In the new normal scenario that the commercial vehicle industry in India is currently facing, there will be many changes, opines Rajesh Khanna, CEO, RACE Innovations (P) Ltd.

The Indian commercial vehicle (CV) industry, pummelled by an unforeseen pandemic, is now pressing players to extreme levels. It’s of paramount importance to the stakeholders to embrace and gear up to handle the wind of change in scenarios where old norms and fundamentals are getting reframed. The CV industry is poised to have a series of new entrants gaining undue momentum, consolidation of old players, setting up a higher degree of global standards, competitiveness in the product offerings, all of which will prime the industry to handle massive global and domestic pent-up demands.

Stakeholders are currently facing various changes and challenges such as government-linked policies reforms, infrastructural push on the anvil to stimulate demand, tiding over the supply chain crisis, cash flow concerns and resources’ availability. Scrapping policy implementation, electric vehicles deployment with infrastructure implementation programs under FAME II subsidy scheme, systems to monitor vehicles loaded in excess than capacity (overloading), production-linked incentives, anticipated budget plan in 2021 with tax reduction SOPs across automotive products, incentivising purchase of non-polluting vehicle, special packages or provision to create financial support facilitation in small, medium and large-scale players to recuperate much quicker than anticipated are the other contributing factors.

Market Scenario

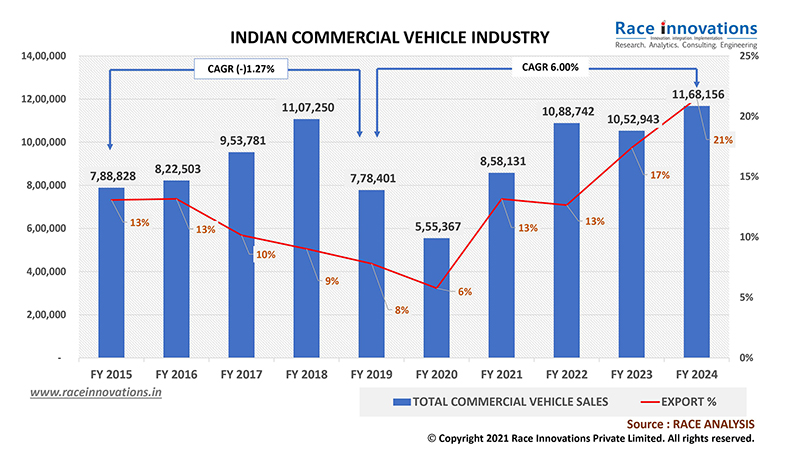

The overall CV volumes between FY 2019-20 recorded sales of 7,17,688 units including trucks, trailers and buses and are estimated to dip by 25-27% for FY 2020-21 with estimated sales of 5,23,329 units. Bus and coach segmental sales are heavily battered with anticipated drop of around 70% compared to previous year’s sale units, Medium and heavy-duty truck segment sales are expected to de-grow up to 35-38%, tractor-trailer segment sales’ de-growth may be up to 60% while light duty trucks’ segment sales de-growth would be 12-15% compared to the FY 2019-20 sales numbers, respectively.

The industry is prepared to absorb these numbers as the first half was a total washout with retrieval being quite optimal in trucks, trailers and not quite encouraging in bus and coach segments as full-scale mobility is expected only in the second half of FY 2021-22. Dealerships been through tough times during the emission norms’ changeover from BS IV to BS VI, involving carrying optimum BS IV stocks, accurate planning to liquidate the stocks, etc. Now, they have turned over-cautious on the discounting front with no aggressive marketing witnessed in the last financial year.

The system now works on a pull market strategy wherein the OEMs are pushed to create an environment for the dealers to perform and generate profits. More emphasis has been towards digitalization, analysis on time spent by customers in vehicle purchase, changes in style of purchase activities, and generation of innovative ideas to reduce cost levels in marketing, sales and distribution process. More thought process is getting into the area of how to create demand and influence customers about committed product lifecycle management while roping in leasing companies and financial packages to sweeten the deal.

On the supply side, OEMs are anticipated to get structural in their approach with vehicle price increase on the anvil, forced to create value in terms of higher degree of standards, modularisation of product variants, quality and safety compliances and overall enhancement in cost of ownerships. The component OEMs i.e. ancillary and accessory manufacturers are now going through a really tough phase; the resilient ones are expected to consolidate, formulate joint ventures, get into technical collaborations, acquire the weaker ones and further shape up as a large-sized fortified export-oriented component OEM base for the global markets.

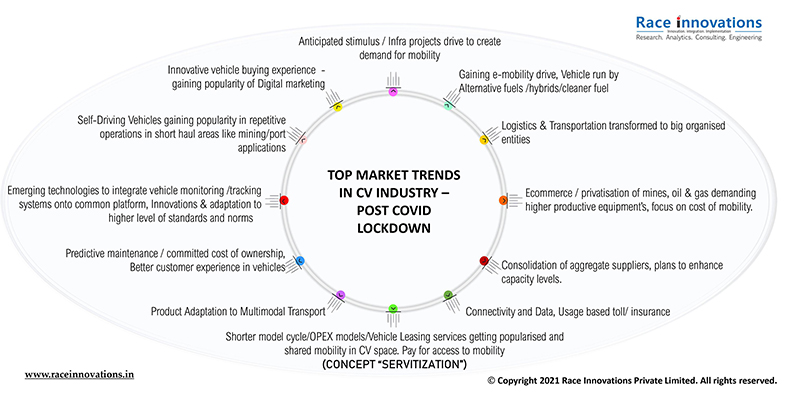

On the end-user front, the logistics business is experiencing transformation in its operations and supply chain management. More structural reforms are underway provided they are executed properly in tune with a stable economic environment. Digital technology will help the market get back on the growth path. Evolving shared mobility or leasing models can bring in the concept of ‘servitization’ in the CV industry, which means pay for access to service with no need to own physical assets. This way the costs will be more predictable with better clarity offering a competitive edge in the mobility of goods and passengers.

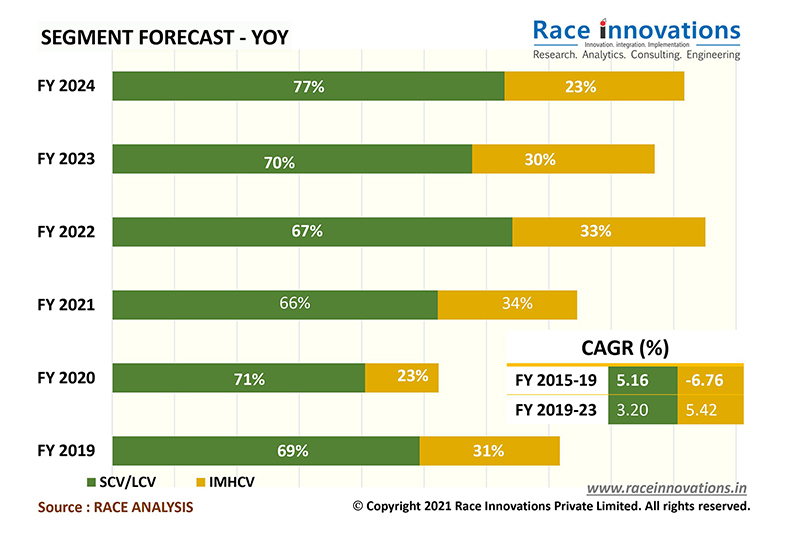

Logistics and transport companies can focus on their efficient distribution process, route or load optimisation, warehouse management and improvement in service deliverables, thereby able to demand long-term contracts with clients and better profitability. The market forecast points to an increase in the sale of light and intermediate commercial vehicles, with demand for high tonnage trucks rising in FY 2022 after exhausting the current excess inventories. Further, we anticipate e-vehicles gaining popularity in short-circuit passenger and goods movement. In addition, there will be recognition for hybrids alternative fuels which will propel the race for non-polluting vehicles.

RACE analysis reports a CAGR of 6-7% estimated over a period of FY 2021-22 to FY 2024-25. Manufacturers currently are exporting 9-10% of the total commercial vehicles with expectation of reaching 25-30% of total commercial vehicles produced by 2024-25. The truck production cycle is set to increase in the coming years owing to the industries overseas seeking ‘budget trucks’ with compliance and standards not compromised. India is destined to become a major export hub for vehicles, allied components, accessories and ancillaries to meet the increasing global demand.

Technology Factor

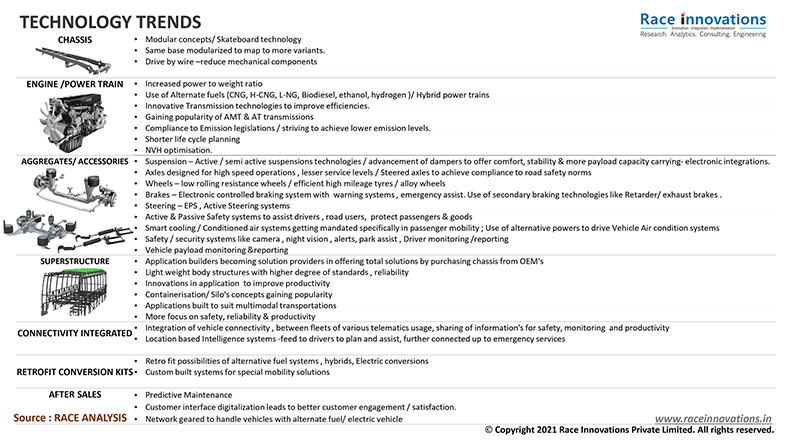

Post the pandemic some of the development plans with the OEMs and component makers are on the backburner. At this stage, more focus and efforts are being directed towards sustaining the existing models, standardising them and perfecting them to adhere to the new emission norms. More emphasis is given to enhancing value add-on to the current platforms along with cost optimisation and modularity of designs and subcomponents to achieve mass manufacturing. Due to the political stimulus for use of cleaner fuels, OEMs and component makers are focussed on e-vehicles, building ecosystems to address the supply. At RACE we predict a shift in demand for e-vehicles towards alternate fuels and hybrid vehicles. EV mobility space will be first tried out in short-circuit mobility areas like urban passenger movement, ports, interplant and warehouse movements and mining areas, mostly covered under the FAME II subsidy under the National Electric Mobility Mission Plan.

Way Ahead

The Indian CV industry is driven by emotions and with the vaccine around the corner the industry should be back on its growth trajectory specific to the domestic front. The cyclical commercial vehicle market looks prospective in terms of possible restoration of vehicle profitability margins and driver safety with instant alerts and notifications for surveillance. Specific to the global scenario, copious space has been created for Indian origin products and components as an outlay of various situations that have emerged before and post the pandemic as well as initiatives undertaken by the government. The challenge now lies in how industry leaders and other stakeholders gear up to take the industry to the next level as a key exporter of various mobility solutions with competitiveness and higher degree of standards and safety.