The global automotive industry is undergoing unprecedented change and disruption. Autonomous driving, connected vehicles, the rise of e-commerce and the sharing economy will change the way consumers look at mobility and logistics. Industry 4.0 with its facets of cobots, 3D printing, etc., will completely change value chains. Competition can and will come from non-traditional companies that are nimbler and more adept at mining today’s “gold”, i.e., at gathering and analyzing data as well as designing products and services based on this analysis. Today’s workforce needs to be skilled and re-skilled at ever increasing pace to keep up with the challenges of the future. On top of all these changes, OEMs and suppliers need to cope with volatile markets, fierce competition, increasing regulations in the area of safety and emissions, trust issues from society at large due to recent scandals, etc. The list of challenges is long not likely to get shorter anytime soon.

The technological and business model disruptions impact Indian OEMs and suppliers at a time when volumes were under pressure for several years. Overall domestic CV sales dropped from a high of 893k units in FY12 to 711k units in FY16, i.e., contracted during that period with a CAGR of -5.5%. Domestic challenges as well as a negative global environment led to a generally challenging environment for commercial vehicles.

Luckily, positive economic impetus over the last two years has led to a turnaround in overall sales. Growth from FY15 to FY16 of about 10% results from significant GDP growth rates of more than 7%. India currently boasts the highest growth rate among major emerging nations. Low inflation and strong FDI inflows have added to positive business and consumer sentiment as reflected in business and consumer confidence indicators that are squarely in positive territory. Pro-investment policies such as the ‘Make in India’ initiative, 100% investment in Defense and increased FDI limits for other sectors such as insurance have supported business sentiment and helped weather negative headwinds from a generally sluggish global economy. Positive momentum continues in Q1 FY16 with about 12% YoY growth in domestic sales.

Segment-wise dynamics

Sales success varies strongly across segments. The SCV passenger segment collapsed from a high of 114k units in FY13 to 25k units in FY16. This collapse was driven by competition from three-wheelers that are cheaper and weigh less and hence provide advantages in total cost of ownership as well as from MPVs and UVs which offer greater passenger comfort. Lack of finance also limited sales in the segment.

The SCV cargo segment also saw significant contraction from a high of 438k units in FY13 to 300k units in FY16. Here, the 2-3.5T pick-up sub-segment was rather stable in terms of overall volume. Sub-2T mini trucks, however, contracted with a CAGR of nearly 22% and are currently about 39% of the overall market from 57% in FY13. The shift in market composition resulted from aggressive pricing of some pick-ups combined with the higher utility value of larger vehicles. In the pick-up segment, Mahindra commands an impressive position with 69% market share while Tata Motors and Ashok Leyland divide the rest nearly equally between themselves.

The LCV passenger segment bounced back to FY12 levels in FY16 with about 49k units sold. Urbanization and increasing need for inter-city and semi-urban transport support volumes of this segment. The cargo segment, however, remains weak with 34k units sold in FY16 vs. 50k units in FY12. Overcapacity and a constrained financing environment lead to subdued sales. However, as the LCV:MHCV ratio in India is only 1.25:1 vs. 2:1 in China and 4:1 in Europe, low penetration is expected to drive sales in the future.

The MHCV passenger segment lost about 10% volumes between FY12 and FY16 with about 44k units sold in FY16. The buses in the 7.5-12T category amounted for 45% of overall volumes, a steady increase from 30% in FY12. The market is dominated by Ashok Leyland (45%) and Tata Motors (34%) followed by Volvo Eicher (10%).

The MHCV cargo segment bore the brunt of weak economic fundamentals during FY12 to FY14. The segment collapsed from a high of 299k units in FY12 to 162k units in FY14. Since then an improved economic environment regarding GDP and core infrastructure growth, decreasing input costs (diesel, interest rates), replacement demand following years of delayed purchases and pre-buying effects regarding the impending introduction of BS-IV emission norms and ABS systems have driven robust growth of the segment at a CAGR of 26.3%. In FY16, overall volumes stood at 258k units and were still shy of previous record numbers. Overall, a clear shift towards higher tonnage vehicles and tractor-trailers is visible. Haulage tractor-trailers grew at a CAGR of 90% between FY14 and FY16, HCV Rigids grew at 27.2%, while MCV Cargo growth was about 17.1% and ICV cargo grew only at a low 3.3%.

The segment did see significant shifts in market share. Ashok Leyland gained 11% from FY12 to FY16 and currently accounts for about 31% of the total volume. Market share gains of Ashok Leyland result from a combination of strong economic activity in South India, the company’s stronghold, as well as a significant increase in dealer network in North India. Strong products in the 35.2-40T and >49T segments also supported market share gains. Tata Motor’s market share dropped from 62% to 55% in the same time frame, however, overall the market position of the duopoly strengthened from 82% in FY12 to 86% in FY16.

Overall, CV volumes in India are expected to grow to about 1.1 mn units in 2020. This development will be driven and influenced by a number of key factors. Significant growth will be driven by the SCV segment which should amount to 615k units. LCVs will grow moderately to 53k units in 2020 and buses will grow even slower to reach about 55k units. The MHCV segment is predicted to grow at a steady 6.2% CAGR and reach about 354k units. As a consequence, India will be the world’s third largest MHCV market.

Growth drivers

Growth drivers are many. Increased integration of India with the global economy will lead to increasing imports and exports and hence transport of goods across the country. Already today, India’s import and export intensity, i.e., the ratio of India’s imports/exports to the country’s GDP is around 25% and on par with China. Factor cost advantages and the increasing tendency of companies to de-risk their Asia footprint by building up or extending production activities in India will ensure that India’s participation in global trade will grow substantially going forward. Infrastructure investments in ports, railways and roads and regulatory efforts such as the recent passing of the goods and services tax create an environment in which India will deliver on her potential.

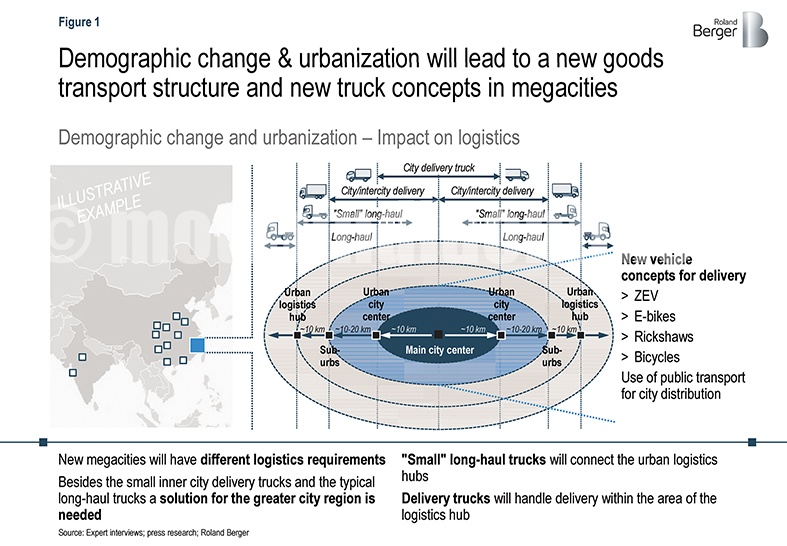

Urbanization in India is expected to increase from a current level of 31.2% (as per 2011 census) to 40.8% in 2030. In particular, mega-cities like Mumbai, Delhi, Bangalore and developing centers such as Pune will face challenges and will need new logistics concepts. For example, Delhi is among the world’s most densely populated cities. While the city itself is dominated by the tertiary sector, it is surrounded by several large industrial areas with intensive manufacturing activities. Currently, these major industrial areas in NCR are connected to the rest of the country via national highways that pass through the heart of Delhi creating unnecessary truck traffic within the city boundaries. Going forward, we can imagine a network of peripheral expressways that connect major industrial areas and bypass Delhi. Corresponding logistics concepts would see a hierarchy of logistics hubs around the city which are served not only by small inner city delivery trucks and typical long-haul trucks but also by “small” long-haul trucks as shown in Figure 1. This would open up volume and product opportunities for Indian OEMs.

Trends such as e-commerce will have an equally important impact on logistics demand in the country. E-commerce is growing globally at about 15% annually and is expected to account for 20-30% of total commerce by 2020. The majority of millennials expects same-day delivery, deliveries that need to be executed either via SCVs and LCVs for last mile transportation complemented by innovative new business models leveraging private cars.

Improved infrastructure and policy initiatives such as the recent adoption of a common GST will drive demand for road logistics. Combined with a fight against overloading this will lead to a continued professionalization of the logistics sector and a continued shift towards higher tonnage vehicles.

Telematics plays an increasing role in an Indian context as it drives overall TCO optimization and logistics efficiency. Penetration levels of telematics solutions of Indian fleet operators have so far been low, however, in particular, large fleet operators (more than 20 trucks) understand the benefits and are increasingly inclined to leverage the same. Innovative logistics models such as the relay approach pioneered by Rivigo heavily depend on the usage of telematics and advanced data analytics. Sophisticated built-in intelligence modules help Rivigo to plan vehicles, have real time vehicle visibility, optimize routes, incorporate information about tolls/borders, driver behavior, performance history, etc., thereby significantly reducing transit time by over 50% compared to typical operators.

New technologies and improved quality of engines, gearboxes, chassis, cabins, etc. will reflect a continuous shift of buying patterns towards value trucks. While initially driven by Western OEMs entering the country and trying to make a mark, technological upgrades have been incorporated successfully by local incumbents. This trend is supported by regulatory efforts, e.g., in the area of safety and emissions.

Increased cost of vehicles is a challenge for Indian players. Scale effects of global competitors matter. For example, while Tata Motors is globally the fourth largest player in the MHCV segment as per 2015 sales, Ashok Leyland is only on 13th position. In the LCV segment, Tata Motors leads the Indian companies with a 20th place. To counter potential scale effects of global players, local incumbents rely extensively on frugal engineering, i.e., finding innovative ways to meet customer and regulatory requirements while achieving the same with a lower cost position than their competitors. Frugal engineering and competitive pricing paired with a strong local footprint of sales and aftersales outlets have so far enabled Indian players to defend and in some cases increase market shares.

So far, Western players have had a limited impact on the domestic market. Sustained, meaningful presence can currently be claimed by Volvo-Eicher and BharatBenz, both operating with very different approaches to the Indian market (joint venture vs greenfield, stand-alone investment). As the domestic market remains challenging from a volume and pricing perspective, both are leveraging exports to increase scale effects and leverage their production investments. Volvo-Eicher’s Pro-series of trucks is designed both for India as well as for emerging markets. Volvo also leverages the country for the global production of a medium-duty engine. BharatBenz currently exports trucks into Africa and similar markets. Chinese players have tried to enter India (e.g., Foton), but have not been able to establish a relevant presence in the market so far.

Both, developed and emerging market players continue to study the Indian market for potential market entry opportunities. However, the Commercial Vehicle market is similar to the Passenger Vehicle market in the sense that duopolies dominate both markets. As a consequence, most competitors outside of Tata Motors and Ashok Leyland or Maruti-Suzuki and Hyundai are left to fight for rather small volumes and market shares. Such a situation complicates business cases and turns significant investments in production and development for the Indian market into risky bets.

A stronger technological position also enables Tata Motors, Ashok Leyland and Mahindra & Mahindra to push exports aggressively. Export success for Indian players has come from the SAARC region, Africa, South East Asian and Latin America. Sustained success will require corresponding organizational changes and structures, the development of strong product planning and engineering capabilities as well as solid customer understanding. Lessons can be learned from both Bajaj Auto as well as Maruti Suzuki. Bajaj Auto has clearly understood how to drive international business and how to give it the necessary importance at the Group level. Maruti Suzuki’s focus on volume up and cost down has enabled it to satisfy customers via modular niche products in a cost effective and profitable manner.

India’s commercial vehicle market promises to be dynamic and exciting going forward. Agile companies with clear strategies and stringent execution are likely to reap most of the benefits that the market will present. Winners will have a unique opportunity to leverage a large volume base in India for global success.

By Wilfried G. Aulbur, Jeffry Jacob, and Premendra, Roland Berger Pvt. Ltd.