partner Larsen & Toubro (L&T) to serve the mining and construction industries.

With the country’s highway infrastructure improving and the hub-and-spoke model gaining increasing acceptance, the domestic truck and bus industry is witnessing greater polarization. As the growth in the heavy commercial vehicles segment outperforms the overall industry growth rate, Scania aims to take the way India views transportation to the next level, in line with the latest world-class manufacturing practices.

By establishing a plant for truck assembly and bus body building and providing a parts depot, Scania will offer trucks, buses and engines in India.

Scania Commercial Vehicles India (SCVI) inaugurated its first-ever manufacturing facility in India, at Narasapura in Bangalore, in October last. SCVI plans to annually produce about 2,500 heavy haulage trucks, besides 1,000 inter-city buses and coaches at its new facility. Set up at an initial investment of Rs. 250 crores, the new facility will procure locally 18 per cent of its parts for trucks and 100 per cent for bus bodies. The company promises employment for over 800 people at the facility within five years.

Scania Commercial Vehicles India (SCVI) inaugurated its first-ever manufacturing facility in India, at Narasapura in Bangalore, in October last. SCVI plans to annually produce about 2,500 heavy haulage trucks, besides 1,000 inter-city buses and coaches at its new facility. Set up at an initial investment of Rs. 250 crores, the new facility will procure locally 18 per cent of its parts for trucks and 100 per cent for bus bodies. The company promises employment for over 800 people at the facility within five years.

Scania’s Narasapura plant will house two manufacturing units, one for truck assembly and the other for buses. The company has started production of trucks at the Narasapura plant in June last, and production trials have started for mining and off-road trucks. On-road trucks production is to start soon, and the bus roll-out is planned for the first quarter of 2014.

Swaraj Mazda Ltd. (SML) had forged an alliance with Isuzu Motors, a JV between Sumitomo Corporation of Japan and Mazda  Corporation, in 2006 to form SML Isuzu (SMLI). The company sells LCVs with gross vehicle weight in the range of 6-13 tonnes.

Corporation, in 2006 to form SML Isuzu (SMLI). The company sells LCVs with gross vehicle weight in the range of 6-13 tonnes.

SMLI is known for its engineering excellence, product upgradation and automation. In order to broaden its product portfolio, it introduced in the Indian market in November last its XM Series vehicles in the 10-13 tonne GVW range. The XM Series vehicles, fitted with improved and better fuel-efficient engines, would provide higher torque on reduced operating cost.

The new vehicle models made available for the Indian market are Cosmo-XM, Super 12.9 XM, Samrat HD 19 XM, Samrat Tipper XM and S7 buses. By April, the company’s entire LCV range is expected to be upgraded to this Series.

With its new vehicle models the company is planning to expand its current eight per cent market share to 10 per cent.

The world leader in the commercial vehicle business, Daimler’s every step since it charted out its strategy for the Indian market, right from the test track inauguration in 2010, the ‘BharatBenz’ brand unveil in 2011, the plant inauguration, start of production and market launch in 2012, till the recent first anniversary celebration in September last, has been executed to perfection. Backed by meticulous planning and foresight, Daimler Trucks’ product range covers light, medium and heavy trucks for local, long-distance deliveries and construction sites, as well as special vehicles for municipal applications, the energy sector and fire services.

The world leader in the commercial vehicle business, Daimler’s every step since it charted out its strategy for the Indian market, right from the test track inauguration in 2010, the ‘BharatBenz’ brand unveil in 2011, the plant inauguration, start of production and market launch in 2012, till the recent first anniversary celebration in September last, has been executed to perfection. Backed by meticulous planning and foresight, Daimler Trucks’ product range covers light, medium and heavy trucks for local, long-distance deliveries and construction sites, as well as special vehicles for municipal applications, the energy sector and fire services.

Daimler India Commercial Vehicles Pvt. Ltd. (DICV) has since 2012 gradually rolled  out its Bharat Benz product range, which includes dump trucks and freight-haulage trucks in the segments ranging from nine to 49 tons. Another four models will be launched very soon, complementing the existing portfolio. The company currently has nine models in the market and will launch more vehicle models, including tractor-trailers, in the coming months, to cover its entire range of 17 models.

out its Bharat Benz product range, which includes dump trucks and freight-haulage trucks in the segments ranging from nine to 49 tons. Another four models will be launched very soon, complementing the existing portfolio. The company currently has nine models in the market and will launch more vehicle models, including tractor-trailers, in the coming months, to cover its entire range of 17 models.

By understanding customer pain points and needs, the company has introduced several new features in its products and differentiated sales and aftersales services. The Indian trucker being the end beneficiary of this evolution, DICV is proud to have triggered such a positive change in the industry.

Mahindra Trucks and Buses Ltd. (MTBL), the erstwhile Mahindra Navistar, a wholly-owned subsidiary of the Mahindra Group, has plans to strengthen its existing product line-up with further investments. The company has also announced new branding for its heavy commercial vehicle range.

Mahindra Trucks and Buses Ltd. (MTBL), the erstwhile Mahindra Navistar, a wholly-owned subsidiary of the Mahindra Group, has plans to strengthen its existing product line-up with further investments. The company has also announced new branding for its heavy commercial vehicle range.

The multi-axle trucks will henceforth be called Mahindra TRUXO 25 and TRUXO 31. The tractor-trailers will be named Mahindra TRACO 35 and TRACO 40 and the tippers will be called Mahindra TORRO 25 and TORRO 31.

The multi-axle trucks will henceforth be called Mahindra TRUXO 25 and TRUXO 31. The tractor-trailers will be named Mahindra TRACO 35 and TRACO 40 and the tippers will be called Mahindra TORRO 25 and TORRO 31.

MTBL intends focusing on running the LCV, truck and bus businesses as a separate division post the proposed demerger, with the objective of growing its presence in the Indian commercial vehicle industry. The company plans to invest significant resources over the next few years which will help strengthen its existing product range and refurbish the current LCV range.

Work has also begun for the introduction of new products that will help address the ICV and MCV segments in the 7.5 to 16-ton GVW category.

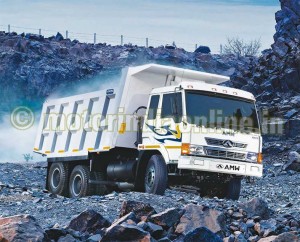

Three more players who have had strong presence in the mining and construction segment are AMW, MAN and Kamaz Vectra.

While AMW has continuously come up with new models and variants, the latest

While AMW has continuously come up with new models and variants, the latest  introduction being the transit mixer 3118 TM, the company has also steadily expanded its dealer network across the country. The company’s new cabin is one to watch out for as it works towards ascertaining its presence in the construction and mining segment and also make a mark in the increasingly competitive haulage space.

introduction being the transit mixer 3118 TM, the company has also steadily expanded its dealer network across the country. The company’s new cabin is one to watch out for as it works towards ascertaining its presence in the construction and mining segment and also make a mark in the increasingly competitive haulage space.

German heavyweight MAN seems to be working on a whole-new strategy after taking over the MAN-Force joint venture. MAN’s CLA series of vehicles has made a mark in the market and though the German giant is taking quite an amount time to make announcements of its next move in India, one could be rest assured that what comes will be a solid long-term strategy in line with the its policies which have proved successful not only in its home European market but also other regions worldwide.

German heavyweight MAN seems to be working on a whole-new strategy after taking over the MAN-Force joint venture. MAN’s CLA series of vehicles has made a mark in the market and though the German giant is taking quite an amount time to make announcements of its next move in India, one could be rest assured that what comes will be a solid long-term strategy in line with the its policies which have proved successful not only in its home European market but also other regions worldwide.

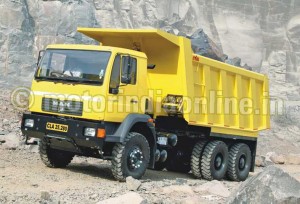

Kamaz Vectra, the joint venture between Russian market leader Kamaz and Indian  company Vectra, has rolled out some impressive products since its market entry, including the 6520 and 6540 tippers. The company has been working on further strengthening its products and making them tougher to be able to go through the challenging mining conditions unscathed. One could expect Kamaz to come up with some new offerings in 2014.

company Vectra, has rolled out some impressive products since its market entry, including the 6520 and 6540 tippers. The company has been working on further strengthening its products and making them tougher to be able to go through the challenging mining conditions unscathed. One could expect Kamaz to come up with some new offerings in 2014.

With the industry hopeful of a recovery in the mining and construction segments sooner rather than later, one could expect tough competition among the entrenched players in the segment, as they fight it out for the top spot. As far the broader picture is concerned, the CV industry is in doldrums at present, however the country’s economy and the industry might not be able to take any further slowdown or recession which is an excuse to hope that things will become better in the coming year. The Lok Sabha elections at the Centre will take centrestage for the first half of the year while for the second, the attention will be on the Government which takes charge at the Centre and its policies to help revive the industry. Whatever be the case, the Indian CV industry has all the ingredients for a fantastic battle among heavyweights, both home-grown and global leaders, with huge capacities and impressive product line-ups. We just need the market to open up, and then we will be set for intense action.