OEMs carry growth momentum into FY19

The year FY18 would be one of the most remembered years in the history of the Indian CV industry. It was a year that threw up major challenges and uncertainties against CV makers, primarily in the form of the BS-III vehicle ban that rocked CV sales at the start of the financial year, followed by the implementation of GST, possibly the most revolutionary tax reform the country has seen, exactly a quarter later. The truck and bus makers weathered the storm during H1 and came back in style in H2, picking up momentum towards the end of the year and carrying it strongly into FY19.

The year FY18 would be one of the most remembered years in the history of the Indian CV industry. It was a year that threw up major challenges and uncertainties against CV makers, primarily in the form of the BS-III vehicle ban that rocked CV sales at the start of the financial year, followed by the implementation of GST, possibly the most revolutionary tax reform the country has seen, exactly a quarter later. The truck and bus makers weathered the storm during H1 and came back in style in H2, picking up momentum towards the end of the year and carrying it strongly into FY19.

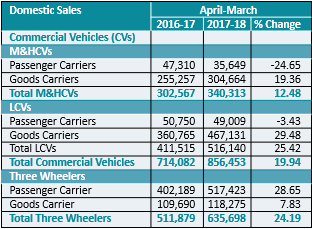

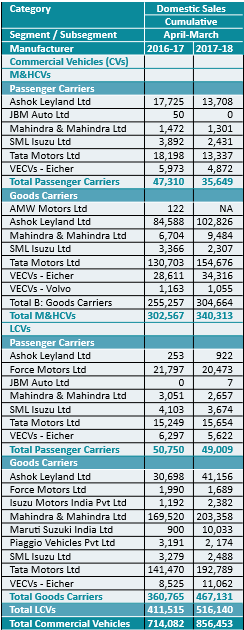

The overall CV segment grew by 19.94 per cent in April-March 2018 as compared to the same period last year. Medium & Heavy Commercial Vehicles (M&HCVs) grew by 12.48 per cent and Light Commercial Vehicles (LCVs) grew by 25.42 per cent in April-March 2018 over the same period last year.

Sharing his views on the CV sector’s performance in FY18, Mr. Rakesh Batra, Partner and Automotive Sector Leader, EY India, said: “The M&HCV market witnessed strong double digit growth of 12.48% during FY18, as BS-IV implementation-based decline in 1Q was offset by strong recovery during rest of the year. The segment growth was driven by demand for tippers (from road construction and mining sector), sustained investment in infrastructure, restrictions in truck overloading, development and streamlining of the logistics and e-commerce sectors post-GST, and replacement buying. LCVs witnessed 25.42% growth during the period, helped by rural economy, increase in supplies to Government and Municipal Corporations, new product launches, uptick in private consumption driving e-commerce sector and improvement in financing conditions.”

Three-wheeler sales grew by 24.19 per cent in April-March 2018 over the same period last year. Within the three-wheeler segment, passenger carrier & goods carrier sales registered a growth of 28.65 per cent and 7.83 per cent respectively in FY18 over FY17.

The overall auto industry’s vehicle production volume too reflected a strong year – a total of 29,075,605 vehicles including PVs, CVs, three-wheelers, two-wheelers and quadricycles were rolled-out in April-March 2018 as against 25,330,967 vehicles in April-March 2017 – registering a growth of 14.78 per cent over FY17, which is quite impressive given the hurdles at the start of the year.

Mr. Batra added: “FY18 was a milestone year for the Indian automotive industry, as it overtook Germany to become the fourth largest global automotive market. The sales volume built upon last year’s momentum to register a double digit growth – first time since FY12 – helped by improvement in the rural economy and partly due to demonetization-influenced low base in the second half of FY17.”

Growth momentum to continue

The Indian automotive industry’s growth is expected to carry the momentum forward in FY19 across majority of segments, with some moderation in CV growth. Improving macroeconomics, including strengthening rural economy, coupled with favorable industry dynamics such as stronger adoption of vehicle financing, and new product launches are likely to sustain buyer sentiment. The upcoming elections will also likely provide a boost to vehicle sales. In the medium term, the industry is set to face large investments in R&D and product development towards implementation of upcoming regulatory changes, especially to meet BS-VI emission norms, besides a push towards electric vehicles (EV) and improvement in safety standards.

The M&HCV segment is expected to carry the momentum into FY19 on the back of pick up in manufacturing sector and likely fleet modernization, however, may witness some moderation in volumes. As far as LCVs are concerned, the segment is likely to sustain growth on the back of improving liquidity, growth in overall spending, forthcoming elections in 2019 and positive macroeconomics. Overall, the CV subsector is expected to witness 10-12% growth in FY19, according to EY India.

Impressive start to FY19

FY19 has kicked off on predicted lines with the top three commercial vehicle players registering robust growth figures. We take a look at the performance of Tata Motors, Ashok Leyland and VE Commercial Vehicles in a bit more detail.

Tata Motors

CV market leader Tata Motors clocked a staggering 126 per cent jump in domestic CV sales in April 2018, selling 36,276 units in the month compared to 16,017 units in April 2017. After the headwinds experienced in April 2017 owing to the Supreme Court ruling on BS-III to BS-IV transition, the sales were affected as there was huge pre-buy and no demand as a consequence, and no supply of BS-IV vehicles. The growth in April 2018 was on the back of various macro-economic factors like investment in infrastructure development, improved industrial activities, and robust demand in private consumption-led sectors. Other factors like lower interest rates, inflation under control are boosting the economy thereby leading to continuing demand.

Contributing to the massive sales rise was the M&HCV segment which continued its significant growth momentum with 14,028 units, an increase by 317% over last year. This is on the back of the government’s focus on infrastructure development, road construction, building of irrigation facilities and housing projects across the country. Additionally, the restrictions on overloading in the States of UP, Rajasthan and Delhi continue to bolster the demand for higher tonnage vehicles. Various sectors like auto carriers, 3PL players, cement, steel and oil tankers are also driving growth.

The I&LCV truck segment reported a strong performance at 3,229 units, growing by 94%, over last year. This growth has been due to new product launches, E-Commerce and increased rural consumption on the back of farm loan waivers, rising rural wages and increased Minimum Support Price (MSP) for crops.

The SCV cargo and pick-up segment reported a significant growth with 14,620 units, up by 84%, over last year. With the hub and spoke model developing, the small vehicles are in demand for the last mile connectivity across both the rural and urban markets. The need for inter-city and intra-city trips, narrow village roads and long highway hauls carrying small loads drives the demand for SCVs.

The commercial passenger carrier segment also posted a growth with 4,399 units, 46% increase over last year. This was led by the robust demand for school buses with the onset of the annual school season.

Ashok Leyland

Ashok Leyland (AL), the country’s No.2 CV maker, also witnessed exponential growth, registering a resounding 79 per cent spike in sales in the first month of FY19, selling 12,677 CVs, compared to 7,090 units last year. AL’s M&HCV sales almost doubled from 4,532 in April 2017 to 8,968 in April 2018, a growth of 98 per cent. Its LCV division fared well too in April, with sale of 3,709 units this year, as against 2,558 units last year.

VE Commercial Vehicles

VE Commercial Vehicles, the JV between Volvo Group and Eicher Motors, recorded sales 3,959 units in April 2018 as compared to 3,089 units in April 2017, recording a growth of 28.1 per cent. 3,939 units of Eicher branded trucks and buses were sold in April 2018 as compared to 3,077 units in April 2017, representing a growth of 28 per cent. In the domestic CV market, Eicher recorded sales of 3,389 units in April as compared to 2,578 units in April 2017 reflecting a stellar growth of 31.5 per cent. On the exports front, Eicher recorded sales of 550 units in April 2018 as compared to 499 units in April 2017, representing a growth of 10.2 per cent. Eicher’s partner and premium segment player Volvo Trucks recorded sales of 20 units in April 2018 as compared to 12 units in April 2017, representing a growth of 66.7 per cent.