In the last five years, investments in the infrastructure sector have been to the tune of Rs. 30 trillion, driven by demand from the power and road sectors, which together account for more than 70 per cent of the investments. Considering a debt to equity ratio of 70:30, the total debt funding to the infrastructure sector has been around Rs. 22 trillion in the five years.

Banks have been the primary source of funding for the infrastructure sector. As a result, their credit to the sector has also increased to around Rs. 10 trillion as on March 31, 2016, and accounted for around 15 per cent of the overall banking sector advances. Infrastructure advances have grown at a CAGR of around 25 per cent in the last 10 years, which is higher than the banking sector advances growth.

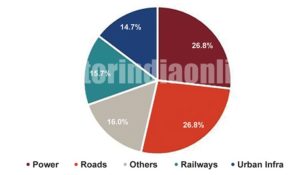

CRISIL estimates the infrastructure investment requirement over the next five years (2016-2020) to be about Rs. 31 trillion, with power, roads and urban infrastructure sectors accounting for about 70 per cent of this. In the power sector, generation will continue to account for the largest share of the investment, whereas in the roads sector, investments will be driven towards building national highways and State roads. In urban infrastructure, municipal bodies will require significant investments for constructing urban roads, expanding urban transport and revamping water supply and sewerage infrastructure.