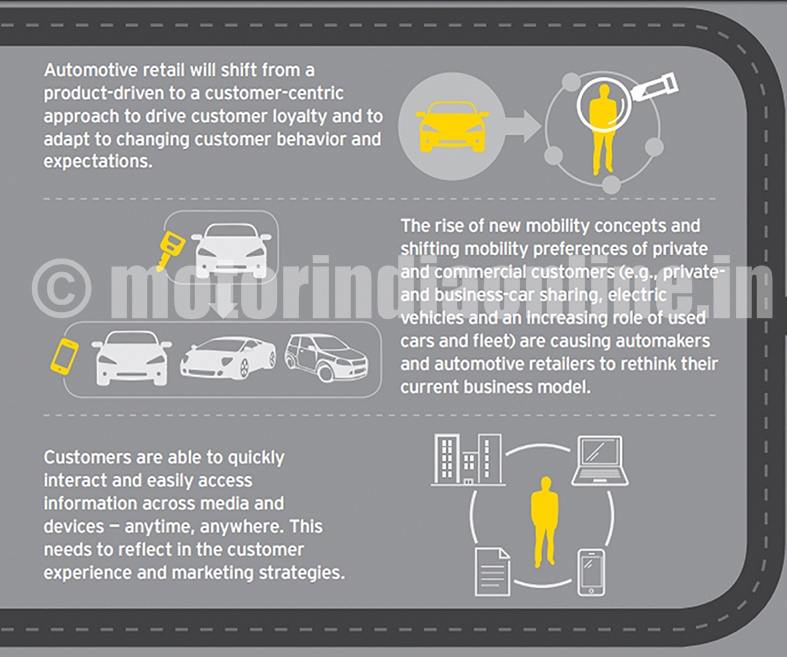

Multi-channel retailing is the future of the automotive industry, with 50 to 60 per cent of deals expected to come through digital means by 2016 compared to 15 per cent in 2014, according to a new report by Frost & Sullivan. As automakers alter the way in which consumers interact with their brand during the purchase and post-purchase, the challenge will be to retain a sense of consistency and loyalty.

Achieving this transformation in automotive retail will not only require a concerted effort from both automakers and dealers, but will also demand an unprecedented level of collaboration with other stakeholders in the ecosystem, particularly insurance companies, auto finance and aftersales market participants. Almost 70 per cent of organizations believe that an increasing emphasis on customer experience is driving business growth strategies.

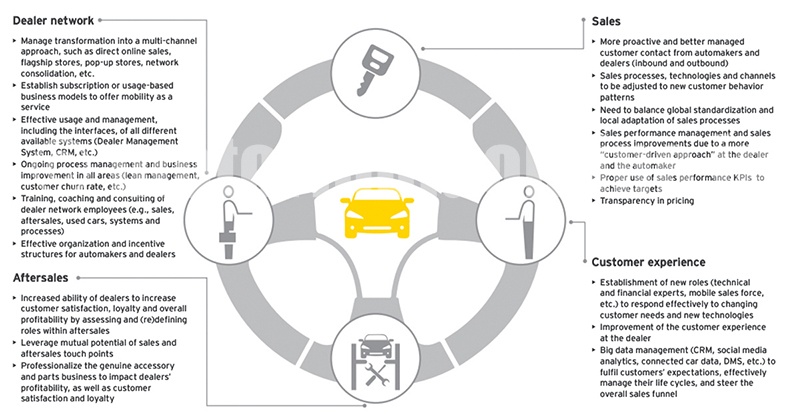

Automakers have an opportunity, for the first time, to not only build a relationship with the customer by leveraging connected vehicles, but also to deliver a rich brand experience through seamless integration across all customer-facing channels. For dealers, the transformation is a significant opportunity to streamline their operations by shedding non-value-adding functions and unlocking capital from redundant infrastructure, while taking on a wider service portfolio that contributes to better margins. In the short term, there is a clear need for stakeholders across the automotive retail ecosystem to undertake significant change management to catch up with the broader retail industry.

This is an executive summary of an analysis of the future of automotive retail after discussing the key forces at play and steps that stakeholders in this ecosystem should take to meet the needs of customers and remain relevant and competitive.

On an average, automotive customers spend 10 hours on the web to search for information and to decide when and where to buy. A majority of 88 per cent of survey respondents say they can no longer rely on traditional sales channels to drive growth.