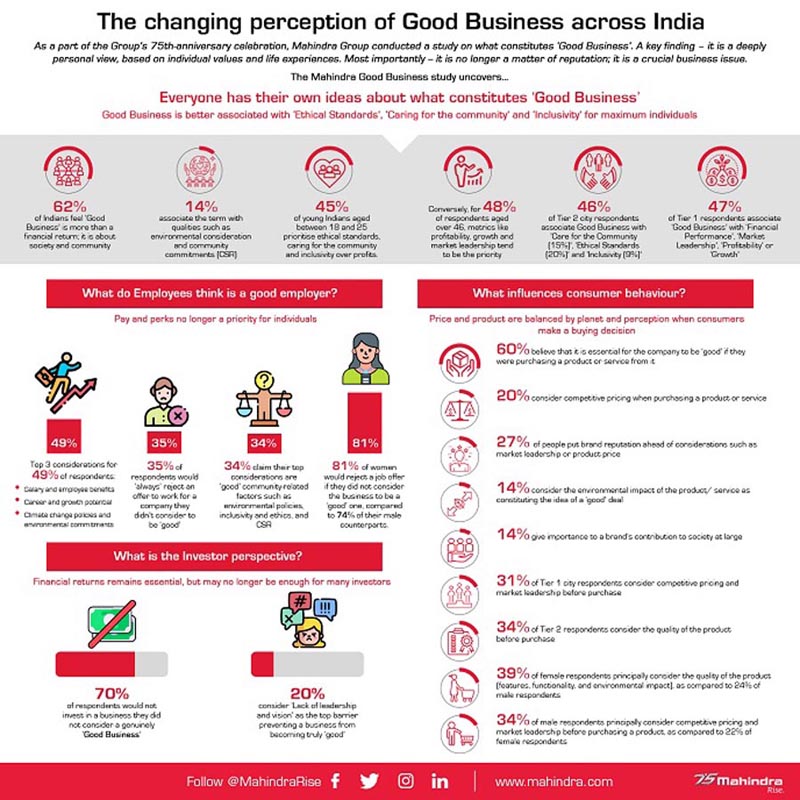

The Mahindra Group has published the findings of the ‘Mahindra Good Business Study’, outlining revealing people’s changing definition of what a ‘Good Business’ actually means.

The study, involving over 2,000 respondents across ten, tier 1 and tier 2 cities, aimed to better understand their perception of what actually makes for a ‘Good Business’ and how this shapes their expectations and decision-making as potential consumers, investors and employees.

The study, commissioned as part of the Mahindra Group’s 75th anniversary celebrations, revealed interesting insights about people’s ideas of what makes a ‘good business’ particularly during these paradigms shifting Covid times. The study uncovered that what constitutes a ‘Good Business’ is a deeply personal view, based on individual values and life experiences. Understanding this is no longer a matter of reputation – it has now become a key business issue.

According to Anand Mahindra, Chairman, Mahindra Group: “The wider role, purpose and meaning of what constitutes ‘Good Business’ has never been more relevant than today. A company’s social and community impact is being discussed as loudly and frequently as its balance sheets; and by more people than ever before. I absolutely believe that these broader, more inclusive expectations – whether from customers, shareholders, employers or other members of society – can be perfectly compatible. The principle role of business leaders today is to find that mutually beneficial, common ground – for me, that is the essence of Good Business. Each one of our own corporate milestones is accompanied by a more human one; whether it be the creation of a truly inclusive workplace or a reduced environmental impact; whether it’s a deeper engagement with our communities, or providing the freedom to experiment (and, even fail) to all our employees. So, the occasion of our 75th anniversary represents an opportune moment to participate in what I believe is the most important conversation of the decade.”

The findings show that the term ‘Good Business’ today is associated with having ‘Ethical Standards’, ‘Caring for the Community’, and ‘Inclusivity’, ahead of traditional business metrics such as ‘Financial Performance’, ‘Market Leadership’, ‘Profitability’ or ‘Growth’.

- 62% of respondents believe that ‘Good Business’ constitutes more than a financial return, 14% associate the term with qualities such as environmental consideration and community commitments (CSR).

- More than 45% of young Indians aged between18 and 25 give priority to ethical standards, caring for the community and inclusivity, rather than just profits. Conversely, ‘transactional and ‘performance’ metrics like profitability, growth and market leadership tend to increase (48% of respondents) among older respondents aged over 46.

- Interestingly, 46% of Tier 2 cities respondents cite ‘Care for the Community (15%)’, ‘Ethical Standards (20%)’ and ‘Inclusivity (9%)’, as the first thing that comes to their minds when they hear the term ‘good business’; as compared to 47% of Tier 1 respondents who associate Good Business with business metrics such as ‘Financial Performance’, ‘Market Leadership’, ‘Profitability’ or ‘Growth’.

Even as employees, people are looking beyond the pay and perks considerations to other factors such as community initiatives, flexible working hours, environmental consideration and workforce diversity when looking for a ‘good employer’. From a gender perspective, some differences also emerged. Some interesting findings included.

From an employment perspective, nearly half (49%) of the respondents chose salary and employee benefits, career & growth potential and climate change policies & environmental commitments as the top 3 considerations for a ‘good’ business’.

- 35% of respondents would ‘always’ reject an offer to work for a company they didn’t consider to be ‘good’.

- While a similar proportion, 34%, claim their top considerations are ‘good’ community related factors such as good environmental policies, inclusivity and ethics, and CSR programs, when they were choosing a new job in the future.

- Additionally, 81% of women would reject a job offer if they did not consider the business to be a ‘good’ one, compared to 74% of their male counterparts.

The profile of the typical Indian consumer is undergoing a transition. From their perspective, price and product are balanced by planet and perception when they make their buying decisions. The findings reveal that as consumers, people are increasingly demonstrating that their idea of a ‘good business’ means that the product and price alone may no longer be sufficient to secure the sale:

- 60% of people believe that it is important or fundamental for the company to be ‘good’ in their opinion if they were purchasing a product or service from it.

- Price and product remain important considerations with 20% of people considering competitive pricing when purchasing a product or service.

- 27% of people consider a brand’s reputation before making a purchase, ahead of considerations such as market leadership or product price.

- 14% consider the environmental impact of the product/ service as constituting the idea of a ‘good’ deal.

- 14% give the same importance to a brand’s contribution to society at large.

- 31% of Tier 1 city respondents consider competitive pricing and market leadership before purchasing a product, as compared to 34% of Tier 2 respondents who consider the quality of the product prior to the purchase.

- 39% of female respondents principally consider the quality of the product (features, functionality, and environmental impact), as compared to 24% of male respondents, and34% of their male counterparts principally consider competitive pricing and market leadership before purchasing a product, compared to 22% of female respondents.

From an investment perspective, financial returns remains essential, but it may no longer be enough for many investors.

- Most respondents (70%) would never invest in a business they did not consider a genuinely ‘Good Business’.

- 20% consider the ‘Lack of Leadership and Vision’ as the top barrier preventing business from becoming truly ‘good’

Mahindra Good Business study Methodology

The above findings are based on research fieldwork conducted by Innovative Research Services (India) Pvt. Ltd., Mumbai, through telephonic interviews with 2,089 respondents in 10 metro cities. Out of these 10 metro cities, six are Tier 1 cities which include Delhi, Mumbai, Bangalore, Chennai, Ahmedabad and Hyderabad while four are Tier 2 cities which include Coimbatore, Chandigarh, Jaipur and Lucknow. Respondents were a representative sample of people from the above cities aged between 18-65 years; respondents represented a wide range of business and professional sectors.