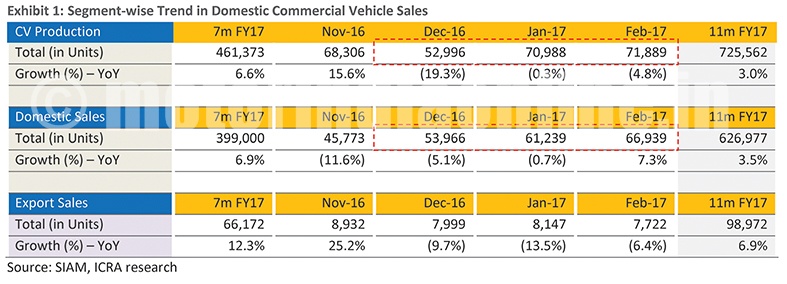

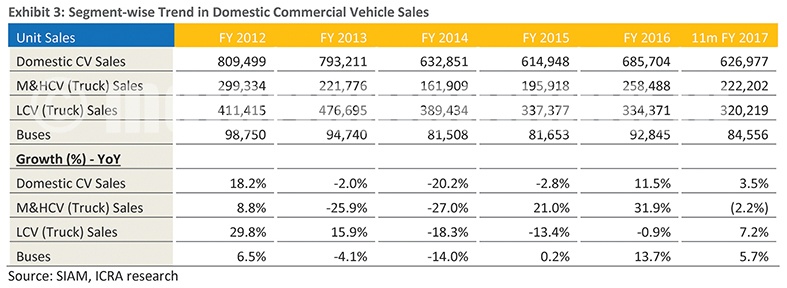

The Indian CV industry ended a challenging FY17 with a growth of 4.16 per cent which was quite subdued in comparison to the 11.5 per cent growth witnessed in the previous year. Confluence of factors including waning replacement-led demand, weak cargo availability from industrial sectors and uncertainty related to effective taxation on CV industry under the GST regime were the key factors that contributed to slowdown. The domestic CV volumes took a further hit after November 2016 when the demonetisation move put brakes on the operations of road logistics sector which depends heavily on cash transactions.

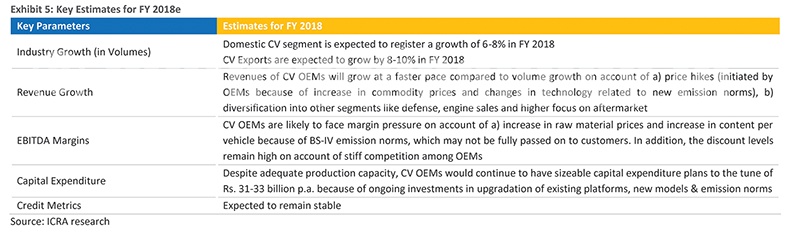

With transition to new emission norms (i.e., BS-IV) from April 2017, the industry was expected to witness pre-buying in the last quarter as vehicles complying with new emission norms can be 6-10 per cent more expensive because of technology upgradation. Although the industry growth recovered in January-February 2017 but the extent of recovery has been below expectations. ICRA believes that subdued economic activity along with impending GST implementation in the near-term has prompted fleet operators to defer fleet expansion or renewal plans.

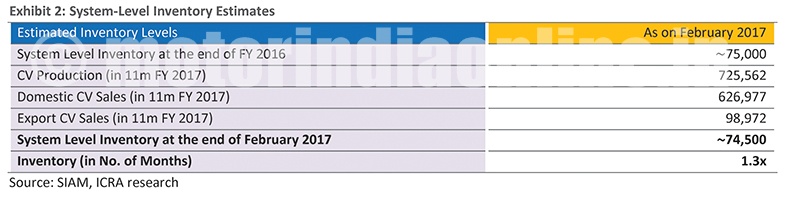

In addition, there has also been uncertainty related to the ability of OEMs to sell BS-III compliant vehicles post April 2017. As a result of these factors, industry-wide inventory levels have inched up as OEMs have scaled up production in Q4 FY 2017 while sales has been below expectations. As per ICRA, the total inventory of CV OEMs is estimated to have been approximately 74K units, which is around 1.3x the average monthly sales.

In ICRA’s view, clarity on sale of BS-III vehicles will help OEMs plan on liquidating existing inventory. Further, companies will also be able to route unsold inventory of BS-III vehicles to near-by export markets where emission norms have not progressed to Euro IV or equivalent.

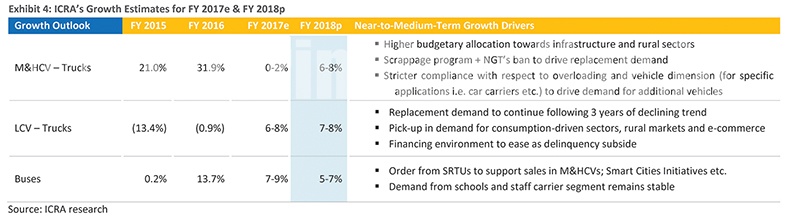

Growth drivers

As per ICRA’s channel check, the extent of lower pre-buying has been partly offset by demand from car carrier segment (on account of implementation of stricter norms related to vehicle dimensions) and new contracts floated by Oil Marketing Companies (OMCs) for carrying petroleum products in the recent months.

Within the M&HCV (Truck) segment, the growth has been driven primarily by the tipper segment, which witnessed a growth of 31 per cent (till 9m FY 2017) on back of strong demand from both construction as well as mining segment.

Market uncertainties

After strong recovery in FY 2016 due to a replacement-led demand, the Commercial Vehicle (CV) industry started on strong note in fiscal 2017. However, after witnessing healthy growth of 13 per cent in the first quarter, the growth momentum came to a grinding halt from June onwards as M&HCV (truck) started witnessing sudden contraction. Waning replacement demand along with uncertainty related to the impact of GST on vehicle prices put brakes on M&HCV (Truck) sales as fleet operators held back on their fleet renewal or addition plans on expectations that vehicles prices may fall once GST is implemented. Along with these factors, the industrial activity has also not improved during the current fiscal to support cargo availability and in turn demand for M&HCVs.

With transition to new emission norms (i.e., BS-IV) from April 2017, the industry was expected to witness pre-buying in the last quarter as vehicles complying with new emission norms may become 6-10 per cent more expensive because of technology upgradation. Although the industry recovered in January-February 2017, the extent of recovery has been below expectations. ICRA believes that subdued economic activity along with impending GST implementation in the near-term has prompted fleet operators to defer fleet expansion or renewal plans to some extent.

In contrast to M&HCV (Trucks), the LCV has registered healthy growth in volumes (up 7.2 per cent in 11m FY 2016) on back of low-base effect (i.e., sales declined by 30 per cent between FY 2013-16) and improving demand for SCVs aided by pick-up in consumption-driven sectors. Among the three segments of the CV industry, the bus segment has been the least impacted by the demonetisation move in the near-term owing to a higher proportion of sales to institutional clients (i.e., SRTUs, schools, colleges and travel operators).

Source: ICRA Research