After a study of the aftermarket scenario in the metro cities of Chennai and New Delhi in our last two editions, we drove down to Jaipur to get a pulse of the bazaar segment in the country’s pink city and to discern the business potential of Federal Mogul in the region. Rajasthan’s capital city is fast catching up in terms of the pace of aftermarket activity when compared to a region like New Delhi and is also by no means on the fringes when it comes to the American auto giant’s spare parts offtake. We got the privilege to catch up with four leading officially-appointed distributors of Federal Mogul India’s aftermarket arm: Choudhary Enterprises (Ramnagar), Gulab Enterprises (Ajmeri Gate), Prashant Agencies, and Shri Mahalaxmi Motor Company (Transport Nagar), all located at Jaipur.

Taking the current scenario in the Indian automotive industry in view, the distributors sounded cautiously optimistic about future projections, but at the same time are happy about the fact that they are associated with a trusted and globally-renowned name in Federal Mogul. The distributors were catering to a range of segments including tractor, truck, passenger car and two-wheeler.

While the truck, passenger car and two-wheeler segments usually take the limelight when it comes to assessing the potential in terms of main stream sales as well as aftermarket, the tractor market is equally interesting and highly growth-oriented, considering that India is the largest tractor market by volume globally. In FY14, the Indian tractor market grew by 20.2 per cent to reach 633,656 units, crossing the 600,000-mark for the first time ever. A good monsoon during the period boosted the Indian agriculture sector which is expected to grow by 4.6 per cent as compared to 1.4 per cent last year. With tractors slowly but surely becoming more advanced in terms of performance and efficiency, the tractor aftermarket holds a lot of potential in the coming years.

We first met Mr. Choudhary of Choudhary Enterprises which initially started as a retail outlet in 1988 before converting itself into a wholesaler in 2003. Mr. Choudhary spoke about the importance of maintaining a wide range of products and inventory and the need for regular investments to grow the business. Choudhary Enterprises deals with a range of Federal Mogul brands and products, mainly for the tractor segment and caters to spare parts of Mahindra, TAFE and Swaraj among others in the segment. The outfit clocked an annual turnover of around Rs. 13 crores, 70 per cent of which came from the tractor segment, in the last fiscal and expects a 25 to 30 per cent increase in revenue annually.

He shared his expectations from different stakeholders which could help the aftermarket wherein he said: “There should be consistency of replacement parts which are to be used so that it is better for us and also the end-customer. Another important aspect is training for the mechanics so that they can handle all kinds of service requirements of the customers. Since the market as such is not too great at the moment, ground-level activities from our principles to generate increased demand in the market will also help us a lot.”

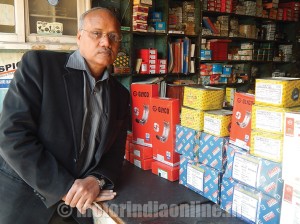

Our second stop was at leading wholesaler Mr. Gulab Jat’s outlet, who started off saying: “I started this business in the year 2011. The experience has been pretty overwhelming till now and I am happy to be Federal Mogul’s distributor for the region. The market here is witnessing an unprecedented pace and notwithstanding the downturn in recent times, we have been growing continuously at 25 to 30 per cent owing to our presence in the two-wheeler space.”

Talking about the company’s key growth drivers, he observed: “Around 70 per cent of our business is derived from mass market two-wheeler players like Bajaj Auto, Hero MotoCorp, etc. The aftermarket vertical has been growing at a record pace which is because the majority of our business is derived from the rural market where mechanics can easily service vehicles. “

Sharing his views on Gulab Enterprises’ association with Federal Mogul, Mr. Jat said: “Our relationship has been very good; we are like an extended family to them. Their products are very good.” Highlighting the current challenges in the market, he went on to add: “Slow availability of parts in the aftermarket, anomaly in the tax structure and availability of duplicate parts are some of the burning issues. If they are addressed, we might see an unprecedented growth in our business.” Gulab’s current turnover is Rs. 1 crore, a major share of which is contributed by Federal Mogul products. It is also planning to diversify into other segments in the near future.

At our third stop, Mr. Prashant of another leading distributor Prashant Agencies stated: “We entered the automobile spare parts wholesale business in 2001 and with started with spark plugs and then added coolants, engine linings, brake pads, etc. to our offering. Our core business comes from the four-wheeler segment. The business is shaping up pretty well, growing by leaps and bounds and we expect a growth of around 20 to 25 per cent this year. During 2013, we grew by 30 per cent while in 2014 we grew by 40 per cent. The market potential is pretty huge right now as the vehicle population is growing in Rajasthan, so the spare parts business is also projected to grow exponentially.” Prashant Agencies is currently clocking a turnover of around Rs. 2.5 crores annually.

Referring to the market response for their products, he said: “All the products have been well accepted in the market, the quality is exceptionally good and they are readily available too. We expect their brands to grow exponentially. We also plan to expand our base in Rajasthan with new product lines and customers and are also planning to expand our reach to smaller towns and cities.”

Like some of his distributor counterparts, Mr. Prashant also stressed the different aspects of the aftermarket trade which require attention: “Most of the businesses (for the aftermarket vertical) are going to roadside outfits where the mechanics are not able to service the products properly. So the industry needs to take the initiative to train the mechanics to mend hi-end vehicles. The availability of spurious parts, especially in the interior regions, is another major menace and we need proper legislation to curb them.”

Our last interaction was with Mr. Kamlesh Agarwal of Shri Mahalaxmi Motor Company, who shared: “We started with piston rings and later added other products too. While the market is down by over 30pc at the moment, we cater primarily to the CV segment which has not witnessed any recovery yet. The mechanics also require training in order to become skilled enough to handle hi-end products.” Out of its current turnover of Rs. 30 crore, nearly 18 per cent comes from its distributor business while 12 per cent comes from the retail space.

Mr. Agarwal was quite ecstatic about his company’s association with Federal Mogul and said: “They have been doing quite well in the aftermarket and I am happy with the way they have been streamlining the whole process by increasing the manpower and other efforts. They have made the work atmosphere of mechanics a lot better.” He also seconded other distributors’ thoughts and added: “We request the automotive industry to handhold the aftermarket industry. Some relief in the taxation structure is also desirable.”

Going by the words of the four distributors, it is unanimous that skill development of mechanics in the region is something which the industry should be focusing on, along with elimination of counterfeits in some areas. Federal Mogul, despite being a global brand but true to its globally-acclaimed position in the aftermarket space, has done exceptionally well to establish strong presence in different aftermarket hubs in the country, including rural regions and catering to the needs of different customers across different product and vehicle segments. Considering the huge growth potential of the aftermarket, the company’s continuous efforts in the space are bound to bring back good returns in the coming years. On its part, the Jaipur aftermarket sector is also expected to mature and reach a more organized state towards the end of the current decade.