As the economy improves and vehicle demand rises, the CV industry is cautiously optimistic and demonstrates stability to tackle the predicted third wave of COVID-19, notes Rajesh Rajgor

The commercial vehicle industry in India is regarded as a barometer of the country’s economic growth and progress. As the second wave of COVID-19 fades, there are signs of an uptick and a pick-up in activity in this segment as well.

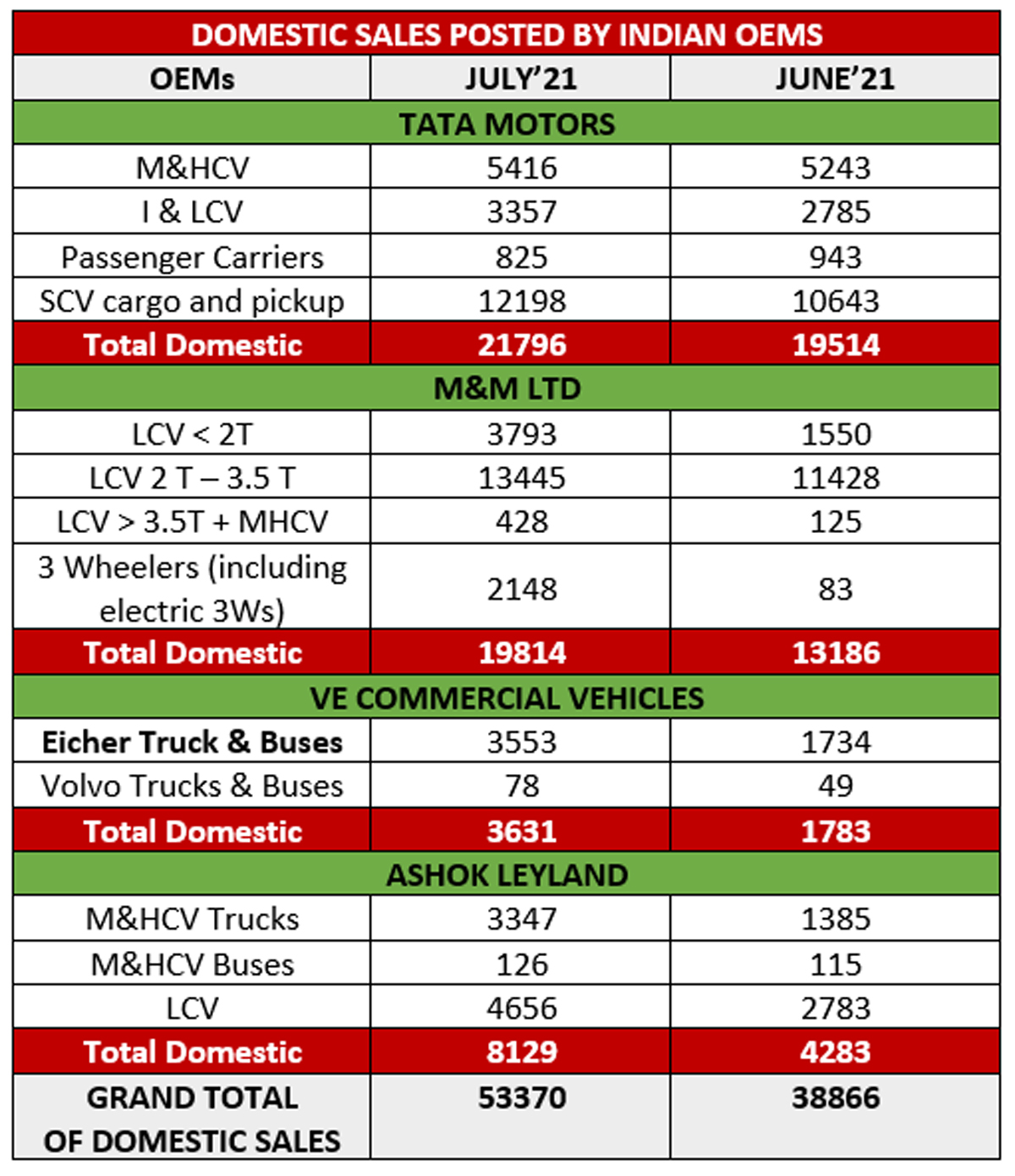

The country’s largest CV maker, Tata Motors sold 23, 848 units in July 2021 (+88% YoY) compared to 22,100 in July 2020. The company’s total MHCVs sales in July 2021 including M&HCV trucks, buses and international business stood at 6,314 units, compared to 2,150 units in July 2020.

Ashok Leyland sold 8129 units in July 2021 compared to 4283 in July 2020 in India. These numbers comprised of 3347 M&HCV Trucks 127 M&HCV Bus 4656 of LCVs. VE Commercial Vehicles Ltd. (A Volvo Group and Eicher Motors joint venture) recorded sales of 4271 units in July 2021 (YTD 10077 units) as compared to 2184 units in July 2020 (LYTD 4313), recording growth of 95.6% (YTD growth 133.6 %). This includes 4193 units of Eicher brand and 78 units of Volvo brand. In the domestic CV market, Eicher branded trucks & buses have recorded sales of 3553 units in July 2021 (YTD 7524 units) as compared to 1734 units in July 2020 (LYTD 3218), representing a growth of 104.9% (YTD growth of 133.8%).

For Mahindra and Mahindra, LCVs (under 2 tonnes) clocked 3,793 units, LCVs (2T-3.5 T) were at 13,445 units, LCV above 3.5 tonnes plus MHCV garnered 428 units and three wheelers (including electric three wheelers) clocked 2148 units in July’21 to mark a total of 19,814 units which was higher compared to 13186 units the company registered in July 2020.

Cautiously optimistic

The economic slowdown of FY19-20 was compounded by the challenges of a pandemic led national lockdown in FY20-21 resulting in decline in vehicle production and consumption. While the first quarter of FY20-21 was a complete washout, the industry regained significant ground second quarter onwards. “The component industry, in tandem, posted a subdued performance in FY20-21 with de-growth of 3 per cent over the previous year, registering a turnover of Rs.3.4 lakh crore (USD 45.9 billion). In the domestic market, Auto Component sales to OEMs at Rs.2.79 lakh crore (USD 37.7 billion) declined by 3 per cent while the Aftermarket at Rs.64,524 crore (USD 8.7 billion) declined by 7 per cent. Exports and imports stood at Rs. 0.98 lakh crore (USD 13.3 billion) and Rs. 1.02 lakh crore (USD 13.8 billion) respectively, thus reducing the trade balance to USD 500 million, the lowest ever; exports declined by 8 per cent while imports by 11 per cent,” said Vinnie Mehta, Director General ACMA at the recently concluded virtual press conference.

While companies are cautiously monitoring the situation and aligning business plans in response to the changing scenario, the stabilisation of supply chains supports the sentiment among CV makers. However, the semiconductor supply issue, rising commodity prices persists, and the Delta strain of COVID-19 is viewed as a future concern.