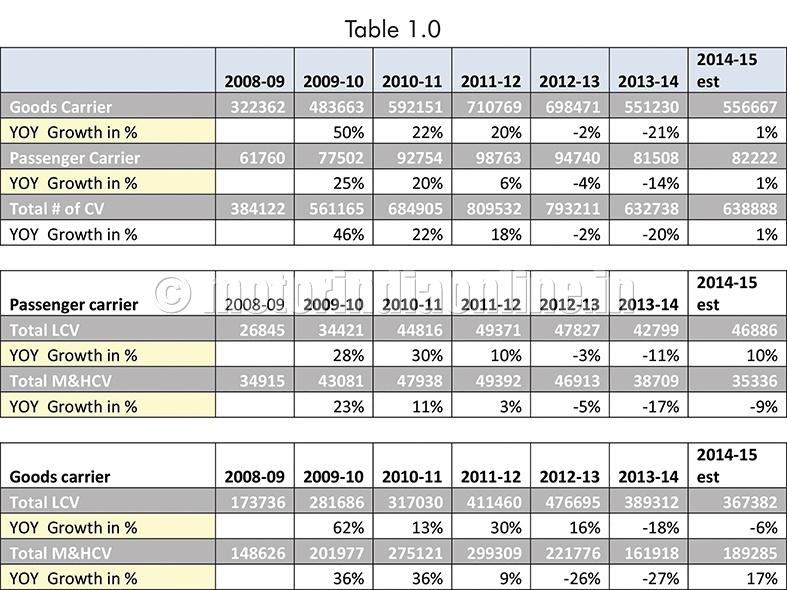

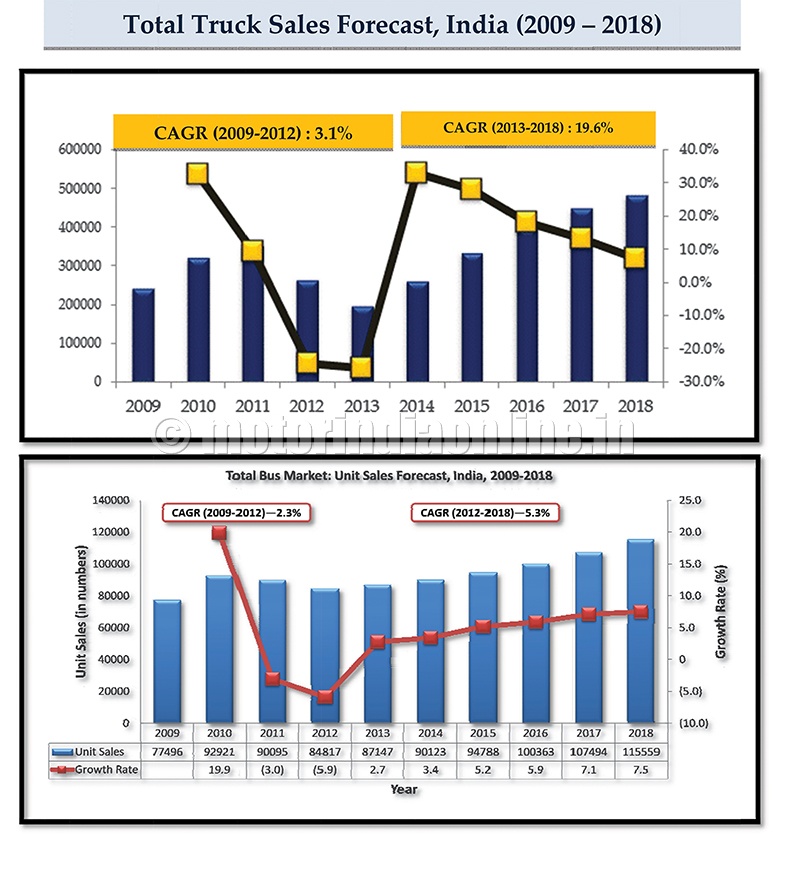

With distinct signs of recovery, the Indian commercial vehicle segment is expected to register a quick turnaround after having withstood the effects of a prolonged slowdown. After registering a volume growth averaging 29 per cent during 2009-12, the last three years have been quite discouraging for the CV industry, with negative trends all around. However, the change of leadership at the Centre has brought about a positive sentiment of revival, with optimism over the future of the Indian automotive industry. The CV output of 2014-15 is estimated to end on a positive note with the likely improvement in the truck segment, particularly M&HCVs. This is further expected to grow moderately at 9.1 per cent CAGR. The passenger vehicle sales is likely to recover slowly with 5.3 per cent CAGR over the next five-year period.

In the current scenario, fleet operators face stiff competition with a general fall in freight rates, with industries in general cutting down on their logistics cost, normally contributing 20-21 per cent of product cost vis-a-vis 4-6 per cent of product cost in the case of developed economies. One of the major concerns is as regards fragmented markets with their impact on the logistics costs.

In the case of passenger vehicles, owners are facing lower occupancy rates as a result of alternate transportation modes becoming more economical. This is also due to cut-throat competition within the system and lack of flexibility to change over to operational routes.

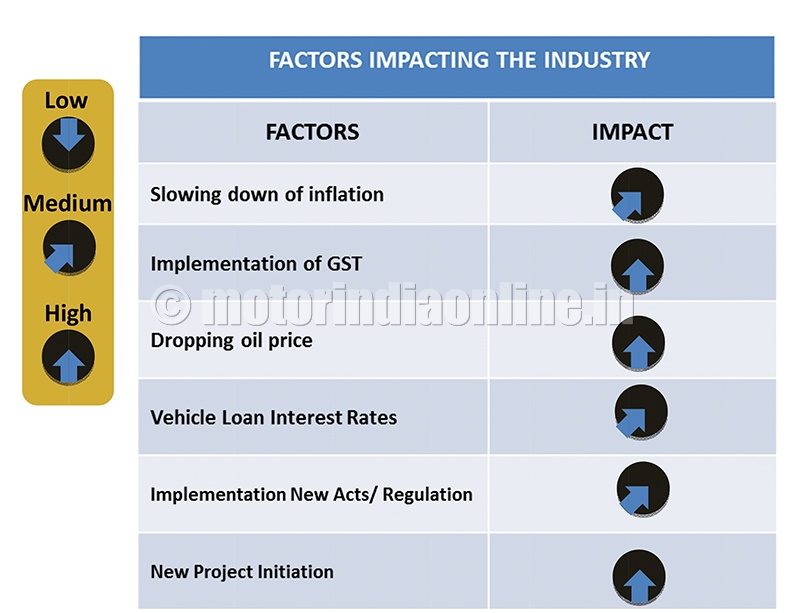

The other main ingredient of the cost of transportation is fluctuating fuel prices accounting for 60 per cent of the total cost of operation. Adding to the woes are the vehicle funding rates which were quite high during the crisis period. This impeded decision-making on new vehicle purchases, leading to fleet operators refurbishing their old vehicles, and greater use of spurious parts or components from used vehicles and deployment of smaller vehicles in areas where bigger capacity vehicles are in operation. All this has caused a major concern over safety and reliability.

These are some of the discouraging trends translating to less growth in volumes, impeding the growth momentum of the CV industry. However, the industry is looking forward to enforcement of the New Motor Vehicle Act, Bus Body Code and other codes related to trucks and trailers.

The industry is also enthusiastically looking forward to GST implementation, which is expected to harmonise different taxes. This  would help transporters in opting or investing on higher capital equipment with a capacity to carry more goods, high-end luxury buses for greater passenger comfort. Also expected is consolidation of warehouses in terms of creation of centrally-located bigger warehouses with modernised infrastructure, efficient processes and advanced transportation equipments.

would help transporters in opting or investing on higher capital equipment with a capacity to carry more goods, high-end luxury buses for greater passenger comfort. Also expected is consolidation of warehouses in terms of creation of centrally-located bigger warehouses with modernised infrastructure, efficient processes and advanced transportation equipments.

The new Motor Vehicle Act & Road Safety Bill, when implemented, is expected to see higher levels of enforcement of the existing and new regulations as well as recommencement of new infrastructure creation. This in turn would have its impact on vehicle sales, safety and environmental control systems which, when introduced, will reduce accidents and air pollution. The industry expects that implementation of the new Motor Vehicle Act which replaces the old one implemented in 1988 will help modernise the transportation and logistics industry and also lay additional emphasis on E-governance to bring in transparency and efficiency in the transport sector.

The OEMs and the related industries are gearing up to take advantage of the opportunities in the next couple of years with the expected growth in technology transfers to Indian industries to raise the standard to that of the developed markets.

Some of the latest technologies to be adopted for Indian vehicles are:

* Automated manual transmission (AMT) system

* Automatic braking system (ABS)

* Air suspensions in buses / trucks

* Air conditioners systems in buses and truck cabins

* Alternate fuel systems like ethanol, CNG, bio gas and hybrid electric vehicles

* Higher horse power (hp) engines with electronic diesel controlled systems

* Auxiliary braking systems like electromagnetic / hydraulic retarders

* Vehicle tracking systems

* Speed governing systems

* Vehicle alarming systems to detect irregular driving patterns (driver sleeping off)

* Engines complying to BS IV / BS V emission norms

Some upcoming developments in OEM technology can be noticed in the areas of transmission (automated-manual), brakes (auxiliary braking systems), higher hp engines with electronic diesel control system (EDC), suspension systems moving from mechanical to pneumatic and the expected shift in emission standards to BS IV by 2017. Direct shift to BS V would be a better option, but it is envisaged to involve high investment for oil companies to an extent of Rs. 75,000 crores. Further, exploring alternate fuel (hybrid and ethanol) will help reduce dependency on the conventional fossil fuels. With these means, the OEMs require adequate infrastructure planning for technology and after-sales support.

Some upcoming developments in OEM technology can be noticed in the areas of transmission (automated-manual), brakes (auxiliary braking systems), higher hp engines with electronic diesel control system (EDC), suspension systems moving from mechanical to pneumatic and the expected shift in emission standards to BS IV by 2017. Direct shift to BS V would be a better option, but it is envisaged to involve high investment for oil companies to an extent of Rs. 75,000 crores. Further, exploring alternate fuel (hybrid and ethanol) will help reduce dependency on the conventional fossil fuels. With these means, the OEMs require adequate infrastructure planning for technology and after-sales support.

Further, we at RACE predict that once the standards are in place, India would emerge one of the global low-cost manufacturing hubs as in the case of the IT revolution.